This week’s best investing news:

Legendary investor Howard Marks on markets, economy and carried interest (CNBC)

Berkshire Hathaway Q2 2022 Report (BH)

Betting Against Expensive Junk (Verdad)

Michael Burry of ‘Big Short’ Fame Says ‘Silliness’ in Markets Is Back (Bloomberg)

Zero inflation last month! (Rudy Havenstein)

The US-China Tit-For-Tat Escalations Are Very Dangerous (Ray Dalio)

Rare Skills (Collaborative Fund)

Billionaire Sam Zell-Backed SPAC to Return Cash to Investors (Bloomberg)

Don’t Sweat It (Humble Dollar)

Berkshire Hathaway’s Distorted Quarterly Results (Rational Walk)

Bottom’s Up? (No Mercy)

Financials are well positioned to withstand a recession, says Oakmark’s Bill Nygren (CNBC)

The Trouble with Sentiment (Barry Ritholz)

Insights Live: Which Way Now? A Conversation with Howard Marks (OakTree)

Small Businesses’ Big Message For The Markets, Part Deux (Felder)

Tom Russo – Concentrated Portfolio: Challenging the Market (WealthTrack)

Thoughtful Arrogance (Vitaliy Katsenelson)

Jim Rogers Reflects on Wealth and the Current Economic Climate (Bloomberg)

Alibaba, Tencent, Meituan’s $1.2 Trillion Selloff Might Not Be the Bottom (WSJ)

Tiger Global blames inflation after 50% drop in flagship hedge fund (FT)

What I learned from Prof. Sanjay Bakshi’s Behavioral Economics Course at FLAME University (Seeking Wisdom)

Buffett’s Berkshire Pounces on Market Slump to Buy Equities (Bloomberg)

How a quant may have unleashed the revenge of the meme stocks (AFR)

The stock market can be an emotional roller coaster. It shouldn’t be (Vox)

The Fed Is About to Ramp Up Balance-Sheet Shrinkage. It May Get Dicey (Barron’s)

Cathie Wood on the Fed, Economy, Coinbase, Tesla (Bloomberg)

Transcript: Anat Admati (Big Picture)

Blame History, Not Biden, for Making Recession Calls So Hard (Bloomberg)

Why Crypto’s Market Cap Never Booms, or Busts, as Much as You Think (WSJ)

This week’s best value Investing news:

The Greatest Value Investor You’ve Never Heard Of (Macro Ops)

There’s Nothing Wrong With Value (Validea)

Value Spreads Are Back to Tech Bubble Highs: Is Everyone Out There Cray-Cray? (Cliff Asness)

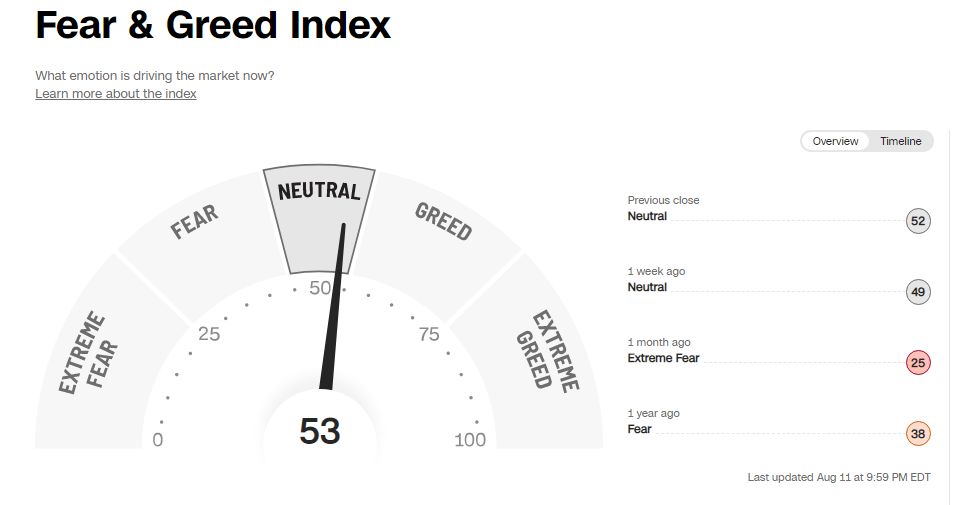

This week’s Fear & Greed Index:

Neutral.

This week’s best investing podcasts:

Q and A with Terry Smith: Boring or Roaring Twenties? (Part 1) (MasterInvestor)

RV Capital’s Letter to Co-Investors for the First Half of 2022 (RV)

#144 Gary Klein: Insights For Making Better Decisions (Knowledge Project)

Show Us Your Portfolio: Phil Huber (Excess Returns)

Hari Krishnan – Market Tremors & Tail Hedging (Flirting With Models)

TIP468: Why Buffett is Investing in Oil Companies W/ Josh Young (TIP)

Ravi Gupta – Focus (Invest Like The Best)

Ep. 237 – Buying into Pessimism with Tim Travis (Planet MicroCap)

The Value Perspective Podcast with Jake Taylor 2.0 (Value Perspective)

Episode #434: Lyn Alden – The Macro Landscape & Bull Case for Real Assets (Meb Faber)

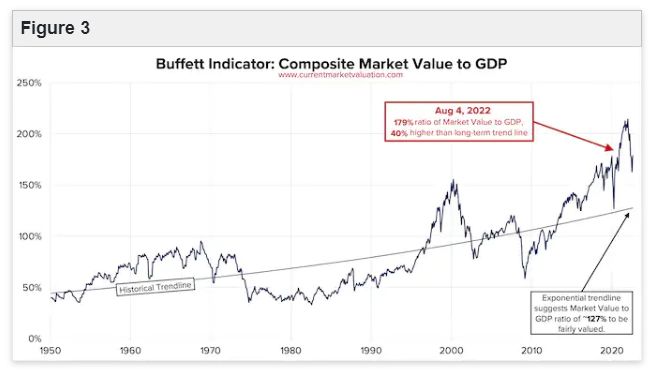

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

What Drives Momentum and Reversal? (AlphaArchitect)

Fundamental Value Revisited? Three Investing Tips for “Absolutely Crazy” Conditions (CFA)

Insiders Still Love Energy Stocks (AllStarCharts)

Evaluating Inflation Hedges (AllAboutAlpha)

This week’s best investing tweet:

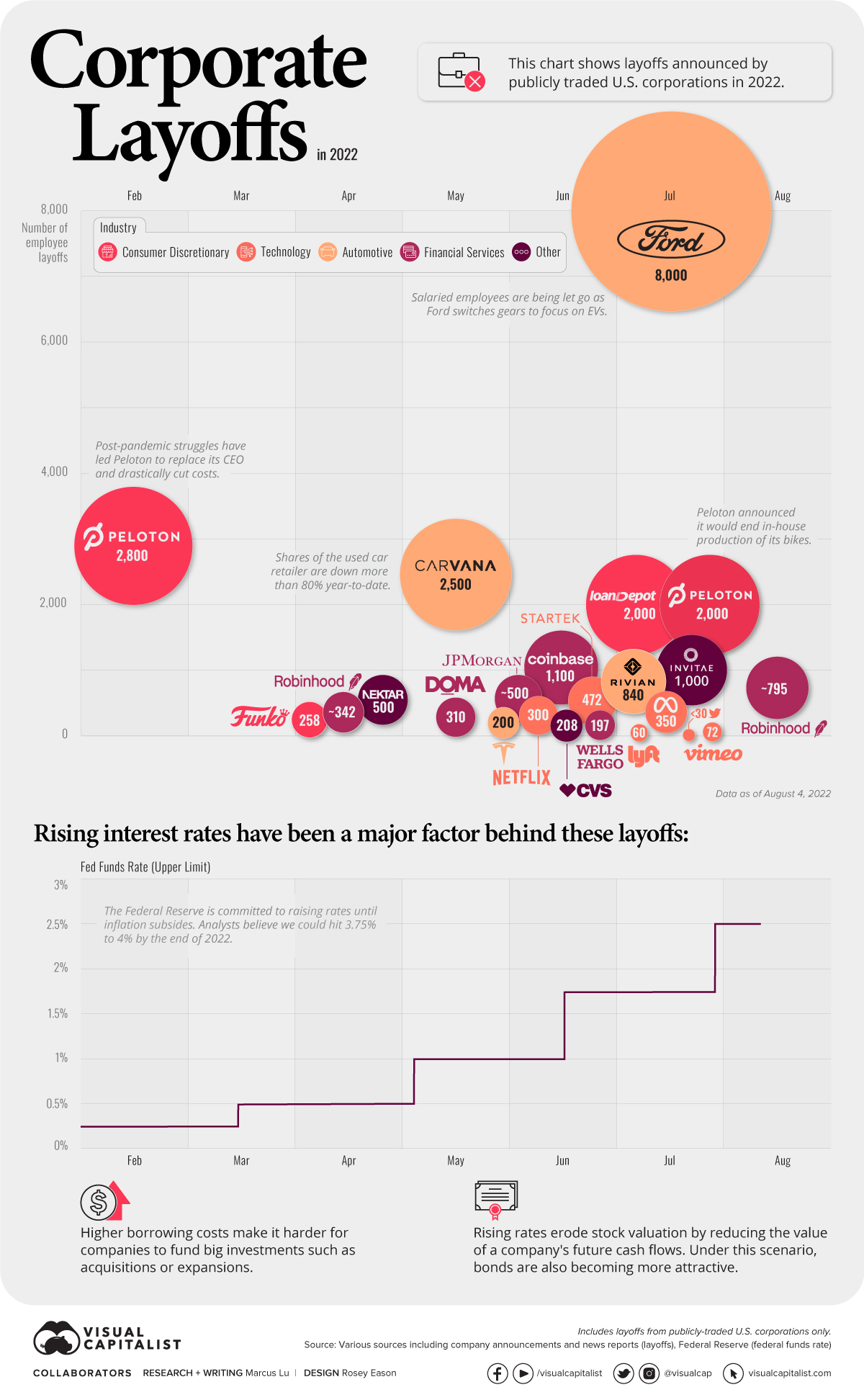

This week’s best investing graphic:

Visualizing Major Layoffs At U.S. Corporations (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: