This week’s best investing news:

Full recording of Berkshire Hathaway 2022 annual meeting (CNBC)

EM Crisis Investing, a Deep(er) Dive (Verdad)

Why Am I Reading This Now? 05.02.22 (Epsilon Theory)

Markets Are At Risk Of Another Major Deleveraging Event (Felder Report)

Buffett: Markets Becoming A “Gambling Parlor” (Validea)

Ray Dalio Demystifies Debt (WTI)

The power of narratives (Klement)

Prices Down, Value Up (Humble Dollar)

Transcript: Michael Lewis (Barry Ritholz)

High School & CNN+ (Scott Galloway)

Howard Marks on Investing Risk – Wharton School Investor Series (Wharton)

274: NASDAQ Underbelly, Mark Leonard’s 7 Lessons (Liberty)

Berkshire Hathaway Q1 2022 Report (BH)

15th Annual Pershing Square Value Investing and Philanthropy Challenge (Columbia)

Tiger Global slumps more than 40% in first four months of 2022 (FT)

Berkshire Hathaway Annual Meeting, Buffett Cracks Jokes and Explains His Latest Investments (Barron’s)

I totally missed the market timing in March 2020, says Warren Buffett (CNBC)

CEO Discussions – Markel (04.29.2022) (Gabelli)

Session 25: Valuation Inputs (Aswath Damodaran)

Making Your Cash Work Harder as Interest Rates Rise (WSJ)

Jensen Quality Growth Fund Webinar (Jensen)

The market is fairly valued, bigger concern is the Fed, says legendary investor Mario Gabelli (CNBC)

10-Year Treasury Yield Hits 3% for First Time Since 2018 (WSJ)

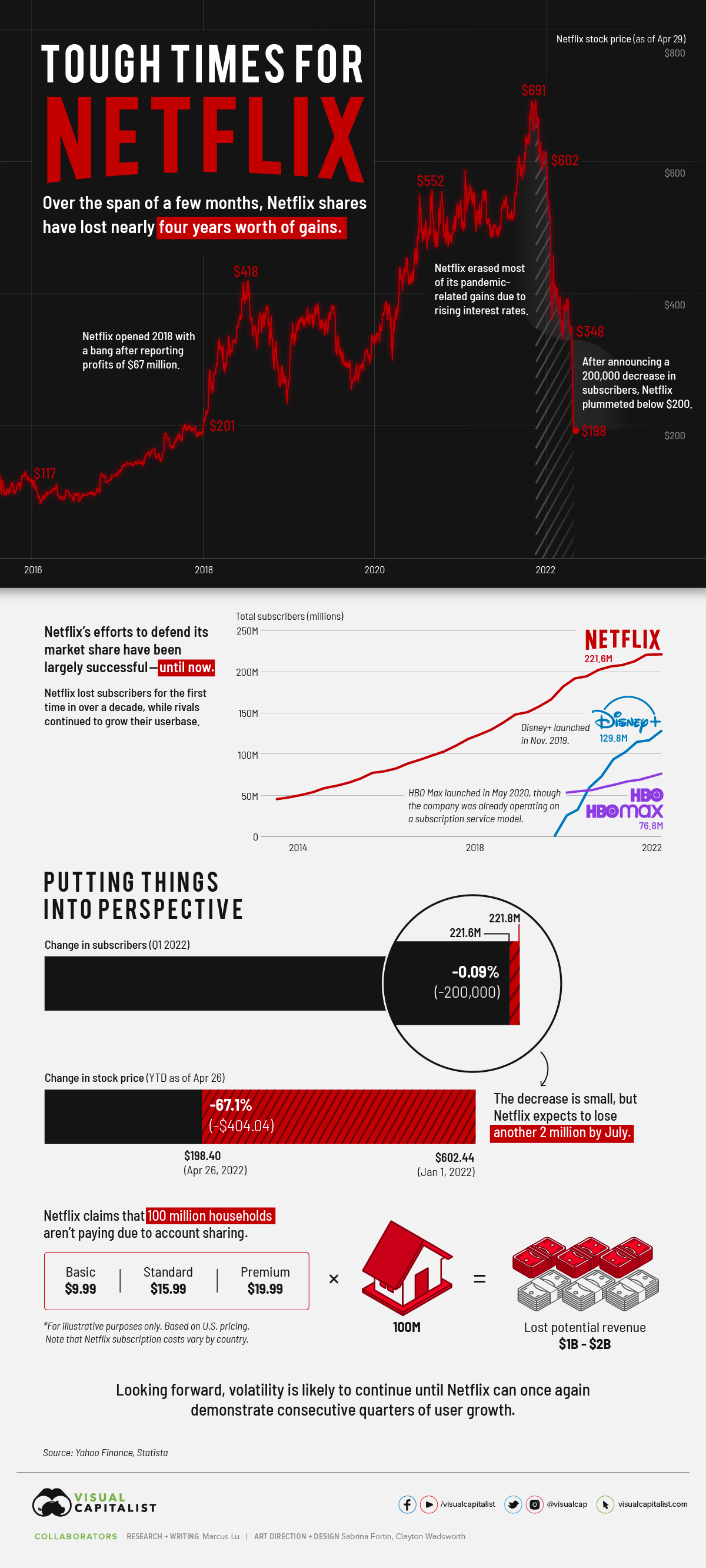

Why Netflix Is the Worst Performing Stock in the S&P 500 (NYT)

Horizon Kinetics Q1 Roundtable Discussion (HK)

Berkshire’s Charlie Munger calls stock market manipulation ‘incredible, crazy situation’ (CNBC)

As The US Economy Stepped Back, The US Consumer Stepped Up (Brinker)

Tom Russo and the Capacity to Suffer and the Capacity to Reinvest (DGI)

Warren Buffett-backed electric carmaker shrugs off China’s lockdowns (CNN)

Elliott Investment Management Letter To Western Digital (Elliott)

CEO Discussions – Lindsay (04.29.2022) (Gabelli)

There is still a lot of inflation in the pipeline, says Wharton’s Jeremy Siegel (CNBC)

Have Growth Stocks Bottomed? (Morningstar)

High flying stocks will continue to come back down to Earth, says veteran value investor John Rogers (CNBC)

Sell In May And Go Away? (AlbertBridge)

Why ‘Free’ Robo-Advisors Aren’t Really Free (Morningstar)

We’re moving from an orderly sell-off to what looks like liquidation: Mark Yusko (CNBC)

How to fail at investing (Occam)

We have become ‘less enamored’ with Berkshire’s capital allocation: David Rolfe (CNBC)

NFT Sales Are Flatlining (WSJ)

David Katz: Buy into weakness, don’t be concerned about where the market’s going in the next year (CNBC)

This week’s best value Investing news:

Evaluating the Current Arguments in the Value vs. Growth Debate (Validea)

Using Momentum To Find Value (Alpha Architect)

Should value strategies adjust for intangibles? (Larry Swedroe)

Value Strikes Back: Is Value Investing Making a Comeback? (Fin Masters)

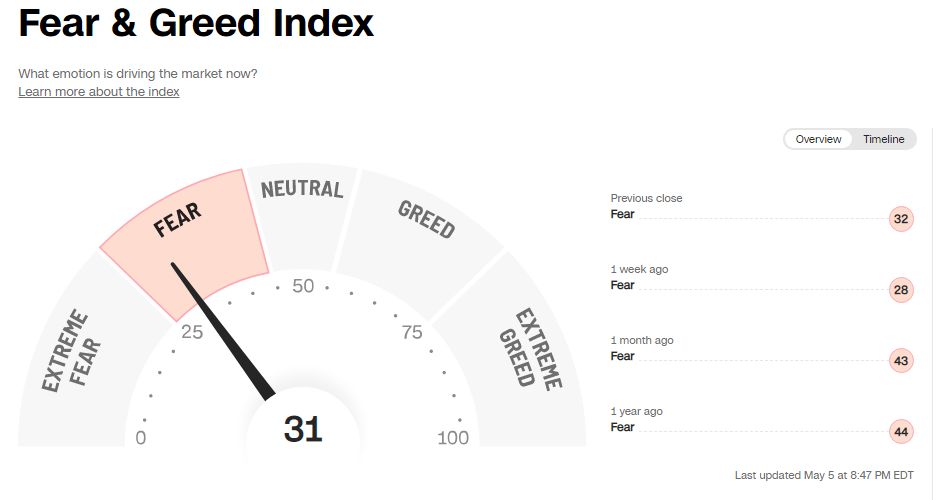

This week’s Fear & Greed Index:

Fear.

This week’s best investing podcasts:

Ted Weschler (Berkshire Hathaway) Interview (I Am Home)

Ten of the Biggest Financial Mistakes Investors Make – And How To Avoid Them – Peter Lazaroff (Excess Returns)

Eric Glyman – Reimagining Corporate Finance (Invest Like The Best)

Episode #411: Kai Wu, Sparkline Capital – Investing in Innovation, Intangible Value, & Web3 (Meb Faber)

Ep. 225 – Turning $10,000 Investment in 2009 to $7 Million in 12 years Investing in MicroCap Stocks with Mariusz Skonieczny (Planet MicroCap)

Lost in Spaces (Business Brew)

TIP444: The Changing World of Endowments and ESG Policies w/ Ted Seides (TIP)

Twitter, Berkshire Hathaway, and Corporate Governance (TWII)

#136 David Sinclair: Reversing the Aging Process (Knowledge Project)

Nick Maggiulli — Just Keep Buying (EP.103) (Infinite Loops)

Expert: Vince Pezzullo – Boring Companies, Exciting Returns | Perpetual (Equity Mates)

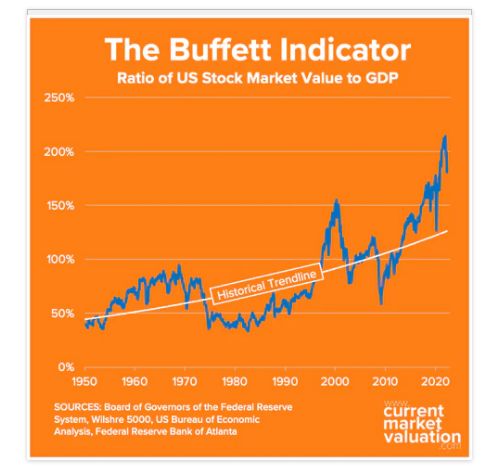

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

The Future of Factor Investing (AlphaArchitect)

Is There a Stronger Trend Than USD? (AllStarCharts)

What a difference a day makes – Major reversal after Fed rate hike (DSGMV)

Higher Interest Rates: Some Hedge Fund Strategies May Benefit (CFA)

Ditch Volatility (AllAboutAlpha)

This week’s best investing tweet:

This week’s best investing graphic:

Why Investors Tuned Out Netflix (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: