As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, and Howard Marks.

While doing this research we’ve also uncovered a number of stocks that superinvestors have sold, or reduced in their portfolios, according to their latest 13f’s. So we’re now providing a new weekly feature article called ‘One Stock Superinvestors Are Selling‘. This week we’ll take a look at:

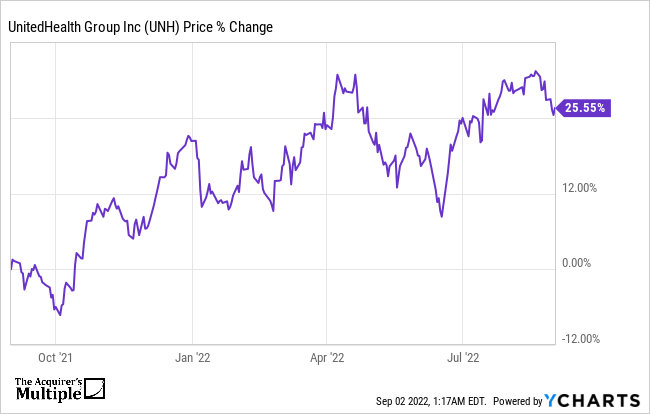

UnitedHealth Group Inc (UNH)

UnitedHealth Group is one of the largest private health insurers, providing medical benefits to 50 million members globally, including 5 million outside the U.S. at the end of 2021. As a leader in employer-sponsored, self-directed, and government-backed insurance plans, UnitedHealth has obtained massive scale in managed care. Along with its insurance assets, UnitedHealth’s continued investments in its Optum franchises have created a healthcare services colossus that spans everything from medical and pharmaceutical benefits to providing outpatient care and analytics to both affiliated and third-party customers.

A quick look at the price chart below for the company shows us that the stock is up 25.55% in the past twelve months.

Superinvestors who reduced, or sold out of the company’s stock, according to their latest 13Fs, include:

(Remaining shares)

John Armitage – 1,497,320

Stephen Mandel – 800,312

Cliff Asness – 600,297

Dan Loeb – 570,000

David Tepper – 150,000

Jean-Marie Eveillard – 71,067

Ken Fisher – 42,036

Paul Tudor Jones – 14,269

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: