This week’s best investing news:

Homeland Securities (Verdad)

Lost Civilizations & Uncovered Ruins (Jamie Catherwood)

Ignore That Gut (Humble Dollar)

The Trouble For Big Tech Stocks In Two Charts (Felder Report)

We’re Entering a Deleveraging Cycle (Epsilon Theory)

David Einhorn Is Prepping Greenlight For The End Of The Bull Market (Forbes)

JPMorgan Expects Earnings To Surpass Estimates (Validea)

Staying Put (Collaborative Fund)

Elon Conquers The Twitterverse (Common Sense)

Fundsmith Equity win Morningstar Award in categorie Aandelen Wereldwijd (Morningstar)

When to listen to markets? Druckenmiller, Diversity, and the Debate over 1987 (Insecurity Analysis)

AQR – Building a Better Commodities Portfolio (AQR)

Power (Scott Galloway)

What if we valued the US government like a company? (Klement)

Markel Corporation’s (MKL) CEO Tom Gayner on Q1 2022 Results (Seeking Alpha)

What is the Point of Owning Bonds in a Rising Yield Environment? (Behavioural Investment)

Activist Investor Daniel Loeb Sees Roughly $1 Trillion of Untapped Value in Amazon (WSJ)

Wise Words from John Neff (Novel)

10 Questions to Ask at Berkshire Hathaway’s Annual Meeting (Morningstar)

A New Generation Learns About Risk (VSG)

The Biggest Danger of Investing in Bad Businesses (Safal)

6 Attributes of Successful Investors (Yahoo)

Jeremy Siegel: The Fed is still way behind the curve, but they’re getting there (CNBC)

Increased Our Fair Value for Berkshire Hathaway (Morningstar)

Revisiting Liar’s Poker, 30 Years Later (Barry Ritholz)

Melvin to return some capital to investors as losses grow (FT)

Transcript: Mark Jenkins (Big Picture)

How to Stop Your Fund Manager From Feeding on Your Cash (WSJ)

Profiting From Lower Volatility (Morningstar)

What Fidget Spinner Mania Can Teach Bond Traders (Washington Post)

What Does Residual Momentum Tell Us About Firm-Specific Momentum? (papers.ssrn)

The Pros and Cons of Market-Cap-Weighted Indexing (Morningstar)

Facebook Is Broken. Execs Say a Fix Won’t Come Fast (Barron’s)

Chris Bloomstran: Berkshire v S&P500 (Twitter)

Sound Shore Q1 2022 Letter (SS)

Weitz Value Fund Q1 2022 (Weitz)

Mairs & Power Q1 2022 (M&P)

Tweedy Browne Q1 2022 Letter (TB)

This week’s best value Investing news:

Value Stocks to Trounce Growth, Say 74% of Votes: MLIV Pulse (Bloomberg)

Making the case for long-term value investing — again (Medium)

Is Common Sense Returning to the Markets? (Heartland Advisors)

Investing in Hated Sectors: Finding Value in Unloved Stocks (FinMasters)

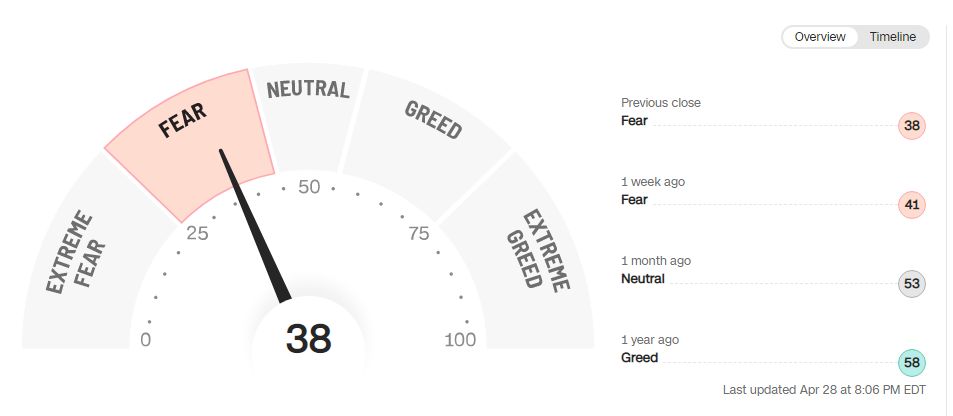

This week’s Fear & Greed Index:

Fear.

This week’s best investing podcasts:

The Rewind: Lines in the Sand (Howard Marks)

TIP443: Buffett’s Biggest Blunders w/ David Kass (TIP)

Episode #410: Chris Bloomstran, Semper Augustus (Meb Faber)

Show Us Your Portfolio: Meb Faber (Excess Returns)

William Green — Lessons for Life and Investing (EP.102) (Infinite Loops)

Interview with REV Group Inc. CEO, Rod Rushing (Pzena)

How to Build a Portfolio for Today’s Crazy Markets (Intellectual Investor)

S2E30: Pricing vs. Valuation | When “Safety” Is Not Cheap (MOI)

Dmitry Balyasny – Building a Better Model (Invest Like The Best)

366- Is Netflix Worth Investing In? (InvestED)

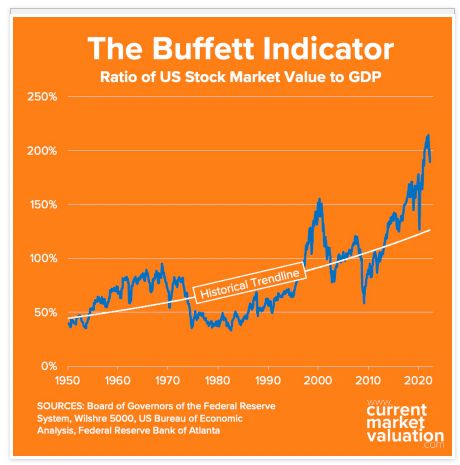

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

Betting Against Beta: New Insights (AlphaArchitect)

ESG Integration: Lessons from US Insurers (CFA)

Inflation is a global problem well before the Ukraine War (DSGMV)

The Bond Market Has Already Crashed (MacroTourist)

Tokens Are Not Stocks: Part Two (AllAboutAlpha)

This week’s best investing tweet:

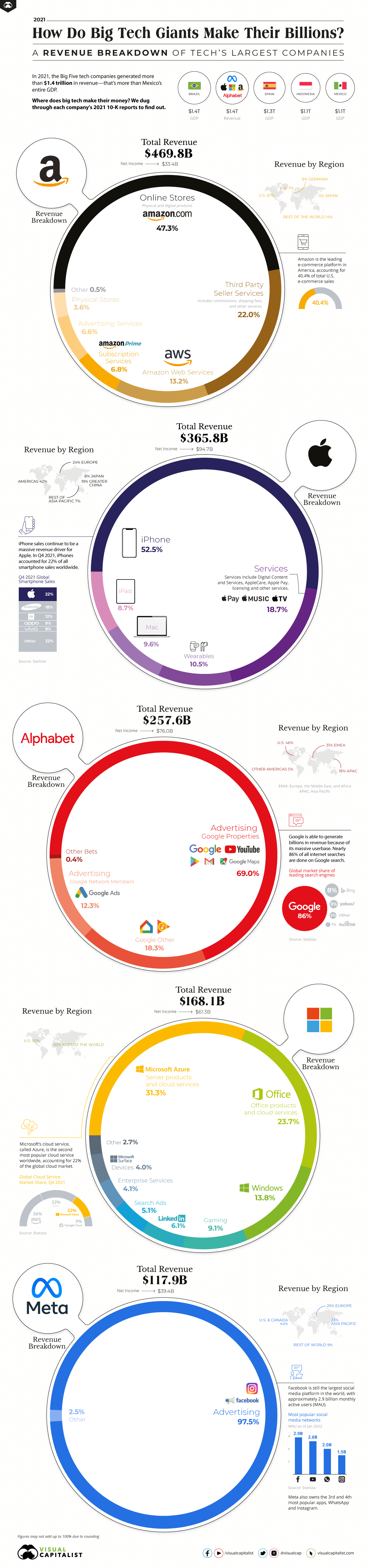

This week’s best investing graphic:

How Do Big Tech Giants Make Their Billions? (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: