This week’s best investing news:

Berkshire Hathaway Annual Letter 2022 (BH)

A History of Invasions, Wars & Markets (Jamie Catherwood)

Index Funds Will Change The World, But Not In A Good Way, Says Munger (Validea)

Japan’s Economic Recovery (Verdad)

Makes You Think (Collaborative Fund)

Want To Win In The Markets? First Learn How To Lose (Felder Report)

Data Update 5 for 2022: The Bottom Line! (Aswath Damodaran)

What Price Evil? (HumbleDollar)

Robinhood and the Gamification of Investing (FinMasters)

Down Round (Scott Galloway)

Lessons from the 2021 Berkshire Letter (Novel Investor)

Three Investing Lessons from the Russian Stock Market Collapse (PragCap)

248: Heico, Second Option Bias, Big Tech & Russia (Liberty)

Transcript: Sebastian Mallaby (Barry Ritholz)

Howard Marks: The 5 Most Important Things in Investing (Yahoo)

My Notes on Warren Buffett’s 2021 Letter to Shareholders (Safal)

Idea Brunch with Ian Cassel of Intelligent Fanatics Capital Management (Sunday Brunch)

Fama: It’s Putin who’s irrational, not the markets (EB Investor)

Bill Miller: Top value investors expect a very hawkish Fed this year (CNBC)

March Views from First Eagle Global Value Team (FE)

Q4 2021 Letters (Updated (reddit)

Guy Spier on Finding Your North Star and the Power of Compounding Goodwill (VK)

Jeremy Siegel: Slowing Fed policy because of Ukraine-Russia war would be big mistake (CNBC)

Russia’s Invasion of Ukraine and Potential Investment Implications (Dodge Cox)

Berkshire’s Businesses, Portfolio in Solid Shape (Morningstar)

Ariel Investments – Conference Call with top value investors (Ariel)

Don’t Invest Like A Billionaire (Demystifying Markets)

Inside Facebook’s $10 Billion Breakup With Advertisers (WSJ)

The two elephants in Warren Buffett’s room (AFR)

Weitz – Analyst Corner -Meta Platforms (FB) (Weitz)

Artemis Capital’s Chris Cole Lays Bare the Forces Destabilizing Markets (DDB)

Getting Real About Interest Rates & Inflation (Polen Capital)

Some Thoughts on Russia & Ukraine (Brinker)

This week’s best value Investing news:

Can Value Investing Work in Emerging Markets? (Advisor Perspectives)

J.P. Morgan Likes Value Stocks Better Than Growth Stocks (The Street)

Ep. 216 – Value Investing Trends and Observations, and Golf with Joe Koster (podcast) (Planet MicroCap)

Berkshire Hathaway Annual Letter 2022 (Berkshire Hathaway)

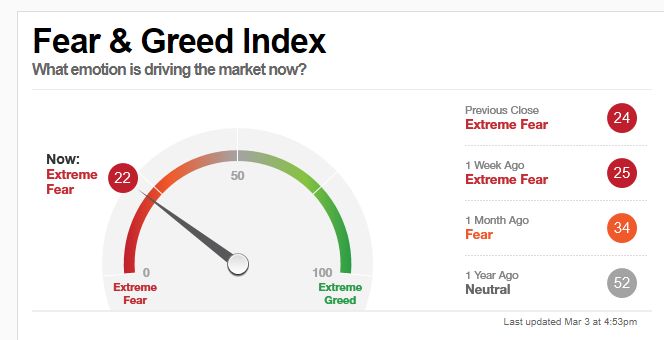

This week’s Fear & Greed Index:

Extreme Fear.

This week’s best investing podcasts:

Rob Arnott: What Better Time to Buy Than During the Lows? (Stansberry)

Bill Nygren: Focus on the long term, not on current events and chaos (Money Life)

TIP425: Top 5 predictions for 2022 w/ Andrew Walker (TIP)

Dave Girouard – Changing Credit (Business Brew)

Decoding the Information in Emotions to Unlock Performance (Barron’s)

Episode #395: Rob Koyfman, Koyfin – Building The Go-To Investing Platform (Meb Faber)

Gamma, Vanna, Charm and the Impact of Options on the Stock Market with Jason DeLorenzo (Excess Returns)

Ep 348. Warren Buffett’s 2021 Letter to Berkshire Hathaway Shareholders (Focused Compounding)

Using Free-Cash Flow to Invest in Value Stocks (Gaining Perspective)

Eric Mandelblatt – Investing in the Industrial Economy (Invest Like The Best)

#267 – Mark Zuckerberg: Meta, Facebook, Instagram, and the Metaverse (Lex Fridman)

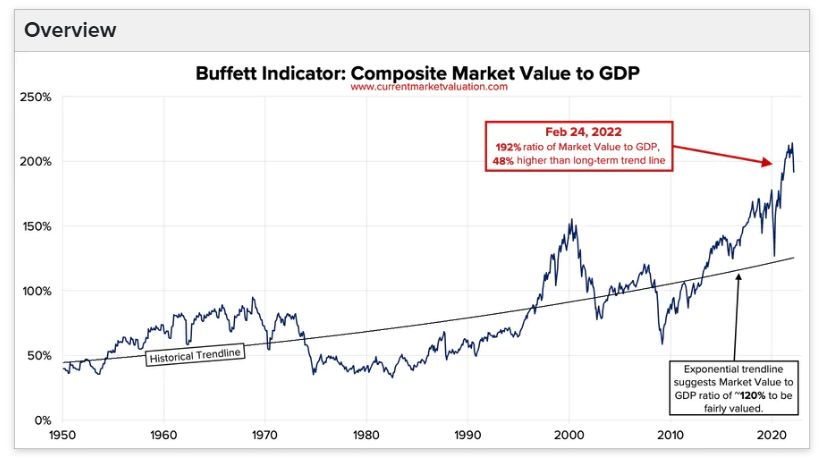

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

Factor Investing: Are Internally Generated Intangibles Worthless? (Alpha Architect)

Alternative Investments: Predictable Uncertainty in Private Markets (CFA)

Beware of the Confirmatory Bias (DSGMV)

Young Aristocrats (March 2022) (AllStarCharts)

This week’s best investing tweet:

This week’s best investing graphic:

Visualizing Apple’s Rise to the Top of the Gaming Business (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: