Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, and Howard Marks. The top investor data is provided from their latest 13F’s. This week we’ll take a look at:

Intel Corp (INTC)

Intel is the world’s largest logic chipmaker. It designs and manufactures microprocessors for the global personal computer and data center markets. Intel pioneered the x86 architecture for microprocessors. It was the prime proponent of Moore’s law for advances in semiconductor manufacturing, though the firm has recently faced manufacturing delays. While Intel’s server processor business has benefited from the shift to the cloud, the firm has also been expanding into new adjacencies as the personal computer market has stagnated. These include areas such as the Internet of Things, artificial intelligence, and automotive. Intel has been active on the merger and acquisitions front, acquiring Altera, Mobileye, and Habana Labs in order to bolster these efforts in non-PC arenas.

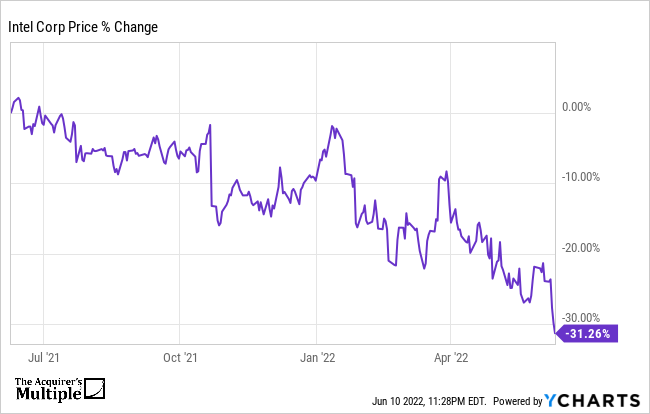

A quick look at the price chart below shows us that the stock is down 31% in the past twelve months. We currently have the stock trading on an Acquirer’s Multiple of 8.20, which means that it remains undervalued.

Superinvestors who currently hold positions in the company include:

(Shares)

Chris Davis – 16,727,945

Seth Klarman – 16,592,431

Cliff Asness – 5,475,920

Ken Fisher – 1,779,519

Tweedy Browne – 1,259,613

Ray Dalio – 994,313

Ken Griffin – 802,278

Bruce Berkowitz – 588,400

David Einhorn – 309,500

Rob Olstein – 265,000

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: