As part of our ongoing series here at The Acquirer’s Multiple, we provide this feature article titled ‘Stock in Focus‘ where we focus on one of the stocks from our Stock Screeners.

One of the cheapest stocks in our Stock Screeners is:

Winnebago Industries Inc (WGO)

Winnebago Industries manufactures Class A, B, and C motor homes along with towables, customized specialty vehicles, boats, and parts. Headquartered in Eden Prairie, Minnesota, Winnebago has been producing recreational vehicles since 1958. Revenue was about $3.6 billion in fiscal 2021. Winnebago expanded into towables in 2011 with the acquisition of SunnyBrook and acquired Grand Design in November 2016. Towables made up 85% of the firm’s RV unit volume, up from 31% in fiscal 2016. The company’s total RV unit volume was 71,015 in fiscal 2021. Winnebago expanded into boating in 2018 with the purchase of Chris-Craft, bought premium motor home maker Newmar in November 2019, and bought Barletta pontoon boats in August 2021.

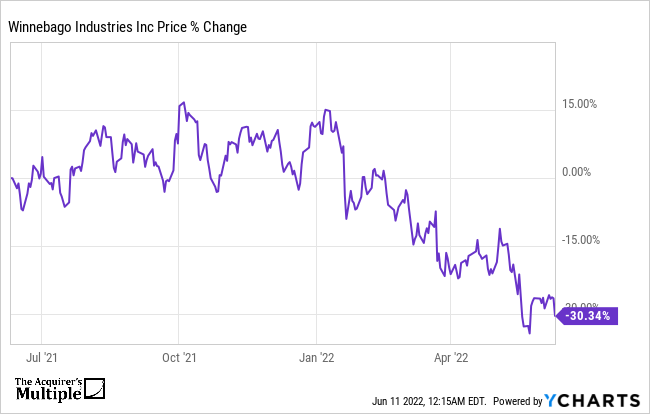

A quick look at the share price history (below) over the past twelve months shows that the price is down 30%. Here’s why the company is undervalued.

Summary

Market Cap: $1.54 Billion

Enterprise Value: $1.98 Billion

Operating Earnings

Operating Earnings: $509 Million

Acquirer’s Multiple

Acquirer’s Multiple: 3.89

Free Cash Flow (TTM)

Free Cash Flow: $143 Million

FCF/EV Yield

FCF/EV Yield: 9.3%

Shareholder Yield:

Shareholder Yield: 7.80

Other Indicators

Piotroski F-Score: 4

Altman Z-Score: 4.82

ROA (5 Year Avge): 22.04

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: