This week’s best investing news:

Why History Matters (Jamie Catherwood)

What to Buy First Redux (Verdad)

Retail Investors’ Appetite For Speculation Appears Insatiable (Felder)

Bridging The Gap Between Investor & Investment Returns (Validea)

¡Peak bearishness, amigos! (Rudy Havenstein)

Cathie Wood’s ARK to Close Transparency ETF (WSJ)

Little Ways The World Works (Collaborative Fund)

‘Recession Man’: Burry’s Tweets Resonate With Traders Worried About a Downturn (Bloomberg)

Hollow Men, Hollow Markets, Hollow World (Epsilon Theory)

Berkshire Hathaway’s stock has gotten a lot cheaper since Warren Buffett’s buyback binge (CNBC)

Keep the Faith (Humble Dollar)

Good Losses, Bad Losses (Michael Mauboussin)

JPMorgan CEO Dimon sums up U.S. economy in one paragraph — and it sounds bad (CNBC)

How To Identify Behavioural Investment Opportunities and Risks (Behavioural Investment)

Tesla Sells 75% of Its Bitcoin Purchases (WSJ)

BofA Survey Shows Full Investor Capitulation Amid Pessimism (Bloomberg)

A Warren Buffett Protégée Strikes Out on Her Own (NY Times)

Rob Arnott: Fed: ‘There was no reason to push us into recession (Yahoo)

Why There’s a Chance the Stock Market Has Hit Bottom (Barron’s)

Hoarding Cash? Don’t Swing at Every Yield Pitch (Jason Zweig)

Did Buffett and Munger See BYD’s One Problem? (Bloomberg)

Transcript: Antti Ilmanen (Big Picture)

Kevin Duffy – We’re Dealing With a Very Different Animal (The Market)

Smead Capital: Two-Headed Investment Monster (Smead)

Thirteen ‘Perfect Storms’ That Are Sweeping the World Right Now (Bloomberg)

Ken Fisher Explains How Legendary Investors Inspired Him (Fisher)

15 Revelations in Twitter’s Suit Against Elon Musk (NY Mag)

Are we headed towards a recession? (Morningstar)

Investing 2022: A Polar Bear in a Snowstorm (William Blair)

Druckenmiller Warns ‘Bear Market Has a Ways to Run’ as Fed Hikes Rates (Bloomberg)

Strong Dollar Extends Gains With No End to Rally in Sight (WSJ)

Bloomberg Wealth: Sam Zell (David Rubenstein)

Josh Wolfe & Nitin Rao Fireside Chat (Cloudflare)

The catch to income investing (Morningstar)

GMO 2Q 2022 Market Commentary (GMO)

Life Imitates Art. Investing Imitates Baseball (Wedgewood)

Ariel Focus Fund Q2 2022 (Ariel)

Extreme Times: A Once in a Decade Opportunity? (Miller Value)

Giverny Capital Q2 2022 (Giverny)

Examining Inflation, the Bear Market, and Economic Cycles (Mairs & Power)

This week’s best value Investing news:

TIP465: Value Investing in the Digital Age w/ Adam Seessel (TIP)

Value as a Philosophy (First Eagle)

BlackRock Tilts the Tables on ESG Toward Value Stocks (Bloomberg)

George Athanassakos on Value Investing: From Theory to Practice (MOI)

How to invest like Warren Buffett during a recession (CNN)

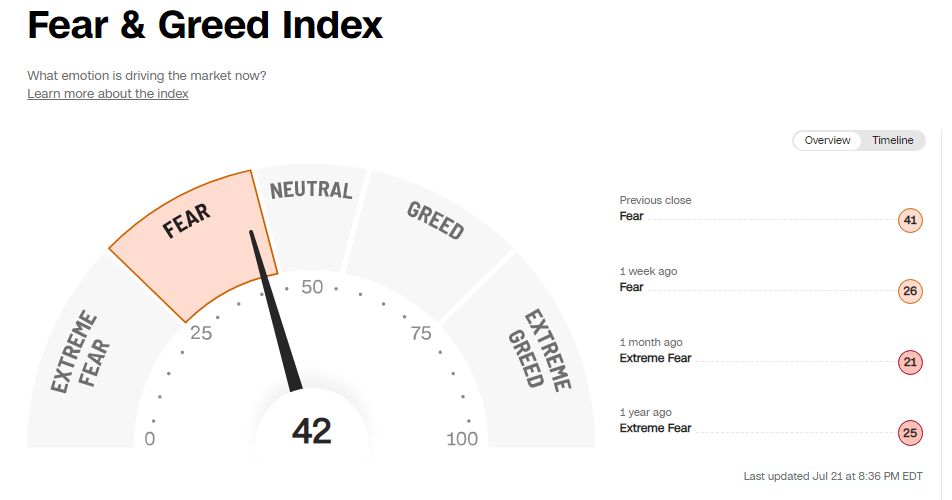

This week’s Fear & Greed Index:

Fear.

This week’s best investing podcasts:

TIP465: Value Investing in the Digital Age w/ Adam Seessel (TIP)

Episode 12 – The Value Architect (Behind The Balance Sheet)

Dan McMurtrie — On Markets and Policy (EP.115) (Infinite Loops)

Episode #430: Frank Giustra & Ian Telfer – The Bull Case for Gold (Meb Faber)

Investing In Asian Markets: Minimize China Risk (WealthTrack)

Matthew Ball – A Manual to The Metaverse (Invest Like The Best)

Finding Opportunity in the Technology Stock Storm (Excess Returns)

Kerry Craig – J.P Morgan Asset Management – State of global markets and what it means for investors (Equity Mates)

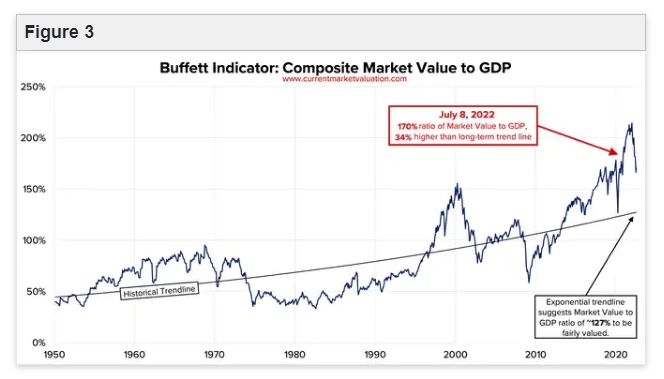

This week’s Buffett Indicator:

Fairly Valued.

This week’s best investing research:

Can We Measure Inflation with Twitter (AlphaArchitect)

Buying a Bounce in Bonds (AllStarCharts)

Navigating Systemic Risks: Ukraine, Climate, and Crypto (CFA)

Why ESG and Why Not Income Inequality? (AllAboutAlpha)

This week’s best investing tweet:

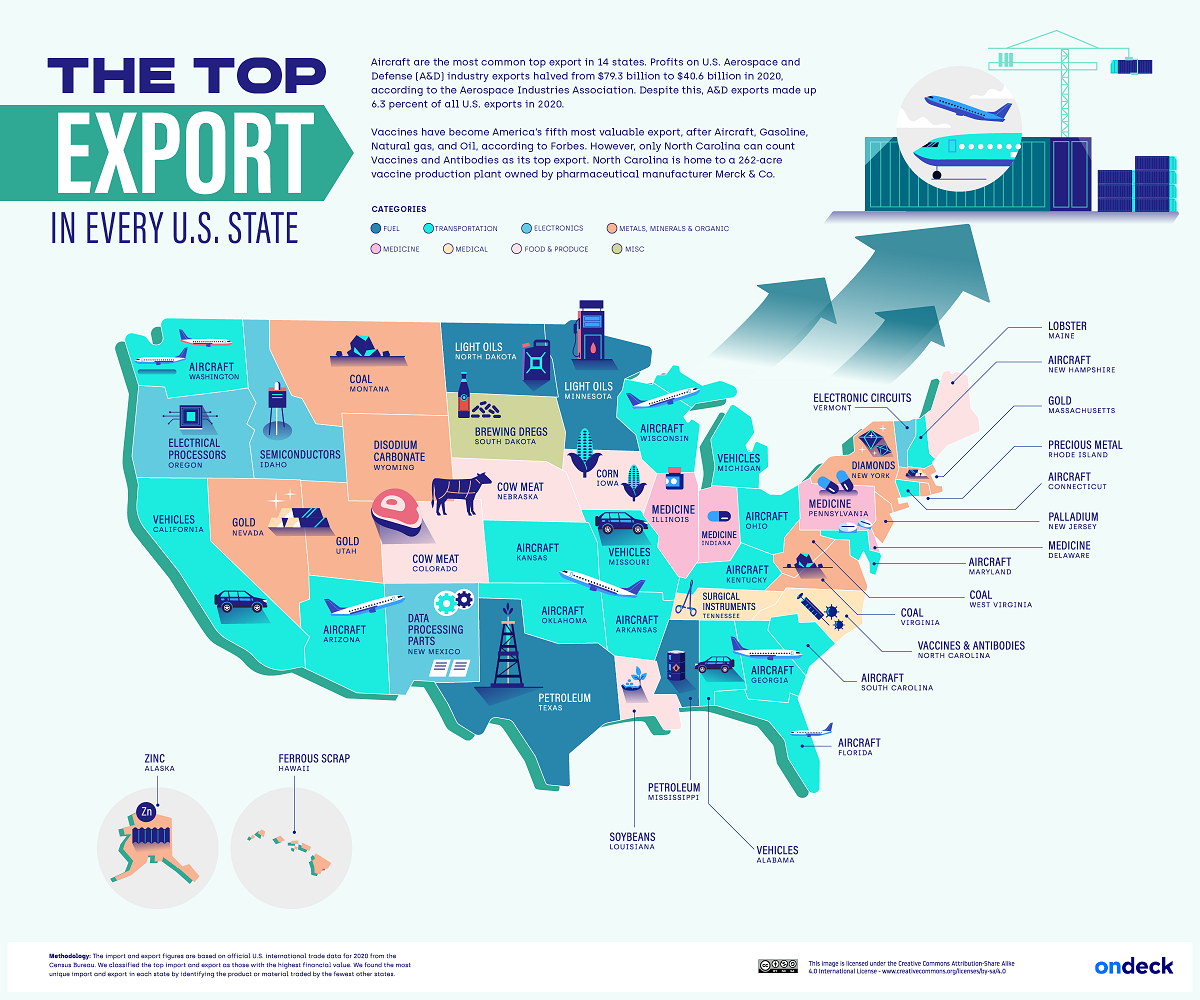

This week’s best investing graphic:

Mapped: The Top U.S. Exports by State (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: