Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, and Howard Marks. The top investor data is provided from their latest 13F’s. This week we’ll take a look at:

Micron Technology Inc (MU)

Micron historically focused on designing and manufacturing DRAM for PCs. The firm then expanded into the NAND flash memory market. It increased its DRAM scale with the purchase of Elpida (completed in mid-2013) and Inotera (completed in December 2016). The firm’s DRAM and NAND products tailored to PCs, data centers, smartphones, game consoles, automotives, and other computing devices.

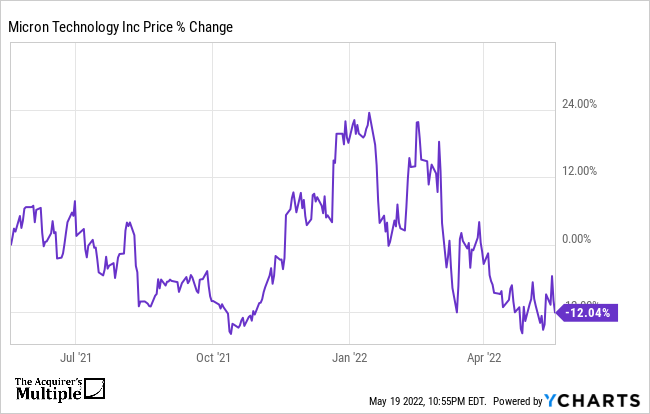

A quick look at the price chart below shows us that the stock is down 12.04% in the past twelve months. We currently have the stock trading on an Acquirer’s Multiple of 7.20, which means that it remains undervalued.

Superinvestors who currently hold positions in the company include:

(Shares)

Li Lu – 11,476,523

Sequoia – 7,705,409

Seth Klarman – 3,110,974

Ken Griffin – 2,907,081

David Tepper – 2,100,000

Cliff Asness – 1,984,727

Mohnish Pabrai – 1,823,812

Prem Watsa – 690,200

Donald Yacktman – 682,375

Ray Dalio – 559,314

Guy Spier – 200,000

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple:

3 Comments on “This Acquirers Multiple Stock Appearing In Klarman, Lu, Pabrai Portfolios”

I don’t think that your 7.2 number is correct. It is much lower.

Hey Jim. We’re showing an EV of $79,519M and OI of $10,384M, which equates to an AM of 7.7.

Johnny,

You are right.

I was using EBITDA not EBIT.

However, I still prefer EBITDA. I could write a book on why but perhaps later.

Briefly, when valuing a business, the historical cost of assets is not part of the calculation. Depreciation is an accounting entry based on historical cost. Certainly for trucking and airlines EBIT is a better measure, but for most businesses EBITDA is the appropriate measure. My average cost on Micron is just over $14 and I used EBITDA. If US companies used IFRS, companies like Micron may not have a depreciation expense. Depreciating intangible assets that are increasing in value makes no sense.

But under US GAAP they are depreciated. Companies like Microsoft materially understate their earnings for the same reason.

Jim