This week’s best investing news:

Accosting Transactions (Verdad)

Bargain Hunting After The Growth Spurt (Validea)

Fiscal Histories (Grumpy Economist)

Too Far (Collaborative Fund)

Stocks on Sale (Humble Dollar)

Markets Have Bought The Fed’s Transitory Narrative Hook, Line And Sinker, Part Deux (Felder)

Seth Klarman: Opportunities and Pitfalls for investors in 2022 (Harvard Business School)

It’s not a bear market – it’s an opportunity to rebalance! (Rudy Havenstein)

Sohn 2022 | John Collison in conversation with Stanley Druckenmiller (SCF)

Josh Wolfe, Venture Capital’s Most Passionate Skeptic (Insecurity Analysis)

Jamie Dimon: Fed Has No Choice But to Do QT (Bloomberg)

Idea Brunch with Balkar Sivia of White Falcon Capital (SIB)

Warren Buffett Donates $4 Billion Berkshire Hathaway Shares (BH)

“Whatever It Takes”…..Ten Years On (Brinker)

Beware of a Bear Market That Is More Than a Cub (Washington Post)

Charlie Munger’s 10 Rules for Investment Success (DGS)

Ruane, Cunniff & Goldfarb 2022 Investor Day Transcript (Ruane, Cunniff)

What the greatest investors did that almost no one ever does (Dakota Value)

Lawson’s Panic: A Lesson in Market Prophecies (Novel)

The Fed Pricked the Everything Bubble (WSJ)

Too Late to Sell, Too Early to Buy… (Barry Ritholz)

Jeffrey Gundlach webcast: “It’s Not Unusual” (DoubleLine)

Leon Cooperman: Wall Street unlikely to go back into a bull market anytime soon (CNBC)

Why we’re not buying the dip in stocks (BlackRock)

Weitz 2022 Annual Shareholder Meeting (Weitz)

Ken Fisher Explains How to Position Your Portfolio for a Rebound (Fisher)

GMO: Inflation In Japan Should Be Cheered, Not Feared (GMO)

Sohn 2022 | An Investment Idea from David Einhorn (SCF)

The S&P isn’t yet in a bear market: Wharton’s Jeremy Siegel (CNBC)

Wall Street’s Favorite Recession Signal Is Back as Curves Invert (Bloomberg)

Why Global Supply Chains May Never Be the Same | A WSJ Documentary (WSJ)

A conversation with Jim Simons: Mathematics, Common Sense and Good Luck (Abel Prize)

Europe Not Ready for Cross-Border Bank M&A, David Herro (CNBC)

Rivian’s Great EV Expectations Meet the Harsh Reality of Manufacturing (WSJ)

Bond Yields, Dollar Surge With Fed Bets as Recession Risk Grows (Yahoo)

What Might Look Good in a Year? (Royce)

2022 Seminar on Value Investing and the Search for Value Guest Speaker: Jeff Stacey (Ivey)

Three signs the US housing boom is petering out (Quartz)

Abandon Stocks for Bonds? If Only Life Were So Simple (WSJ)

“We Appear To Be Entering A Recession”: Coinbase Explains Why It Is Firing 18% Of Employees (ZeroHedge)

How to Fix Twitter and Facebook (Atlantic)

Get In. We’re Going to Save the Mall (NYT)

Stores Have Too Much Stuff. Here’s Where They’re Slashing Prices (WSJ)

This week’s best value Investing news:

What Does An 8% Yield Pay For? (GMO)

Cathie Wood sinking with tech stocks, value investors will be hunting for the biggest bargains (MarketWatch)

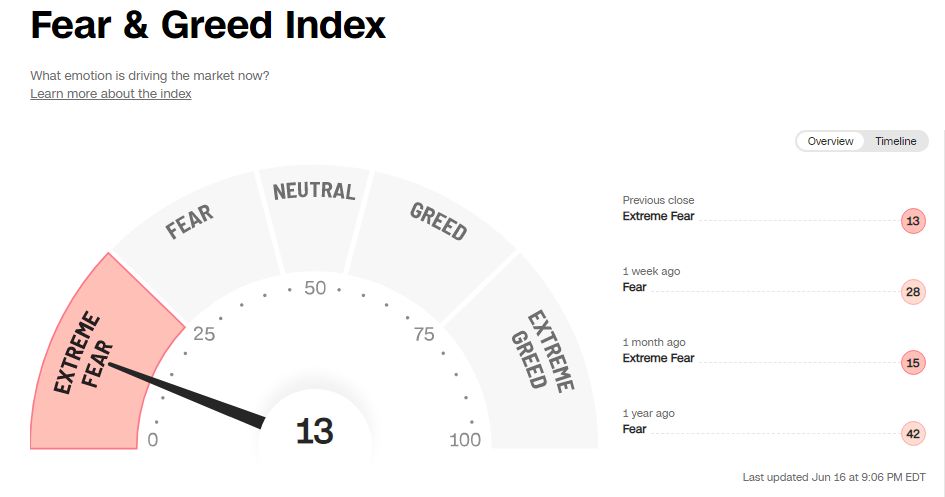

This week’s Fear & Greed Index:

Extreme Fear.

This week’s best investing podcasts:

The Rewind: Something of Value (Howard Marks)

Chris Davis Picks Stocks, Praises Buffett, Rips Politicians (Barron’s)

Show Us Your Portfolio: Wes Gray (Excess Returns)

Meb Faber — Two Quants Walk into a Bar (EP.110) (Infinite Loops)

#139 Laurie Santos: The Pursuit of Happiness (Knowledge Project)

Josh Wolfe & Chris Power – Factories of the Future (Invest Like the Best)

TIP457: Why the Dollar Is Not Collapsing w/ Jeffrey Snider (TIP)

Episode #423: Mebisode – Shareholder Yield: Does it Work Within Sectors and Industries? (Meb Faber)

Mortiz Seibert & Moritz Heiden – From CTA to web3 (S5E3) (Flirting with Models)

Ep. 229 – Patience is Your Friend with Adam Mead, CEO and CIO of Mead Capital Management (Planet MicroCap)

Expert: Yanis Varoufakis – “You should be screaming from the rooftops, stop doing this!” (Equity Mates)

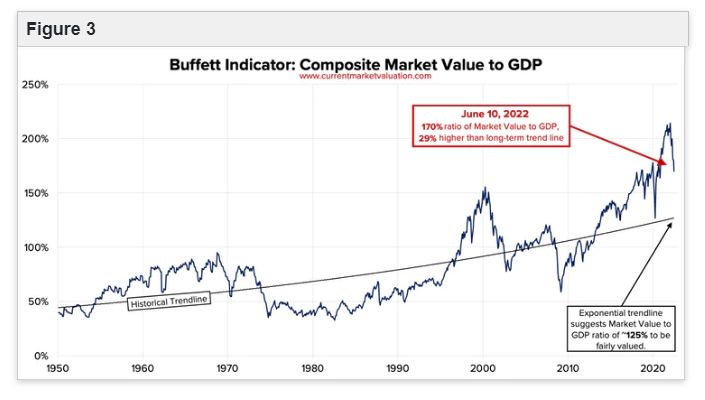

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

The Unintended Consequences of Single Factor Strategies (AlphaArchitect)

Below Overhead Supply (AllStarCharts)

Consumer sentiment index shows strong pessimism (DSGMV)

The Academic Failure to Understand Rebalancing (AllAboutAlpha)

This week’s best investing tweet:

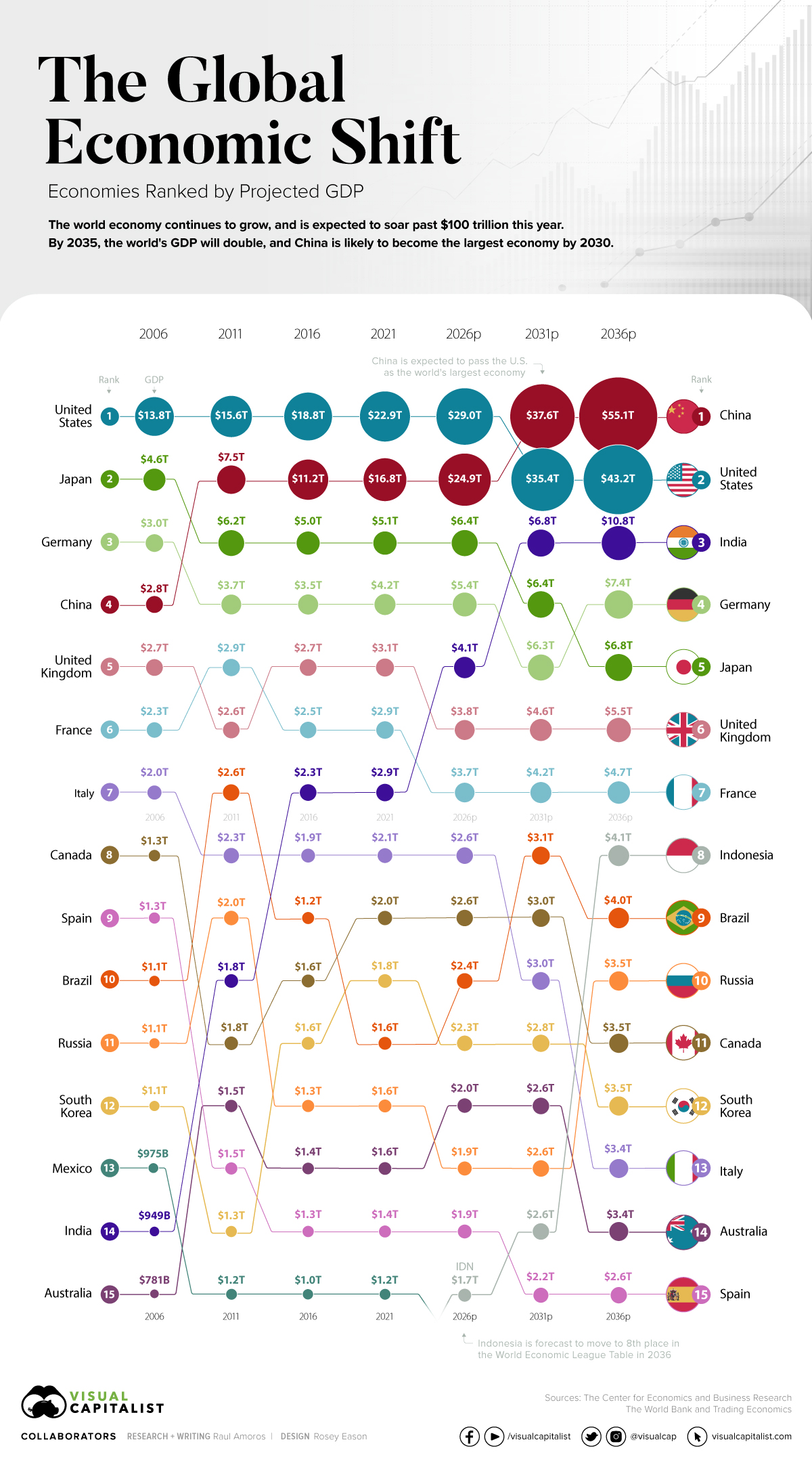

This week’s best investing graphic:

Visualizing the Coming Shift in Global Economic Power (2006-2036p) (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: