In the book, 100 Baggers, Chris Mayer discusses a number of studies that explain why owner-operators outperform typical public companies. Here’s an excerpt from the book:

In today’s weird marketplace, the presence of owner-operators can be a signal of a likely value. And as with value, an owner-operator is a predictor of future outperformance. “Owner-operators, over an extended period of time,” [Peter] Doyle said, “tend to outpace the broad stock market by a wide margin.”

On this topic, there is a wealth of research and practical experience. On the research front, here are a few relevant studies:

• Joel Shulman and Erik Noyes (2012) looked at the historical stock-price performance of companies managed by the world’s billionaires. They found these companies outperformed the index by 700 basis points (or 7 percent annually).

• Ruediger Fahlenbrach (2009) looked at founder-led CEOs and found they invested more in research and development than other CEOs and focused on building shareholder value rather than on making value-destroying acquisitions.

• Henry McVey and Jason Draho (2005) looked at companies controlled by families and found they avoided quarterly-earnings guidance. Instead, they focused on long-term value creation and outperformed their peers.

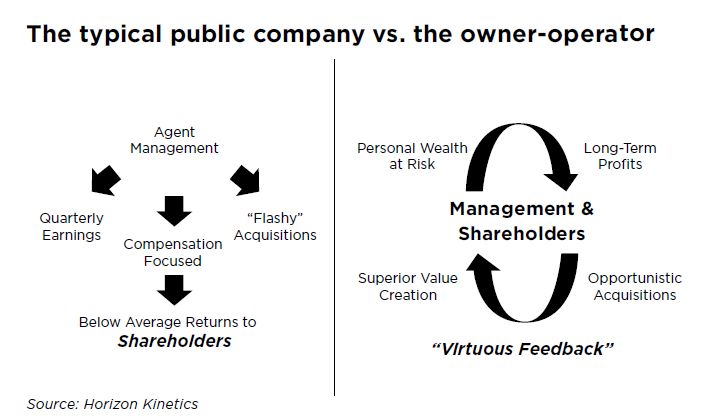

There is much more, but you get the idea. People with their own wealth at risk make better decisions as a group than those who are hired guns. The end result is that shareholders do better with these owner-operated firms. Horizon Kinetics has a neat graphic to illustrate the difference between a typical public company and an owner-operator. (See the chart below.)

The Virtus Wealth Masters Fund (VWMCX), managed by Murray Stahl and Matthew Houk, focuses on owner-operator companies. For a stock to get in the fund, management “must maintain a significant vested interest.” Stahl and Houk write,

By virtue of the owner-operator’s significant personal capital being at risk, he or she generally enjoys greater freedom of action and an enhanced ability to focus on building long-term business value (e.g., shareholders’ equity).

The owner-operator’s main avenue to personal wealth is derived from the long-term appreciation of common equity shares, not from stock option grants, bonuses or salary increases resulting from meeting short-term financial targets that serve as the incentives for agent-operators.

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: