This week’s best investing news:

Lessons for Crypto from The Gilded Age (Jamie Catherwood)

Where the Money Is (Verdad)

The Federal Reserve, explained simply. (Havenstein)

ARKK Stocks Sunk (Vitaliy Katsenelson)

Inflation And The $64(0),000 Question (Felder)

Six Charts to Help Understand Stock Valuations in the Wake of This Year’s Decline (Validea)

Once In A Lifetime (Collaborative Fund)

Mutual Admiration (Humble Dollar)

Warren Buffett-Backed EV Maker To Soon Supply Batteries To Tesla (Benzinga)

Guy Spier on Missed 100-Baggers, Tech Stock Crash & Much More (Investing with Tom)

The power of narratives in the US stock market (Klement)

Howard Marks Says Market Attitudes Are More Balanced (Bloomberg)

Smead Capital: When Quality Fails (Smead)

Oakmark Funds Commentary: Can Wine Make You a Better Investor? (Oakmark)

Short-Term Performance is Everything (Behavioural Investment)

Warren Buffett Has Gained Over $171 Billion On These 4 Stocks (G&M)

The Universe is Healing … or Going Nuts, Kinda Hard to Tell (Epsilon Theory)

Investing To Beat Inflation (Fortune)

Todd Wenning Presentation at MOI Best Ideas Omaha (Intrinsic Investing)

Investing legend Mario Gabelli on navigating market volatility and high energy prices (CNBC)

Investor Profile: Jesse Felder (Finmasters)

Ray Dalio: Going broke ‘was one of the best things that ever happened to me’ (CNBC)

A Question: What is The Most Underappreciated Thing in Investing? (Real Returns)

An Old Way to Fight Inflation Gets New Fans (Jason Zweig)

Transcript: Dan Chung (Barry Ritholz)

June Views from First Eagle Global Value Team (First Eagle)

Crypto investments will be a ‘big zero’ in the end, says value investor Mohnish Pabrai (CNBC)

Vanguard Case Study: Active vs. Passive Investing (Morningstar)

How Cliff Asness survived the ‘everything bubble’ (AFR)

Nine Suggestions To Help You Stay Sane In A Volatile Market (Apprise)

Terry Smith named City A.M.’s Investor Of The Year and Morningstar award wins for Fundsmith Equity Fund (Fundsmith)

Pzena Investment Management Q1 2022 Commentary (SA)

What inflation struggles of the past can tell the Fed right now (Washington Post)

From the Big Short to the Big Scam (NY Times)

Virtual Value Investing Q&A Speaker Series Event at Brown University with Ross Glotzbach of Southeastern Asset Management (Brown University)

Is Overconfidence Ruining Your Returns? (Morningstar)

Ken Fisher Explains the Dangers of Breakevenitis (Fisher)

Ray Dalio on the Rise and Fall of Nations (FWAY)

Where to Look for the Next Wall Street Blowup (WSJ)

SPACs Were All the Rage. Now, Not So Much (NY Times)

How Did It Happen?: The Great Inflation of the 1970s and Lessons for Today (Fed Reserve)

Short-term Momentum (Larry Swedroe)

Highflying Tiger Global Humbled by Unraveling of Giant Tech Bet (WSJ)

Are Stocks Undervalued Yet? (WSJ)

How I Learned to Stop Worrying, and Love the (Interest Rate) Bomb (Elm)

Chevron CEO on Oil Demand, Costs, Refinery Closures (Bloomberg)

Small-Cap Quality’s Advantages During Market Declines (Royce)

About 200 years ago, the world started getting rich. Why? (Vox)

Are US Big-Tech Stocks Following In The Footsteps Of Their Chinese Counterparts? (ZeroHedge)

GM’s Cruise approved to offer driverless ride-hailing services in San Francisco area (CNBC)

This week’s best value Investing news:

We’re All Bargain Hunters Now That the Market’s Growth Spurt Is Over (Bloomberg)

Are value stocks cyclical or defensive? (Schroders)

What’s next for tech stocks as value investing edges out growth trades (Yahoo)

Why Some Value Strategies Struggle When Value Stocks Surge (Northern Trust)

Correlation ‘is not causation’ for rates and value stocks (Risk.net)

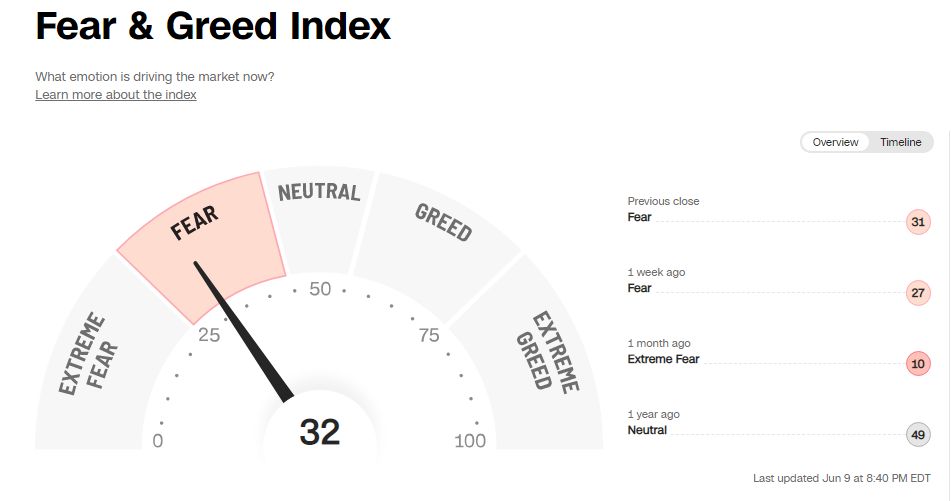

This week’s Fear & Greed Index:

Fear.

This week’s best investing podcasts:

Current Market Conditions w/ Tobias Carlisle (TIP)

Indexing: Why Can’t Money Managers Beat The Market? Charles Ellis Explains (WealthTrack)

Everything Investors Need to Know About Risk Parity with Adam Butler (Excess Returns)

Ep 360. Natural Gas, Inflation, Elon Musk + Twitter, and How Do You Know if Capital Allocation Has Created Value? (Focused Compounding)

Trung Phan — On Smart Threads and Dumb Memes (Infinite Loops)

BONUS: Cem Karsan – Derivatives Are The Underlying (Business Brew)

Martin Casado – The Past, Present, and Future of Digital Infrastructure (ILTB)

Episode #420: Dan Cooper, ROC Investments – ROC: Return on Character (Meb Faber)

Stagflation (Intellectual Investor)

S2E36: Michael Mauboussin’s “Man Overboard Moment” (MOI)

Asset Class Scoreboard: May 2022 (RCM)

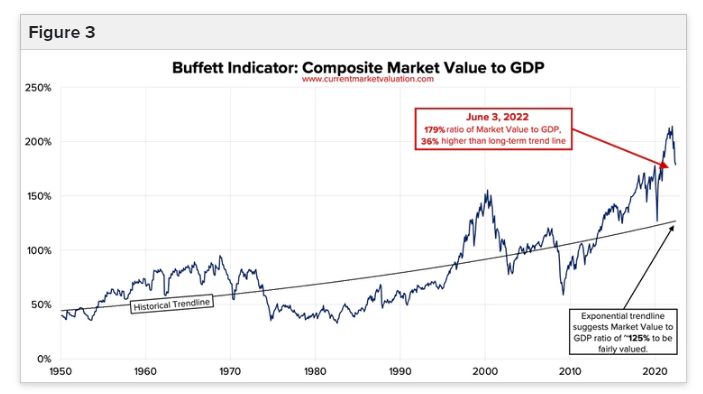

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

Global Factor Performance: June 2022 (AlphaArchitect)

The Death of Risk Premia is Greatly Exaggerated (AllAboutAlpha)

How Sharp Is the Sharpe Ratio? An Analysis of Global Stock Indices (CFA)

This week’s best investing tweet:

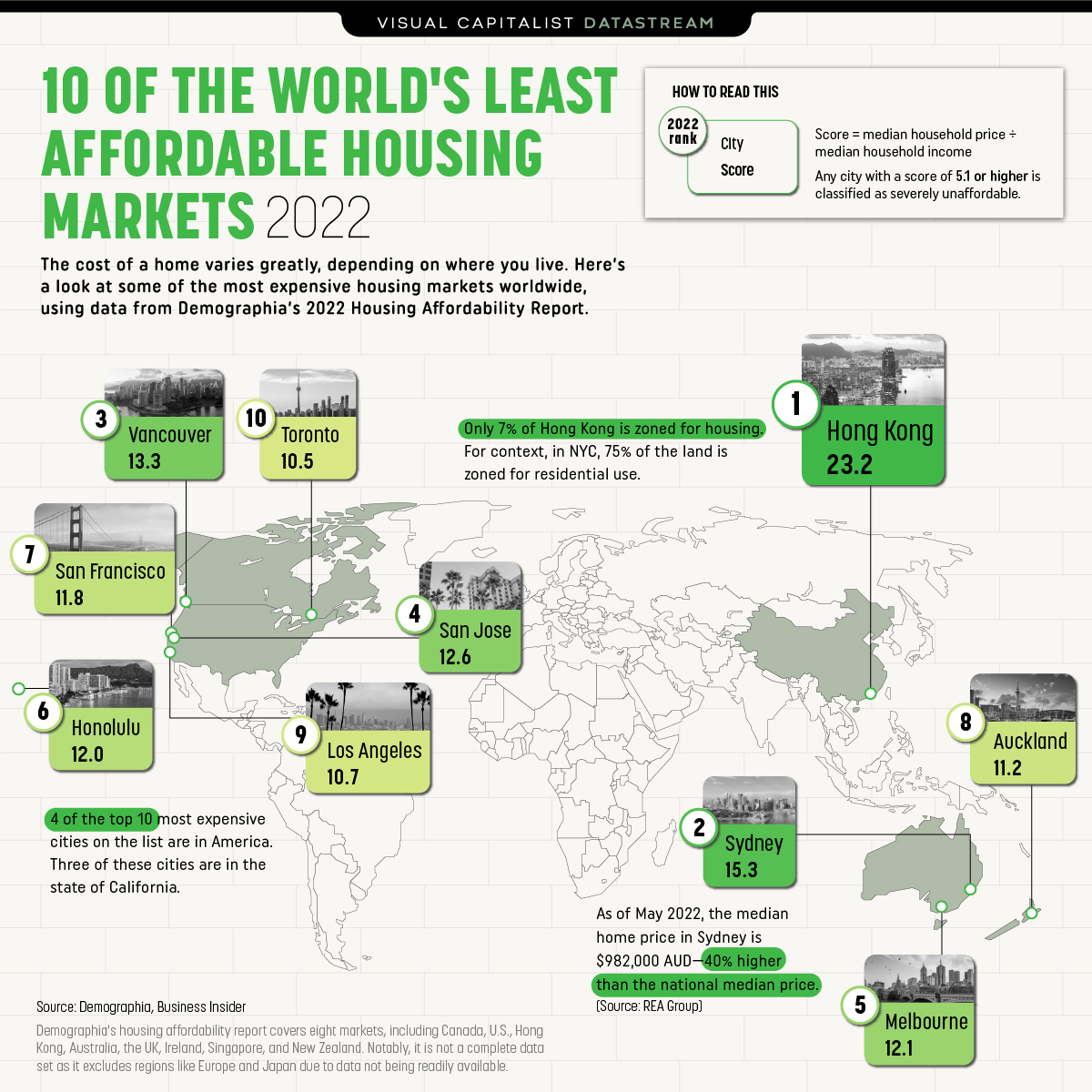

This week’s best investing graphic:

Ranked: These Are 10 of the World’s Least Affordable Housing Markets (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: