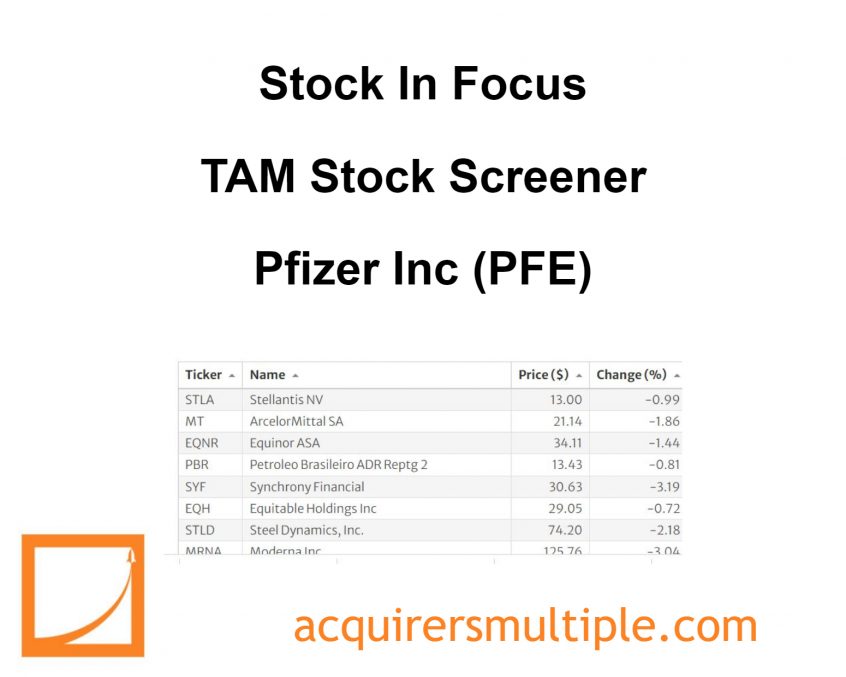

As part of our ongoing series here at The Acquirer’s Multiple, we provide this feature article titled ‘Stock in Focus‘ where we focus on one of the stocks from our Stock Screeners.

One of the cheapest stocks in our Stock Screeners is:

Pfizer Inc (PFE)

Pfizer is one of the world’s largest pharmaceutical firms, with annual sales close to $50 billion (excluding COVID-19 vaccine sales). While it historically sold many types of healthcare products and chemicals, now, prescription drugs and vaccines account for the majority of sales. Top sellers include pneumococcal vaccine Prevnar 13, cancer drug Ibrance, cardiovascular treatment Eliquis, and immunology drug Xeljanz. Pfizer sells these products globally, with international sales representing close to 50% of its total sales. Within international sales, emerging markets are a major contributor.

A quick look at the share price history (below) over the past twelve months shows that the price is up 2.49%. Here’s why the company is undervalued.

Summary

Market Cap: $260 Billion

Enterprise Value: $267 Billion

Operating Earnings

Operating Earnings: $33 Billion

Acquirer’s Multiple

Acquirer’s Multiple: 8.10

Free Cash Flow (TTM)

Free Cash Flow: $28 Billion

FCF/EV Yield

FCF/EV Yield: 10.92%

Shareholder Yield:

Shareholder Yield: 4.20%

Other Indicators

Piotroski F-Score: 9

Altman Z-Score: 3.685

ROA (5 Year Avge%): 17

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: