In their latest Q2 2022 Letter, Oaktree Capital explain why today’s sharp price declines provide investors with numerous opportunities. Here’s an excerpt from the letter:

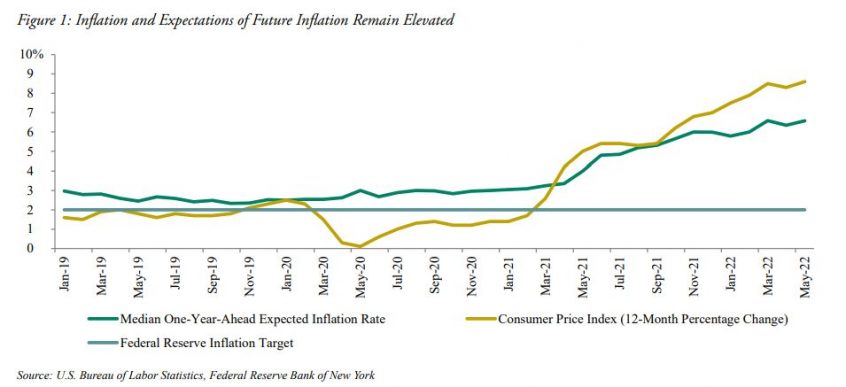

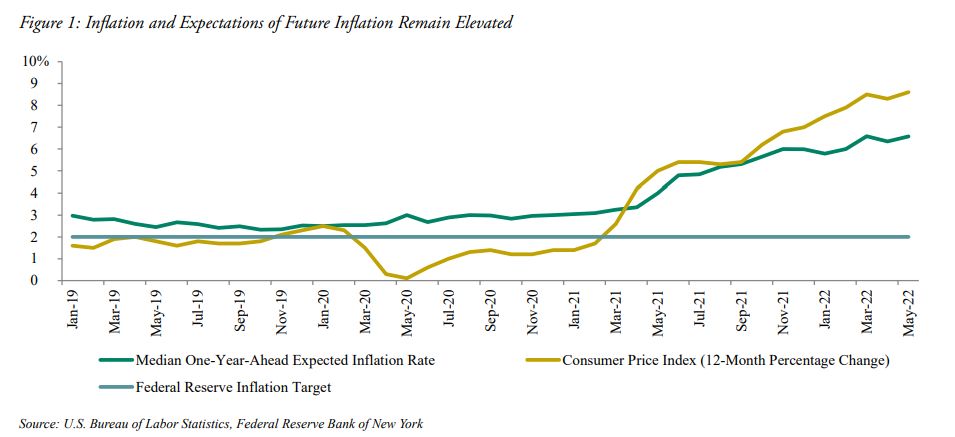

While we aren’t macro forecasters, we are able to analyze macro trends by noting their effects on our portfolio companies. That’s why we knew that rising inflation was a serious concern long before the Federal Reserve stopped referring to rapid price increases as “transitory.” In recent quarters, we’ve seen many of our companies pass on increased costs to their customers, but we’re cognizant that this dynamic may eventually become unsustainable if inflation remains elevated. (See Figure 1.)

We’re also well aware of the challenge the Fed faces as it seeks to engineer a soft landing – i.e., bring down the rate of inflation without causing a recession.

If the Fed fails to successfully strike this balance, then we think the opportunity set in distressed publicly traded credit will expand, as a rising number of companies will likely require restructuring and other liquidity solutions. U.S. public credit – high yield bonds and leveraged loans – has already grown more attractive in recent months, as markets have weakened.

In today’s uncertain environment, we’re reminded of a quote from Warren Buffett that Howard included in his memos It’s All Good (July 2007) and The Tide Goes Out (March 2008): “It’s only when the tide goes out that you find out who’s been swimming naked.”

This quote underscores our long-held belief that focusing on risk control is especially important during good times, when risk aversion among investors is low and asset prices are high. By remaining cautious when others are fearless, investors make it more likely that (a) they’ll be covered when the tide turns and (b) they’ll be in a position to take advantage of opportunities created by those with less forethought.

During periods like the present, we’re mindful that the sharpest asset price declines – and most attractive bargains – often emerge when investors conclude that the tide will never come in again.

You can read the entire letter here:

Oaktree Capital – Q2 2022 Letter

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: