As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, and Howard Marks.

While doing this research we’ve also uncovered a number of stocks that superinvestors have sold, or reduced in their portfolios, according to their latest 13f’s. So we’re now providing a new weekly feature article called ‘One Stock Superinvestors Are Selling‘. This week we’ll take a look at:

Berkshire Hathaway Inc (BRK.B)

Berkshire Hathaway is a holding company with a wide array of subsidiaries engaged in diverse activities. The firm’s core business segment is insurance, run primarily through Geico, Berkshire Hathaway Reinsurance Group, and Berkshire Hathaway Primary Group. Berkshire has used the excess cash thrown off from these and its other operations over the years to acquire Burlington Northern Santa Fe (railroad), Berkshire Hathaway Energy (utilities and energy distributors), and the firms that make up its manufacturing, service, and retailing operations (which include five of Berkshire’s largest noninsurance pretax earnings generators: Precision Castparts, Lubrizol, Clayton Homes, Marmon, and IMC/ISCAR). The conglomerate is unique in that it is run on a completely decentralized basis.

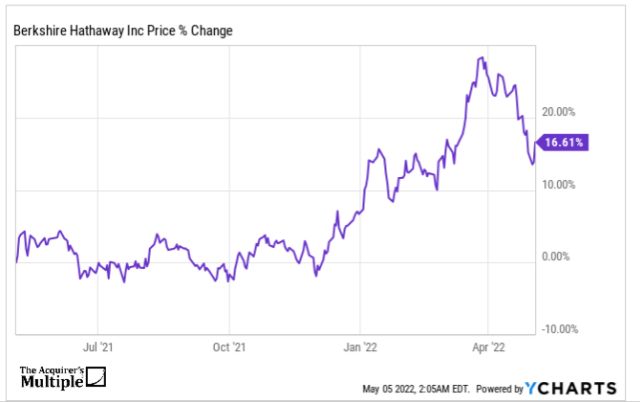

A quick look at the price chart below for the company shows us that the stock is up 17% in the past twelve months.

Superinvestors who reduced, or sold out of the company’s stocks include:

(Remaining shares)

Bill Gates – 33,686,679

Tom Russo – 1,826,210

Chris Davis – 1,489,321

Cliff Asness – 983,462

Donald Yacktman – 715,628

Glenn Greenberg – 671,870

Francois Rochon – 554,588

Harry Burn – 314,449

Tweedy Browne – 281,043

Chris Bloomstran – 211,508

Bruce Berkowitz – 49,155

Rob Olstein – 27,000

David Rolfe – 19,500

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: