This week’s best investing news:

A History: Interest Rates, Inflation & Markets (Jamie Catherwood)

Biggest Winning Stocks Of Past 30 Years (Validea)

Why Am I Reading This Now? 12.20.21 (Epsilon Theory)

Henry Ellenbogen’s Playbook for Durable Growth (Neckar)

The Liberty Complex: Cash Flow Today, Taxes Eventually (Diff)

Bill Foley (EC)

The Web3 Renaissance: A Golden Age for Content (Li)

The Last Last Mile (Scott Galloway)

What We Control, and What We Don’t (Safal Niveshak)

The Financialisation of Art (NI)

38: Buffett on ROE; The Jack Welch Paradox (WL)

Prem Watsa: We can’t think of a better country to invest in than India (Bloomberg)

Blockchain and Music NFTs (BL)

Aswath Damodaran: Back in the Classroom: Time to Teach! (AD)

Mohnish Pabrai on Chinese Stocks (EM)

2021 shows that investors can be right for the wrong reasons (FT)

Transcript: Michael Mauboussin (Barry Ritholz)

Ray Dalio Discusses Currency Debasement (WTI)

Cathie Wood Tones Down 40% Return Forecast to Avoid ‘Misconception’ (Bloomberg)

Dealing With Supply Chain Stresses—Lessons From Financial Crisis (Forbes)

Where to Find Cheaper Alternatives to Expensive Stocks (Bloomberg)

An Interview with Peter W. May, President and Founding Partner, Trian Fund Management, L.P (TP)

Is the Fed Deflating Prospects for Speculative Stocks? (WSJ)

Morgan Housel Book Recommendations (CF)

This week’s best value Investing news:

Value investing: What history says about five-year periods after valuation peaks (AlphaArchitect)

Forget Value vs. Growth–Size Drove Returns in 2021 (Morningstar)

Treasuries at 3% Is the Time for Value Investors to Go All In (Bloomberg)

This week’s Fear & Greed Index:

Fear.

This week’s best investing podcasts:

Deep Value Investing w/ Tobias Carlisle (MI126) (TIP)

#127 Best of 2021: Conversations of the Year (KP)

The ‘Restart of History’ & How to Invest in a Broken Economy (HF)

Lisa Feldman Barrett — Why does the brain exist? (IL)

Jenny Johnson – Seven Decades of Investing Expertise (ILTB)

348- Betting with Options (InvestED)

TIP406: Finding Hidden Treasure w/ Thomas Braziel (TIP)

Ep. 206 – Understanding Current Market Structures in this Economic Environment with Michael Green (PlanetMC)

Kristi Ross – Entrepreneur Extraordinaire (BB)

This Holiday, Will Mr. Market Eat Too Much Pi? (II)

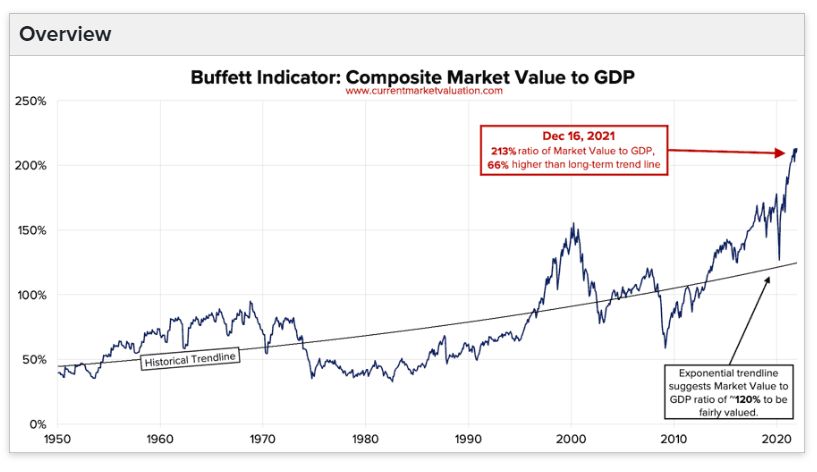

This week’s Buffett Indicator:

Strongly Overvalued.

This week’s best investing research:

The Relationship Between the Value Premium and Interest Rates (AlphaArchitect)

Engine 1: A New Way of Seeing Value (AAA)

Green and Renewable Energy: Not So Fast? (CFA)

Performance curves – Still says that simple works relative to complex (DSGMV)

The Second Strongest Year in Stock Market (PAL)

This week’s best investing tweet:

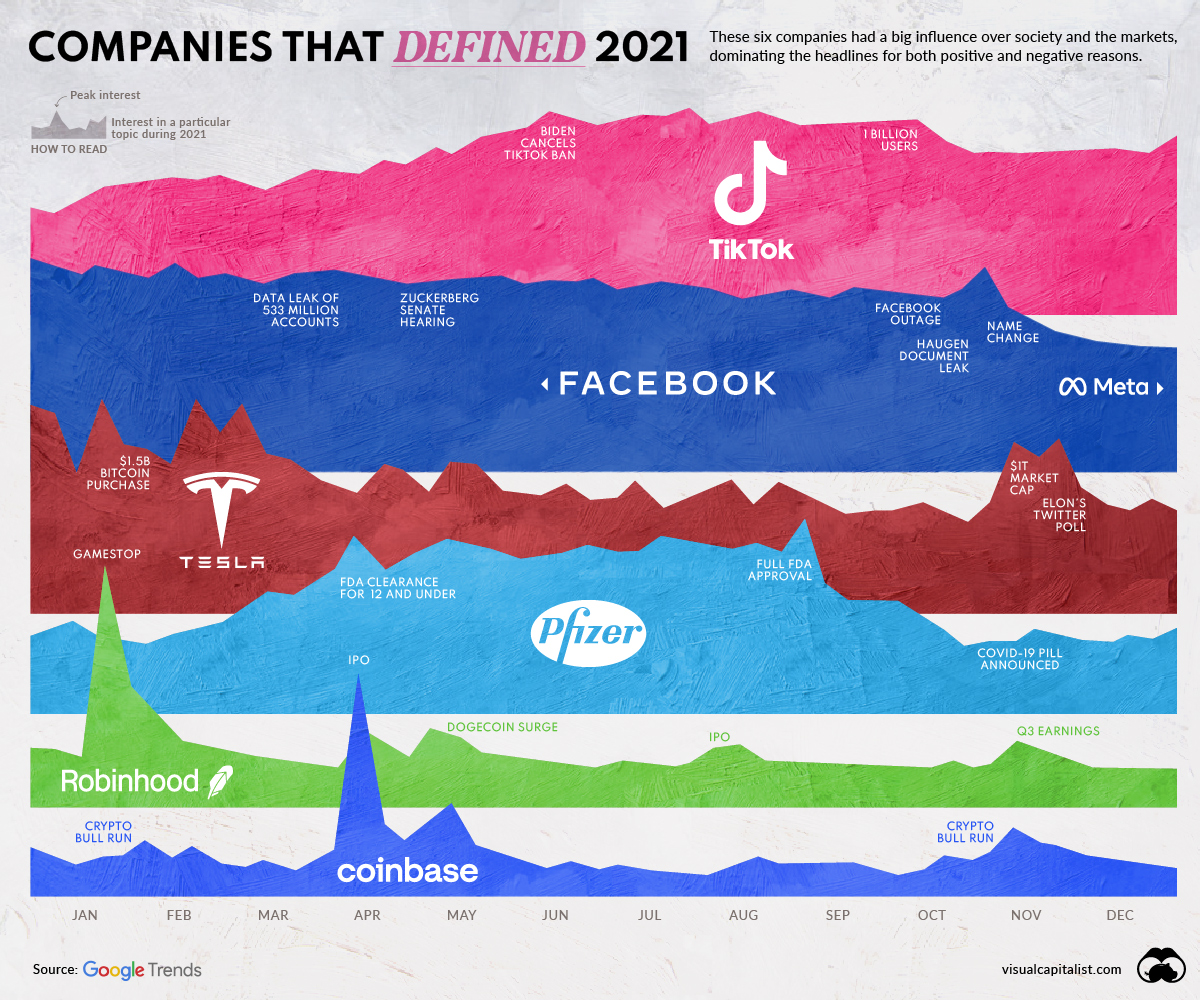

This week’s best investing graphic:

The Companies that Defined 2021 (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: