This week’s best investing news:

A Poisoned Chalice (Jamie Catherwood)

How to Worry about Duration (Verdad)

A Shortseller’s Perspective (Epsilon Theory)

Jeremy Grantham: Tesla Is A Bubble (Validea)

Are Big Tech Stocks Following In The Footsteps Of Their Chinese Counterparts? (Felder)

Big Skills (Collaborative Fund)

It’s Never a Market Crash Problem (Safal)

Transcript: Tina Vandersteel (Barry Ritholz)

Are You Investing or Merely Speculating? (Compound Advisors)

I Made a Rookie Mistake During Yesterday’s Market Selloff (CMQ)

Measuring valuation uncertainty (Klement)

Studying Great Industrial Companies (Book Review: Lessons from the Titans) (Neckar)

How (Not) to Talk About the Benefits of ESG Investing (BI)

Mohnish Pabrai – Value Investing, Lessons from Warren Buffett & Charlie Munger (WallStreetLab)

Alibaba Group: What Has Really Happened Since Munger Last Doubled Down (SA)

Data Update 3: Inflation and its Ripple Effects! (Aswath Damodaran)

Morningstar – 4 Good Reasons to Sell Stocks Now (MS)

Unilever + GSK Consumer: A post mortem (FS)

Warren Buffett’s Berkshire Hathaway Will Host Annual Meeting in Person (WSJ)

Robert Vinall’s tips to evaluate good businesses to seek stellar returns (ET)

David Katz: These mega-caps have valuations with very attractive entry points (CNBC)

Crypto collapse erases more than $1 trillion in wealth, forcing a reckoning for everyday investors (Washington Post)

Warren Buffett closes in on Cathie Wood as tech stocks tumble (AFR)

Netflix is still a very cheap stock: Oakmark Funds’ Bill Nygren (CNBC)

Q4 2021 Letters & Reports (Reddit)

Jim Chanos says the notion that the Fed will always bail out the stock market is dangerous (CNBC)

Miller Deep Value Strategy 4Q 2021 Letter (Miller)

Weitz Q4 2021 Market Commentary (Weitz)

Sequoia Q4 2021 Letter (Sequoia)

The Boyar Value Group 4th Quarter Client Letter (Boyar)

David Poppe – Q4 2021 Letter (Giverny)

Third Avenue Value fund Q4 2021 Commentary (ThirdAvenue)

This week’s best value Investing news:

Value Investing with Vitaliy Katsenelson (GuruFocus)

Big US Fundies Pivot Back to Value Investing (ShareCafe)

Brace Yourself For The Great Growth To Value Rotation (Seeking Alpha)

This week’s Fear & Greed Index:

Fear.

This week’s best investing podcasts:

Gavin Baker – The Cyclone Under the Surface (Invest Like The Best)

Episode #386: John Arnold, Arnold Ventures (Meb Faber)

Ep. 211 – Long Term, High Conviction Growth Investing with Joe Magyer (Planet MicroCap)

Andrew Freedman – TMT talk! (Business Brew)

Observations From The Recent Market Decline (Validea)

#129 Marc Andreessen: Interview with an Icon (KP)

In Pursuit of the Perfect Portfolio with Stephen Foerster (ER)

Sahil Lavingia — From Web 2.1 to Web 3 (Infinite Loops)

Venture is Eating the Investment World (CA)

Cameron and Tyler Winklevoss – Investors and Founders of Gemini Cryptocurrency Exchange (CWTG)

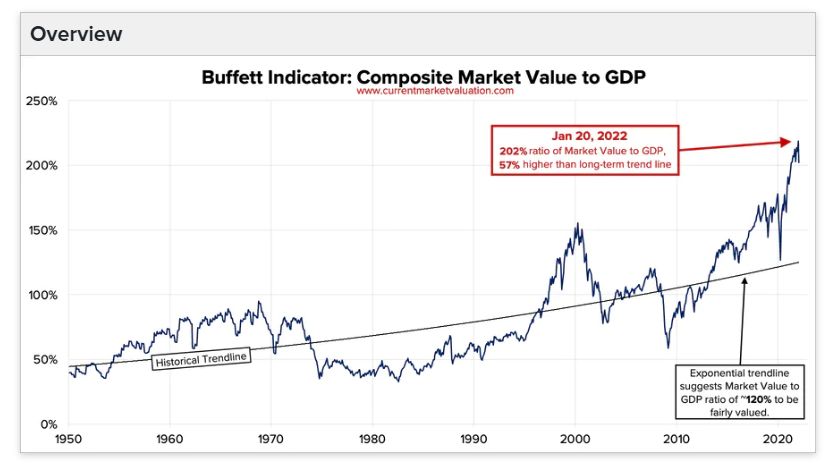

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

Portfolio Strategies for Volatility Investing (AlphaArchitect)

Breaking Down Credit Spreads (AllStarCharts)

A Probabilistic View of Private Equity Returns (AllAboutAlpha)

Equity investing – It is all about the timing of cash flows (DSGMV)

This week’s best investing tweet:

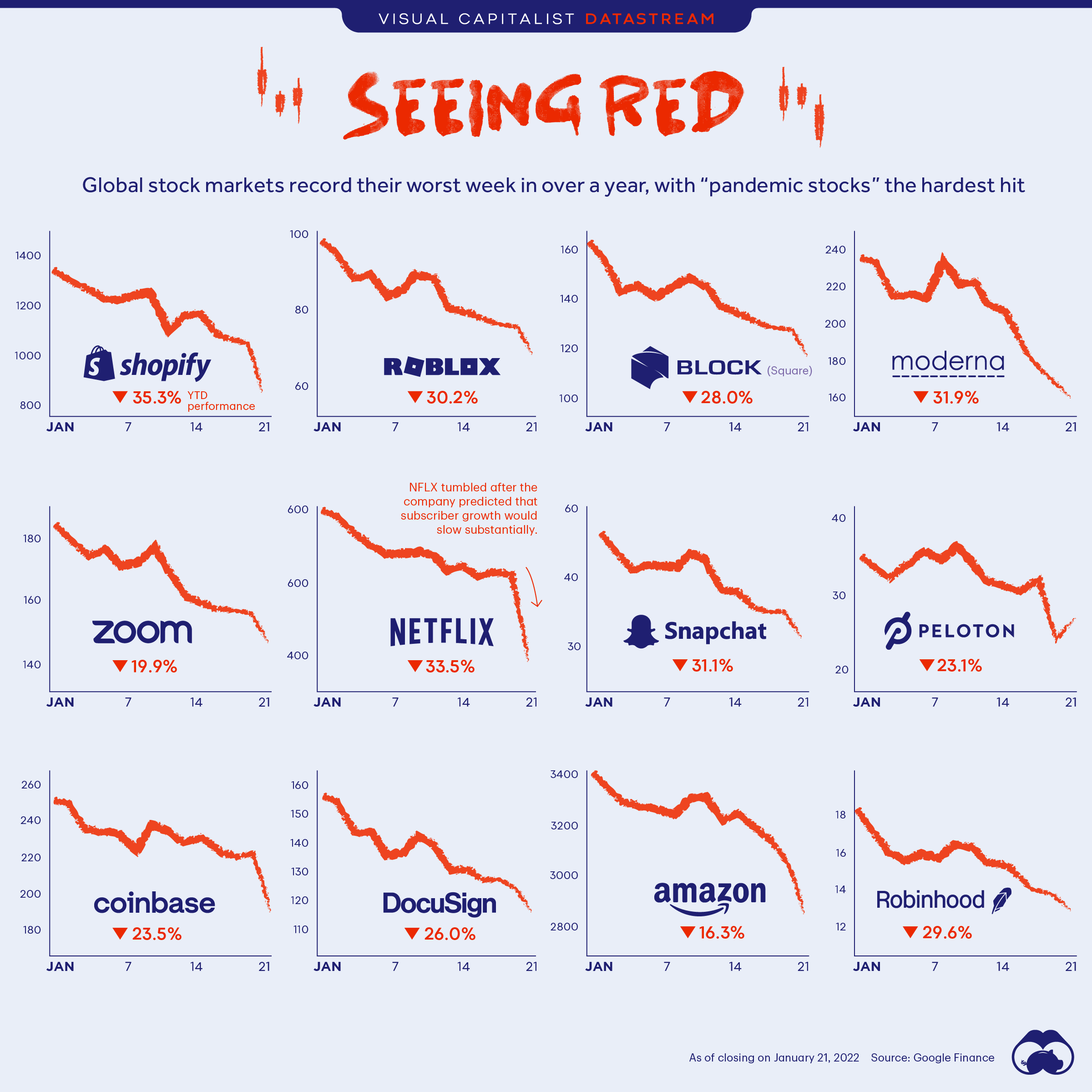

This week’s best investing graphic:

Seeing Red: Is the Heydey of Pandemic Stocks Over? (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: