This week we take a look at some big named companies that generate huge ‘free’ cash flows compared to their market cap, using the price to free cash flow ratio (P/FCF).

Price to free cash flow (P/FCF) is an valuation metric that compares a company’s per-share market price to its free cash flow (FCF). This metric is very similar to the valuation metric of price to cash flow but is considered a more exact measure because it uses free cash flow, which subtracts capital expenditures (CAPEX) from a company’s total operating cash flow, thereby reflecting the actual cash flow available to fund non-asset-related growth.

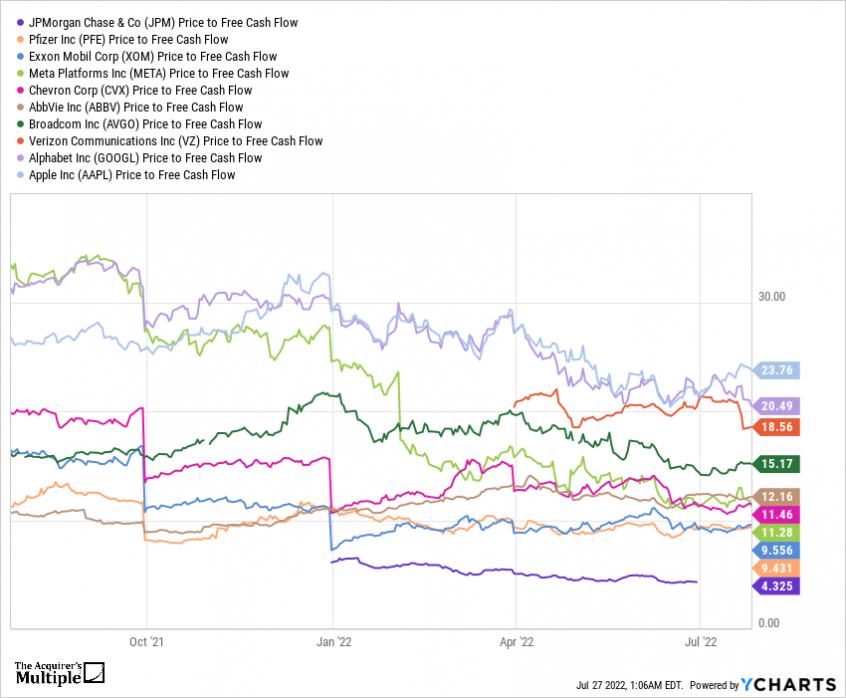

Here’s 10 big named companies with huge free cash flows compared to their market cap:

1. JPMorgan Chase & Co (JPM): Market Cap $333.36B, Free Cash Flow $80.04B – P/FCF 4.32

2. Pfizer Inc (PFE): Market Cap $293.45B, Free Cash Flow $31.78B – P/FCF 9.43

3. Exxon Mobil Corp (XOM): Market Cap $377.63B, Free Cash Flow $40.07B – P/FCF 9.55

4. Meta Platforms Inc (META): Market Cap $430.71B, Free Cash Flow $39.81B – P/FCF 11.28

5. Chevron Corp (CVX): Market Cap $289.44B, Free Cash Flow $24.78B – P/FCF 11.46

6. AbbVie Inc (ABBV): Market Cap $266.60, Free Cash Flow $22.05B – P/FCF 12.16

7. Broadcom Inc (AVGO): Market Cap $206.39B, Free Cash Flow $14.42B – P/FCF 15.17

8. Verizon Communications Inc (VZ): Market Cap $188.65B, Free Cash Flow $10.11B – P/FCF 18.56

9. Alphabet Inc (GOOGL): Market Cap $1.383T, Free Cash Flow $68.98B – P/FCF 20.49

10. Apple Inc (AAPL): Market Cap $2.474T, Free Cash Flow $105.79B – P/FCF 23.76

Here’s what they look like in one chart:

JPM Price to Free Cash Flow data by YCharts

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: