This week’s best investing news:

Is There Such a Thing as Good Taste? (Paul Graham)

Understanding Systematic FX Strategies (Verdad)

The Fasten Seat Belt Sign Just Lit Up (Felder)

Prime Time in Crypto (Epsilon Theory)

Clutter and the Clean Slate. (Neckar)

203: Twitter’s Bad Move, Invest like Buffett does M&A (Liberty)

Steer Clear of U.S. Stocks & Bonds in 2022 Says Morgan Stanley Strategists (Validea)

Buffett’s Cash Pile Hits Record $149.2 Billion (Bloomberg)

CNBC Interview With Liberty Media Chairman John Malone (CNBC)

Talking success with Terry Smith (CGWM)

Tiger Global: How to Win (The Generalist)

Michael Mauboussin Is Unshaken (RIAIntel)

Jim Simons’ RenTech fund quadrupled its Tesla stake last quarter – and boosted its AMC bet by 38% (BI)

Ray Dalio Brilliantly Explains The Big Debt Catastrophe (Freenvesting)

Li Lu $245 million stake in Berkshire Hathaway (Business Insider)

Investing legend Mario Gabelli weighs in on markets, conglomerate break-ups (CNBC)

You Probably Own Too Much Domestic Equity (Morningstar)

John Malone – Big Tech’s ‘Natural Monopoly’ Tough to Self-Regulate (Bloomberg)

Packed Ports and Empty Shelves (60 Minutes)

Sir John Templeton: An American Investor with a Dream [Full Documentary] (Robert L. Redstone)

Elon Musk is right about Rivian – and so is Michael Burry (AFR)

Web3/Metaverse Chat With Mark Zuckerberg (GeryVee)

Roger Lowenstein – What if the Fed Is Wrong? (IV)

GE & The Belief In Management Magic (WSJ)

Inside Maverick’s Rebound (II)

GMO’s Grantham: Fed Is Erring on Highest Inflation Since 1990 (Bloomberg)

Goldman Sachs Macro Outlook 2022 Report (GS)

Q3 2021 Letters (Reddit)

Hayden Capital Q3 2021 Letter (Hayden)

This week’s best value Investing news:

OPTO Sessions Tobias Carlisle on deep value investing (CMC)

Growth stocks vs value stocks: Guess who’s the winner in this market? (ET)

Warren Buffett shows his fear by dumping the most shares since 2008 (AFR)

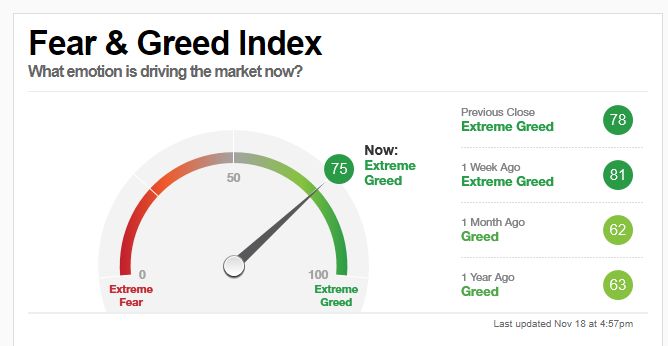

This week’s Fear & Greed Index:

Extreme Greed.

This week’s best investing podcasts:

Tobias Carlisle The Non-Warren Buffet Approach to Value Investing (Pitchboard)

#124 Douglas Rushkoff: The Perils of Modern Media (Knowledge Project)

TIP396: China and the Macro Impact w/ Kyle Bass (TIP)

Stock Buyback Myths (WealthTrack)

An In Depth Look at Multi-Asset Investing with Westwood’s Adrian Helfert (Excess Returns)

Will Marshall – Indexing the Earth (Invest Like The Best)

Episode #368: Rodrigo Gordillo & Corey Hoffstein (Meb Faber)

Ep. 201 – The In‘s and Out‘s of Stock Spin-Off Investing (Planet MicroCap)

Jonathan Boyar – Intrinsic Value Opportunities (Business Brew)

Is the Value Premium Smaller Than We Thought? (Rational Reminder)

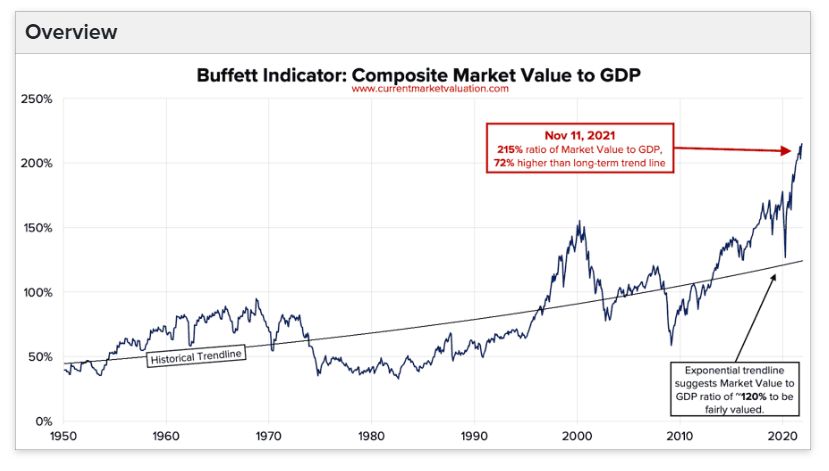

This week’s Buffett Indicator:

Strongly Overvalued.

This week’s best investing research:

How to Start an ETF? Resources and FAQ (AlphaArchitect)

A 20% Drop in Stock is not a Bear Market (PAL)

The Consumer Price Index Jumps 6.2%….Now What? (Brinker)

The Case For SPACs (AllAboutAlpha)

When Indices Are Cut: What Withdrawals Teach about Risk-Control Index Design (CFA)

This week’s best investing tweet:

This week’s best investing graphic:

Ranked: The Best and Worst Pension Plans, by Country (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: