This week’s best investing news:

Predicting Growth (Verdad)

Oaktree’s Howard Marks in ‘fireside’ chats, new funds on horizon (AFR)

Dan Loeb’s Third Point builds stake in Colgate, sees value in pet food business in potential spinoff (CNBC)

Alien Truth (Paul Graham)

Bill Nygren Market Commentary | Third Quarter 2022 and Fiscal Year-End (Oakmark)

The Financial Media Goes Gaga For The Greenback (Felder)

Berkshire Hathaway Completes Acquisition of Alleghany Corporation (Berkshire Hathaway)

Four Hard Investing Lessons From 2022 With Silver Linings (Validea)

The Stock Market Had a Terrible Year. These Americans Aren’t Bothered (WSJ)

Statistics and Narrative Creation (Shelter Inflation ed.) (Epsilon Theory)

Jamie Dimon says expect ‘other surprises’ from choppy markets after U.K. pensions nearly imploded (CNBC)

Hold Opinions Loosely (Humble Dollar)

Ken Fisher, Explains the Midterm Miracle (Fisher)

Transcript: Tom Rampulla (Barry Ritholz)

Warren Buffett-backed BYD pops more than 5% after Chinese EV maker forecasts surging profits (CNBC)

The Perfect Time to Start Investing: When Prices are Low (Darius Foroux)

Different Perspectives on Investment Performance (Tweedy Browne)

A Strong U.S. Dollar Buoys Small-Cap Companies’ Stocks (WSJ)

Twitter Faces Only Bad Outcomes If the $44 Billion Musk Deal Closes (Bloomberg)

Groping for a Bottom (Barry Ritholz)

Jeremy Siegel: If the Fed waits for core inflation to hit 2%, it’ll drive economy into depression (CNBC)

Will the 60/40 Portfolio Start to Work Again? (Morningstar)

BofA’s Moynihan: Consumer Spending Slowing, Still Strong (Bloomberg)

El Salvador’s bitcoin experiment: $60 million lost, $375 million spent, little to show so far (CNBC)

October Views from First Eagle Global Value Team (First Eagle)

Ron Muhlenkamp Q3 2022 Letter (Muhlenkamp)

Akre Focus Fund Commentary Q3 2022 (Akre)

Wedgewood Partners Third Quarter 2022 Client Letter (Wedgewood)

Newfound Research Q3 2022 Letter (Newfound)

Ensemble Capital Investor Letter Q3 2022 (Ensemble Capital)

Third Point Q3 2022 Letter (Third Point)

Sequoia Strategy – Q3 2022 – Portfolio Review (Sequoia)

This week’s best value Investing news:

Why Value Investing is Making a Comeback (Columbia Business)

Value fund managers: Let your winners run (Klement)

Investing for Your Values, but Betting on Growth (NY Times)

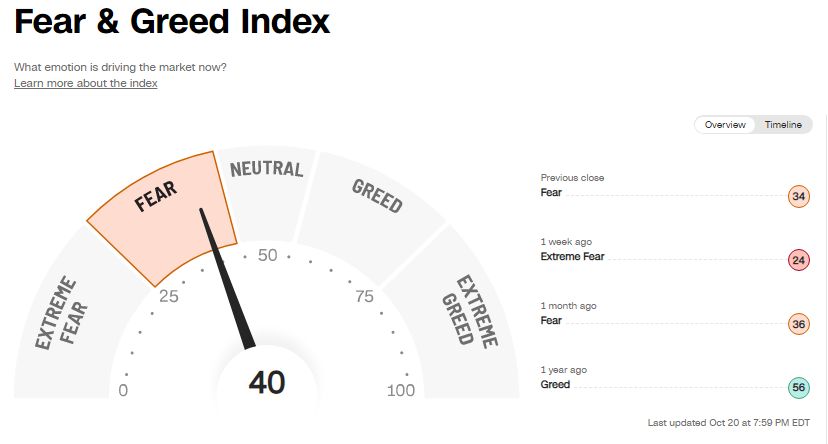

This week’s Fear & Greed Index:

This week’s best investing podcasts:

TIP485: Market Updates, Ray Dalio Retiring, Elon Buying Tesla and Elemental Power w/ Josh Wolfe (TIP)

Are Stocks Facing a Lost Decade? (Barron’s)

Replicating Hedge Fund Strategies with Andrew Beer (Excess Returns)

Daniel Needham – Multi Asset Investing (Business Brew)

Paul Orfalea – It’s About the Money (Invest Like The Best)

Episode #450: Harris “Kuppy” Kupperman – Oil is the World’s Central Banker Now (Meb Faber)

Markets Are Undervalued, and We Highlight Some Cheap Stocks (Morningstar)

#149 Neil Pasricha: Simple Rules for Happiness (Knowledge Project)

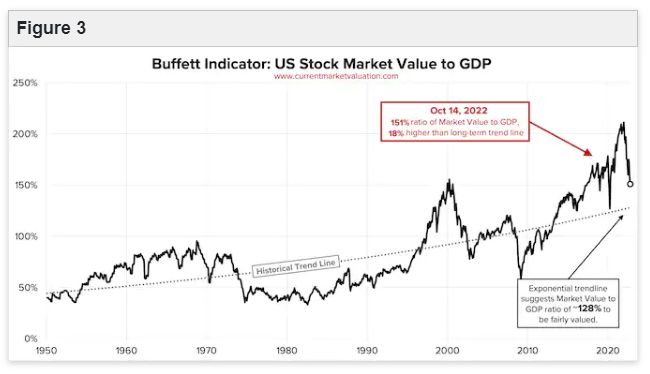

This week’s Buffett Indicator:

Fairly Valued.

This week’s best investing research:

Is Democracy better for the stock market? (AlphaArchitect)

Chart of the Day: Energy Stocks Keep Winning (AllStarCharts)

The Objective Function of Greedy Passive Investing (PAL)

This week’s best investing tweet:

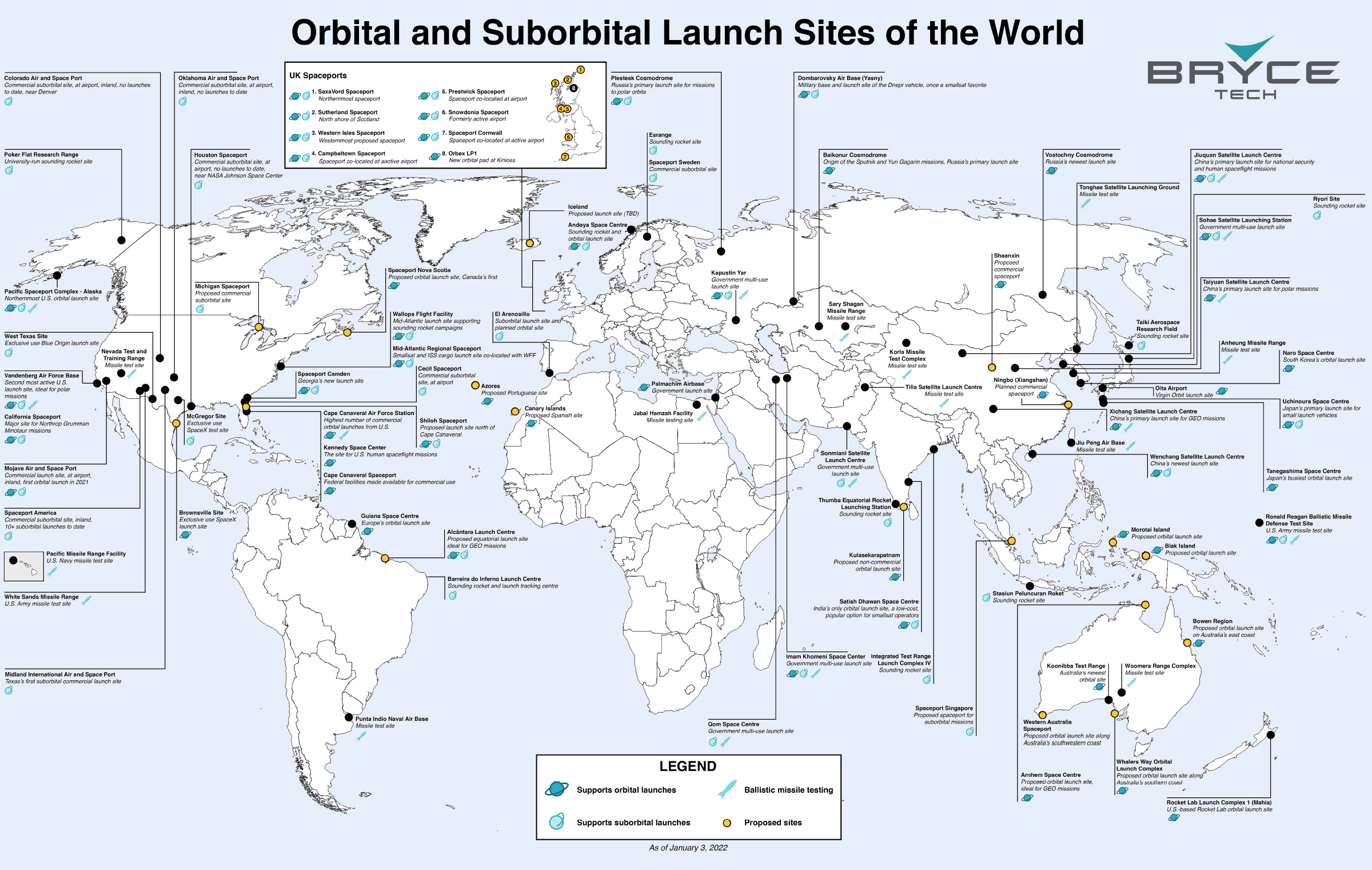

This week’s best investing graphic:

All of the World’s Spaceports on One Map (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: