This week we take a look at some big named non-financial companies that generate huge ‘free’ cash flows compared to their market cap, using the price to free cash flow ratio (P/FCF).

Price to free cash flow (P/FCF) is an valuation metric that compares a company’s per-share market price to its free cash flow (FCF). This metric is very similar to the valuation metric of price to cash flow but is considered a more exact measure because it uses free cash flow, which subtracts capital expenditures (CAPEX) from a company’s total operating cash flow, thereby reflecting the actual cash flow available to fund non-asset-related growth.

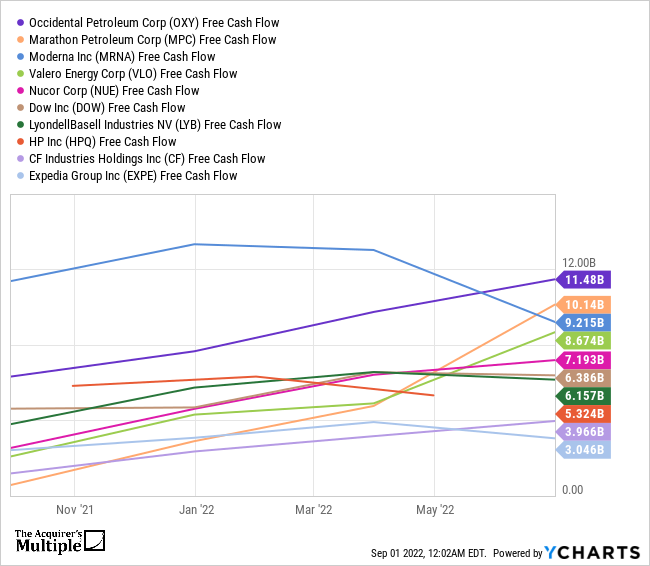

Here’s 10 big named non-financial companies with huge free cash flows compared to their market cap:

1. Occidental Petroleum Corp (OXY): Market Cap $66.11B, Free Cash Flow $11.48B

2. Marathon Petroleum Corp (MPC): Market Cap $50.23B, Free Cash Flow $10.14B

3. Moderna Inc (MRNA): Market Cap $51.72B, Free Cash Flow $9.21B

4. Valero Energy Corp (VLO): Market Cap $46.13B, Free Cash Flow $8.67B

5. Nucor Corp (NUE): Market Cap $34.80B, Free Cash Flow $7.19B

6. Dow Inc (DOW): Market Cap $36.62B, Free Cash Flow $6.39B

7. LyondellBasell Industries NV (LYB): Market Cap $27.07B, Free Cash Flow $6.16

8. HP Inc (HPQ): Market Cap $29.66B, Free Cash Flow $5.32B

9. CF Industries Holdings Inc (CF): Market Cap $20.62B, Free Cash Flow $3.96B

10. Expedia Group Inc (EXPE): Market Cap $16.17B, Free Cash Flow $3.05B

Here’s what they look like in one chart:

OXY Free Cash Flow data by YCharts

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: