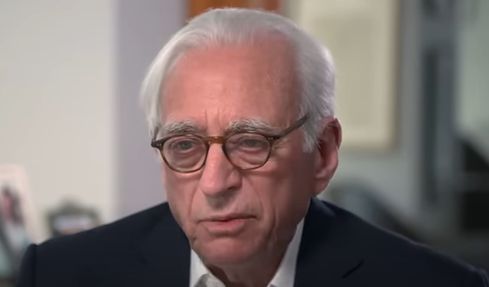

In his recent interview with David Ruubenstein, Nelson Peltz discussed the biggest mistake that investors make. Here’s an excerpt from the interview:

“I think they lose sight of their own common sense, their own judgment, and start to get swept up in a tide of euphoria. I think that’s what happens.

And you know without mentioning any specific companies, I don’t have stock in one. I mean there are companies today… finally the market woke up to them.

But they had 10 plus years of phenomenal market share growth and never generated one dollar of free cash flow. And they did it for 10 plus years and the markets kept rewarding them until they finally stopped.”

He also discussed the types of companies that will do well going forward:

“Those of you who invest in public securities as opposed to private ones is that unless you’re in 12 of 14 stocks it was really hard to keep pace with the S&P over the last five or six years. It was ridiculous! All of the gains came in that dozen or so stocks.

Today I think there is a reversal. I think even though we’re gonna be in a recession I think cash flow, stability, good quality companies, when this is all over are going to be valued once again.

And those are the kind of companies that we invest in, the boring companies. They’re really wonderful companies that generate cash. Just need to be treated properly and have a good plan. And those are the companies we like.”

You can watch the entire discussion here:

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: