This week’s best investing news:

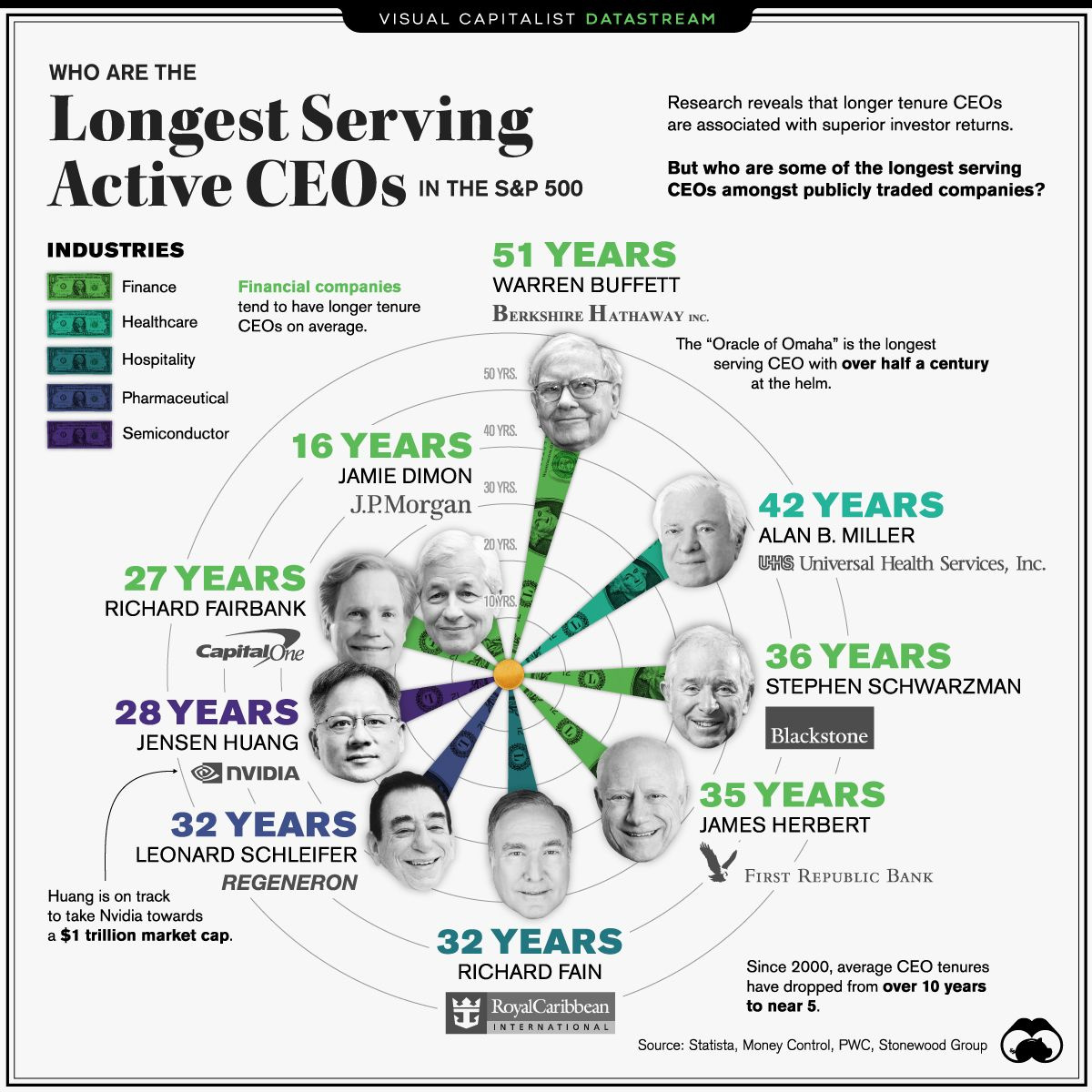

Who are the Longest Serving Active CEOs in the S&P 500? (Visual Capitalist)

Credit-Driven Asset Price Inflation (Verdad)

Sumner Redstone: Winning Above All Else (Neckar)

The Truth About P/E Ratios (Validea)

Inflation and the Common Knowledge Game (Epsilon Theory)

Comparing Peter Lynch with the Beatles (Ritholz)

213: Amazon Logistics vs Fedex/UPS, Microsoft Office Pricing (Liberty)

Charlie Munger goes off on crypto, says China made the right decision when they banned it (Fortune)

If Software Is Eating the World… Payments Is Taking a Bite (CS)

4 strategies for setting marketplace take rates (Tanay)

The Ugly Truth About Market Bubbles Is That Everyone Loses (Bloomberg)

The Davis Dynasty by John Rothchild (Novel Investor)

All-in on passive investing? You’re losing out, says Peter Lynch (AFR)

The Classic Mistake Most Investors Make (Safal)

Interview With Oaktree Capital Founder Howard Marks on the Company Further Expansion in China (Yicai)

Ray Dalio: Clarifies Comments On China (Twitter)

Investors piling on risk are setting themselves up for a fall (FT)

Star Money Manager Nick Train Warns of Worst Returns in 20 Years (Bloomberg)

This Inflation Defies the Old Models (WSJ)

You Probably Need to Rebalance (Morningstar)

Stock Investors’ Returns are Exaggerated (papers.ssrn)

It’s the Most Forecasty Time of the Year (Barry Ritholz)

The Pros and Cons of ‘Direct Indexing’ (WSJ)

In the Tarantino Market, the Hottest Stocks Are Getting Quietly Killed (Bloomberg)

Finding Attractive Stocks for Our Opportunistic Value Strategy (Royce)

Volatility Takes a Bite (Woodlock House)

Gabelli: How To profit from corporate love making (Fox)

Bill Ackman says the Fed is one of the biggest risks to markets (Yahoo)

This week’s best value Investing news:

Small cap and value stocks set to keep climbing in 2022 (CNBC)

Where We See Opportunity, and the Fallacy of Growth vs Value (Clipper Fund)

GMO: Value Traps vs Growth Traps (GMO)

Did You Miss the Rotation from Growth to Value? (T Rowe Price)

Value and Momentum Factors? Naw, Focus on the Music Factor! (AlphaArchitect)

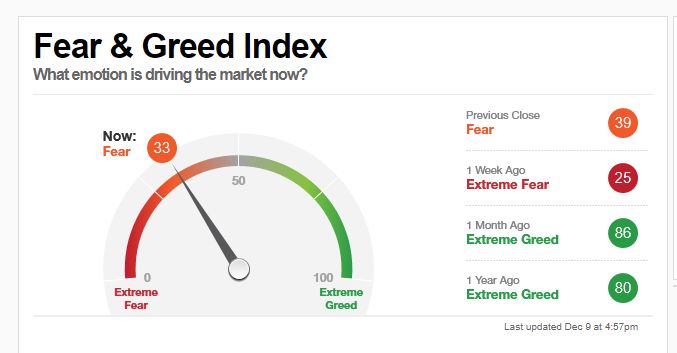

This week’s Fear & Greed Index:

Fear.

This week’s best investing podcasts:

TIP402: Investing Mastermind Q4 2021 (TIP)

Jesse Livermore — Future of Money, Education, and Health (EP.78) (Infinite Loops)

People Always Overestimate The Extent To Which Tobacco Is A Dying Business (Meb Faber)

Tren Griffin – Giving to Get (Business Brew)

The Future of Brands and Brand Value (TWII)

What Do You Need to Know About Crypto? (Morningstar)

Ep. 204 – Planet MicroCap LIVE: (Planet MC)

The Value Perspective with Rob Gardner (VP)

S2E12: The Future of Brands (MOI)

The Market Doesn’t Care About Omicron or Inflation (Contrarian)

Behind The Markets Podcast: Phil Huber (BTM)

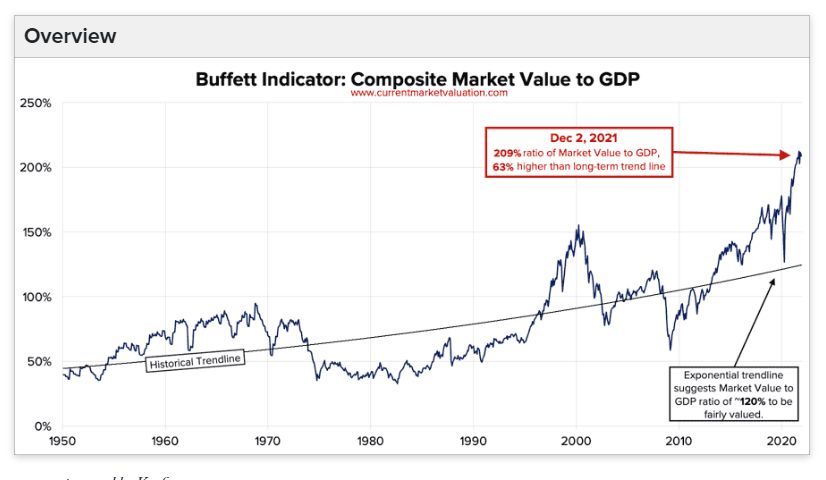

This week’s Buffett Indicator:

Strongly Overvalued.

This week’s best investing research:

The Bear Market Has Begun (MT)

Will the Metaverse Catch Down to the Internet? (AllStarCharts)

Global Factor Performance: December 2021 (AlphaArchitect)

Modern Variants of Capitalism (CFA)

Equity Index Publishers Are Better Stock Pickers (PAL)

Why Pension Plans and Net Zero Companies Should Consider Investing in Forestry? (AllAboutAlpha)

This week’s best investing tweet:

This week’s best investing graphic:

Who are the Longest Serving Active CEOs in the S&P 500? (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: