This week’s best investing news:

Howard Marks Memo – The Pendulum in International Affairs (OakTree)

A Brief History of Economic Warfare (Jamie Catherwood)

The Loan Engine (Verdad)

The Secret Message In Buffett’s Newest Deals (Validea)

Why You Should Look At Markets Like A Martian (Felder)

Narrative and Metaverse, Pt. 3: The Luther Protocol (Epsilon Theory)

So Much Losing (Humble Dollar)

Changes (VSG)

Transcript: Darren Palmer (Barry Ritholz)

Petrified in a bear market – until you see an exit sign (Klement)

Carl Icahn describes how his style is different from that of fellow investing icon Warren Buffett (CNBC)

Investing vs spending: a question of balance (EB Investor)

Michael Price, Michael Mauboussin, Pierre Andurand (Insecurity Analysis)

Q4 2021 Letters (Reddit)

Has the Yield Curve Flattened or Steepened? Yes. Wait, What? (Brinker)

Warren Buffett Makes a Match (WSJ)

Safer, Yet More Afraid Than Ever (Collaborative Fund)

Bill Miller’s Market Perspective March 2022 (Miller)

Do Options Belong in the Portfolios of Individual Investors? (Elm Partners)

Opportunities In The Metaverse (JP Morgan)

Advantages of The Real Asset Ecosystem (Massif)

Christopher Bloomstran’s Twitter thread on Berkshire’s Alleghany acquisition (Twitter)

Fundsmith 2022 Annual Shareholders’ Meeting (Fundsmith)

Citadel’s Ken Griffin: Be a Problem Solver (David Rubenstein)

Five Lessons Entrepreneurs Can Learn From George Soros (Forbes)

Michael Mauboussin: Feedback- Information as a Basis for Improvement (MS)

Berkshire shareholder Robert Miles discusses Berkshire buying insurer Alleghany (CNBC)

Drinking Less, Drinking Better (Lindsell Train)

Russia in Ukraine: Let Loose the Dogs of War! (Aswath Damodaran)

The companies that Wall Street legend Jim Chanos is shorting in 2022 (LiveWire)

Wash (Scott Galloway)

Stock Pickers Watched the S&P 500 Pass Them by Again in 2021 (WSJ)

3 Sources of Investor Advantage (Novel)

First Eagle – Without a Net (FEIM)

Is The Fed on the Verge of a Policy Mistake? (PragCap)

Brandes Letter: The Enduring Value of Graham Principles (Brandes)

Investing in a time of inflation: what they don’t tell you (Real Returns)

Investors should be buying during times of peak fear: Robert Arnott (Bloomberg)

The Need for an Investment Premise (Safal)

First Eagle Ukraine/Russia Update: Uncertainty Reigns (FEIM)

This week’s best value Investing news:

Forget Benjamin Graham? These Legendary Investors Have Changed Their Definitions Of Value Investing (Forbes)

What’s Behind the UK Value Renaissance? (Morningstar)

Value stocks still cheap relative to growth sector peers (bnpparibas)

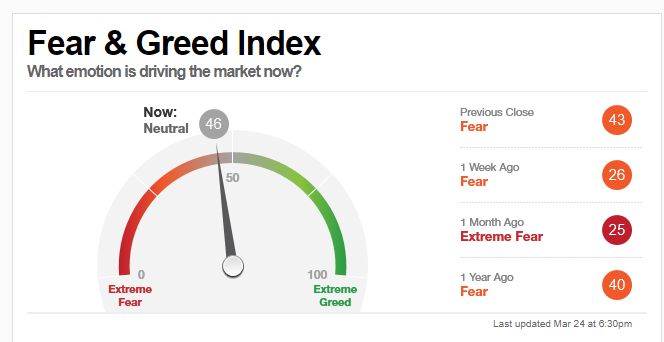

This week’s Fear & Greed Index:

Neutral.

This week’s best investing podcasts:

#133 Andrew Huberman: The Science of Small Changes (Knowledge Project)

Patrick O’Shaughnessy on Custom Indexing and the Portfolio of You (Barron’s)

TIP432: The Creator Economy, Building a Personal Moat and Mental Health Stack w/ Alex Lieberman (TIP)

Expert: Thomas Valenzuela – Building a concentrated portfolio of long-term compounders (Equity Mates)

Breaking Down the Russia Ukraine Conflict with Epsilon Theory’s Ben Hunt (Excess Returns)

Opportunities in commodities (Grant’s)

Gaurav Kapadia – Everything Compounds (Invest Like The Best)

Episode 360 – From the Vault: Moat and Processes (InvestED)

S2E26 SPECIAL: Roger Lowenstein on His Book, Ways and Means (MOI)

Episode #401: Clay Gardner, Titan – Investment Management Services for The Everyday Investor (Meb Faber)

A Hawkish Fed Eyes Inflation (and Not Much Else) (Real Vision)

Eric Schoenstein: The Case for Quality Stocks (The Long View)

(Modern) Modern Portfolio Theory (EP.193) (Rational Reminder)

The Value Perspective with Tim Davies (Value Perspective)

Frederik Gieschen: Lessons From Trading Greats, Writing Habits & Black Holes (Value Hive)

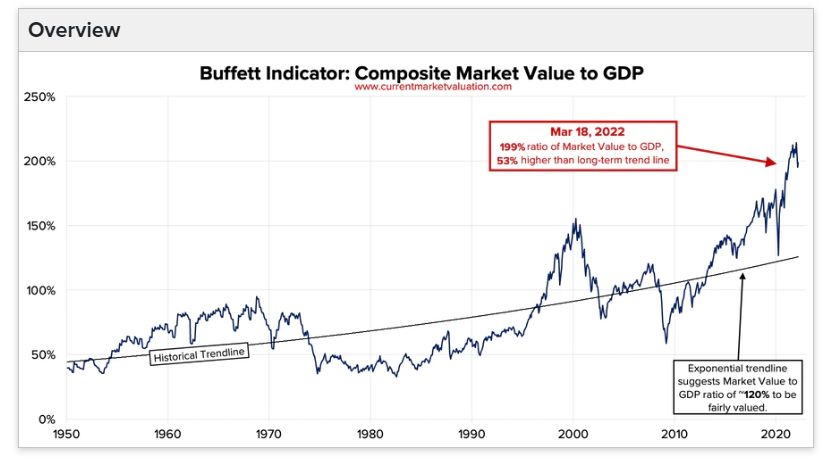

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

Are Quant Approaches Best for Sustainable (ESG) Investing? (Alpha Architect)

Why don’t gasoline prices move one-for-one with oil prices (DSGMV)

The Illusion Of 1% Up Days Winning Streaks (PAL)

A Paradigm Shift in Investing — Are You Ready? (CFA)

Growth vs Value: 2022 Edition (All Star Charts)

The Five Marks that Define the Portfolio for the Future (All About Alpha)

This week’s best investing tweet:

This week’s best investing graphic:

Mapped: Global Happiness Levels in 2022 (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: