This week’s best investing news:

Surprised by The Inevitable (Jamie Catherwood)

Dalio : “If You Worry, You Don’t Have To Worry” (Validea)

Invest Don’t Bet (Humble Dollar)

Corporate Margins Are Stronger Than You Think (Epsilon Theory)

Assured Misery (Collaborative Fund)

Thank You (Verdad)

The Other Side of a Mania (Compound Advisors)

Never Take a Risk You Do Not Have to Take (Safal Niveshak)

Cathie Wood doubles down again (WTI)

A Decade In The Making…a 10-Bagger & a 26.0% pa Investment Track Record (Wexboy)

Michael Mauboussin: Navigating the Complexity of Today’s Markets (LWL)

The best stock-picking advice for 2022, according to 5 star investors (Fortune)

The FAANG Market Is Fading (Morningstar)

Bulls, Bears, And Pigs (Jason Zweig)

208: Constellation Software Launches VMS Venture Fund (Liberty)

Making Conviction Count (ithought)

Bill Miller’s Journey (Part II): Lessons of Triumph and Tragedy (Neckar)

The power of playing the long game (Sequoia)

The evolution of SaaS companies (Tanay)

Aswath Damodaran interview (PFI)

Half of this year’s big IPOs are trading below listing price (FT)

The Poverty of Compromise (Naval)

How to value new-age IPOs (Fortune)

Jeremy Grantham – ‘I made a small fortune… and managed to lose it all’ (CityWire)

The Shocking Truth About Today’s P/E Ratios (Fisher)

3 Lessons I Learned From ARK Innovation ETF (Morningstar)

On the Front Lines of the Supply-Chain Crisis (WSJ)

For the Bond Market, This Time May Be Different (Morningstar)

There’s a right way and a wrong way to think about inflation. Here’s a right way (LA Times)

This week’s best value Investing news:

What Charlie Munger taught me over breakfast about investing (AFR)

Graham & Doddsville Fall 2021 Investment Newsletter (G&D)

Hedge funds have flipped to a value strategy, Goldman says. Here’s what they like (CNBC)

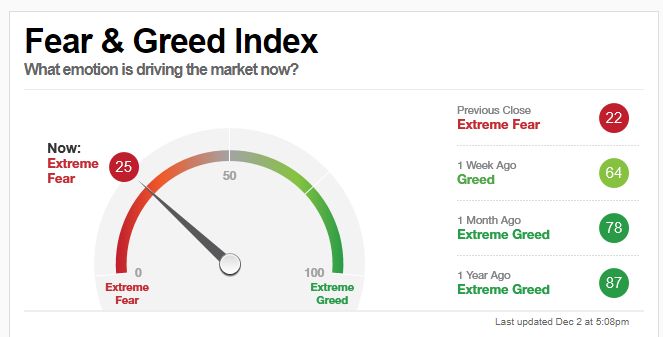

This week’s Fear & Greed Index:

Extreme Fear.

This week’s best investing podcasts:

TIP400: Mastermind Q4 2021 (The Investors Podcast)

#125 Paul Rabil: Confidence and Competition (Knowledge Project)

Andrew Thrasher Schools Two Value Guys on Technical Analysis and Forecasting Volatility Tsunamis (Excess Returns)

Jim Grant on What Inflation Means for Asset Values, Crypto, and Meme Stocks (Hidden Forces)

Ep 106: Michael Goldberg – Long live value (Inside The Rope)

Francis Davidson – Design-led Hospitality (Invest Like The Best)

How to Make It on Wall Street: Advice From 3 Portfolio Managers (WealthTrack)

Episode #373: Tim Maloney, Roundhill Investments, “We Hit The Right Theme At The Right Time” (Meb Faber)

Ep. 203 – Finding Canadian MicroCap Opportunities (Planet MicroCap)

Surprise, Surprise: Inflation Is Not Transitory? (Real Vision)

Matthew Sweeney: Frameworks, Patience, and Edge (Value Hive)

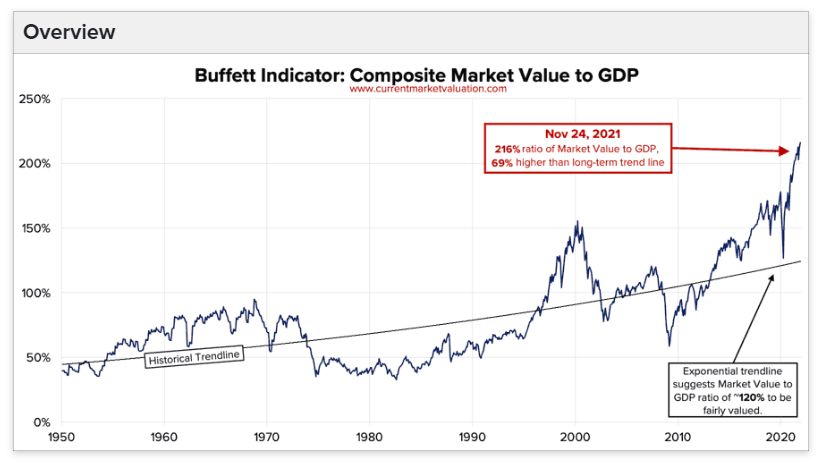

This week’s Buffett Indicator:

Strongly Overvalued.

This week’s best investing research:

Size, Value, Profitability, and Investment Factors in International Stocks (AlphaArchitect)

Inflation: What If It Doesn’t? (CFA)

The Most Bears In Over A Year (AllStarCharts)

Long Winning Streaks For the Month of November Were Broken This Year (PAL)

This week’s best investing tweet:

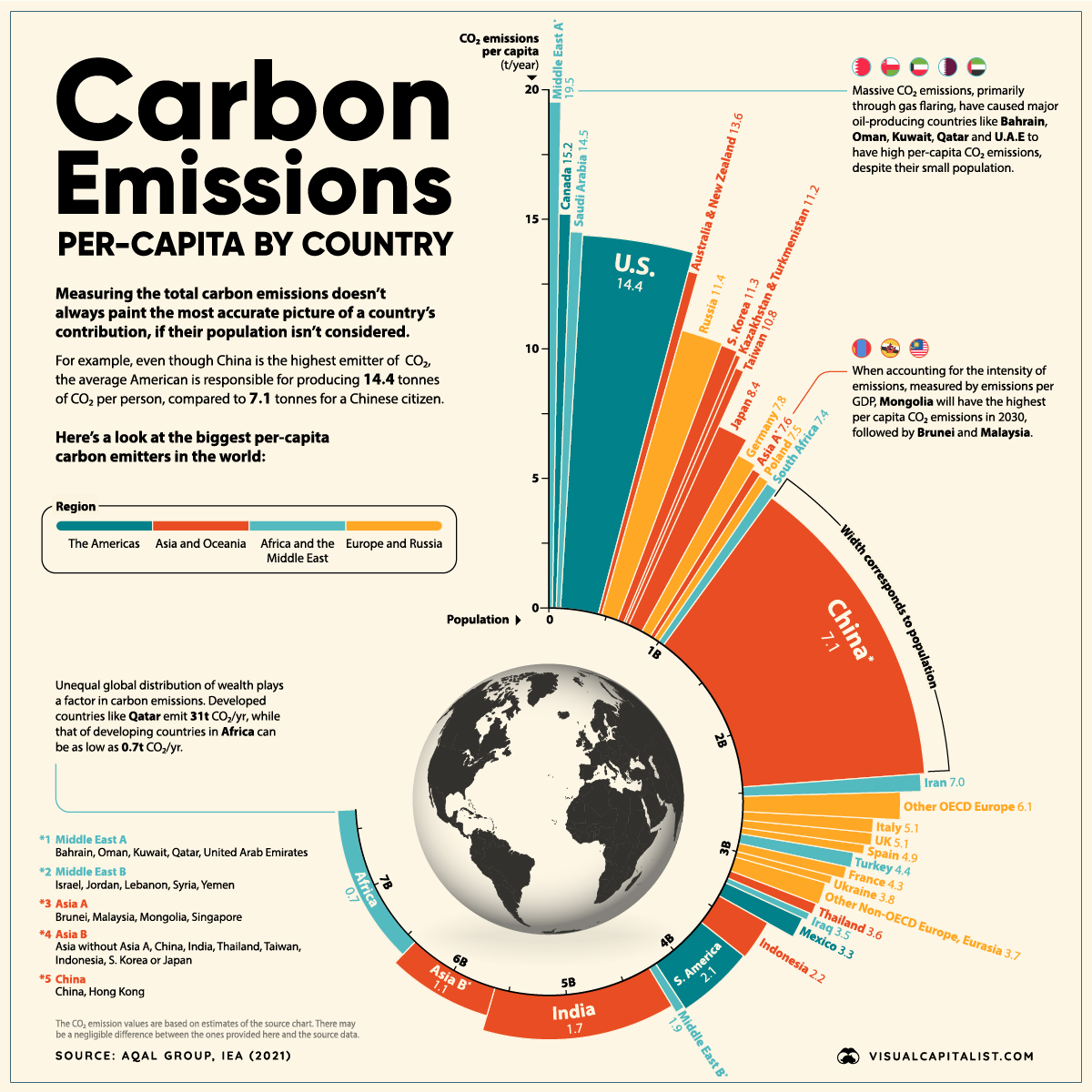

This week’s best investing graphic:

Visualizing Global Per Capita CO2 Emissions (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: