This week’s best investing news:

Inflation, Monetary Policy & Pandemics (Jamie Catherwood)

What’s the point of hedge funds? (Verdad)

Other People’s Mistakes (Collaborative Fund)

Howard Marks Memo – Thinking About Macro (OakTree)

Nudging State, Noble Lies (Epsilon Theory)

Ray Dalio: Understanding China’s Recent Moves in Its Capital Markets (Linkedin)

David Einhorn Sheds Light (WTI)

Not Buying It (Humble Dollar)

Updating The Spock Market (Barry Ritholz)

Three Things I Think I Think – Macro Thoughts (PragCap)

Learn to profit from uncertainty (EB Investor)

A few Q2 earnings musings (Tanay)

There’s A Way You Can Beat The Best Investors. You’ve Just Got To Know When To Sell (NPR)

Metaverses (Stratechery)

The Man Who Solved the Market by Gregory Zuckerman (Novel)

$HOOD (No Mercy)

The Velocity Of Money In Startupland, IPO’s and M&A …Also The Velocity of Bad Takes (Howard Lindzon)

Cash on the Sidelines? (Frank Martin)

Demand Is Way Back Yet Workers Remain Scarce (GMM)

Tuesday Trends (8/3/21) (Compound Advisors)

164: Amazon Q2, Google Custom Silicon, China vs Video Games (Liberty)

How To Maximize Your Dividend Stocks’ Earnings (DGS)

A vital characteristic of successful investors: Grit (Klement)

Blackstone’s Moment (Net Interest)

Alta Fox Q2 2021 Commentary (Alta Fox)

Tweedy Browne Q2 2021 Commentary (TB)

First Eagle – Inflation: Keeping It Real (FEIM)

Markel (MKL) Q2 2021 Earnings Call Transcript (TMF)

This week’s best value Investing news:

Investing basics: 4 things Gen Z can learn from Charlie Munger (Morningstar)

The Softer Side of Value Investing (Vitaliy Katsenelson)

Growth vs Value – Are We Setting Up For A Photo Finish? (Brinker)

Caught in a value-buying trap: why retail investors often get it wrong (ET)

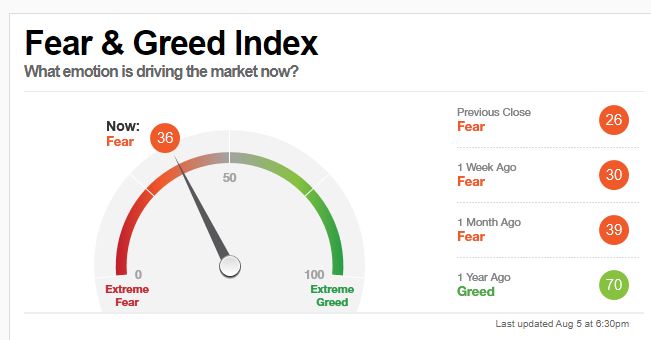

This week’s Fear & Greed Index:

Fear.

This week’s best investing podcasts:

Revisiting All Things Value with Tobias Carlisle of the Acquirers Funds (Validea)

Morgan Stanley’s Audrey Choi: Focus on this macro trend (Barron’s)

“Maybe I’m the Retail Idiot” with Bill Brewster (RCM)

Warren Buffett’s Evolution Into a Great Manager (WealthTrack)

A Generational Opportunity In Commodities, Part Deux (Felder)

Zoom Chat with Radhika Gupta (Fundoo)

CMQ020: Robinhood (HOOD) – Hot Stock or Future Flop? (CMQ)

Karen Karniol-Tambour – All Things Macro (Invest Like The Best)

TIP365: Has Inflation Peaked? w/ Richard Duncan (TIP)

Rooting For The Underdog – Ep 135 (Intellectual Investor)

Bryn Solomon – Exploiting Fat Finger Errors in Cryptopunks (Flirting with Models)

328- Valuation Checklist (InvestED)

Episode #337: Professor Richard Thaler, University of Chicago (Meb Faber)

China Tech Sell-off Explained: Twitter Spaces Feat. Rui Ma (Value Hive)

The Investors Roundtable #40: SEC Dark Stock Rule – What’s going on? (Planet MicroCap)

Is Elon Musk Humanity’s Savior or a Supervillain? | Tim Higgins (Hidden Forces)

Linda Lebrun — The Substack Economy (EP.59) (Infinite Loops)

Private Equity Masters 7: Orlando Bravo – Thoma Bravo (Capital Allocators)

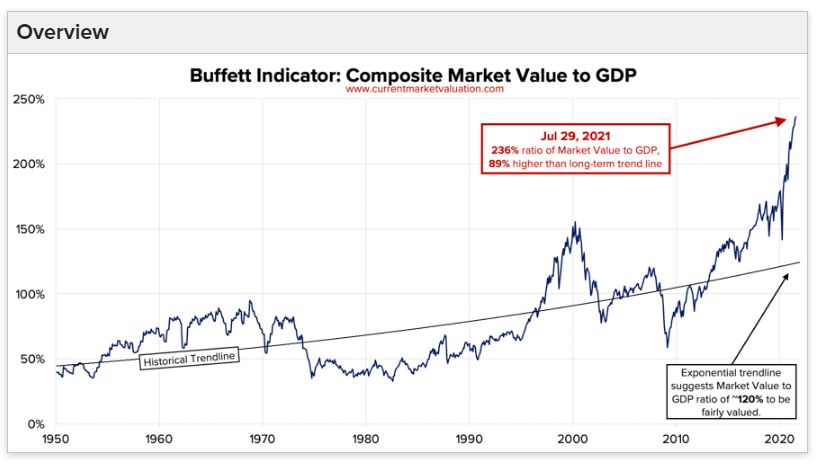

This week’s Buffett Indicator:

Strongly Overvalued.

This week’s best investing research:

The Active vs Passive: Smart Factors, Market Portfolio, or Both? (Alpha Architect)

Vineer Bhansali: What’s Wrong with Negative Yields? (CFA)

Betting Against Quant: Examining the Factor Exposures of Thematic Indices (ssrn)

Stocks or Bonds? (All Star Charts)

Counterfactuals, history, and market analysis (DSGMV)

Illiquidity Is the Wrong “Common Enemy” (All About Alpha)

Overnight Effect in Amazon Stock (PAL)

This week’s best investing tweet:

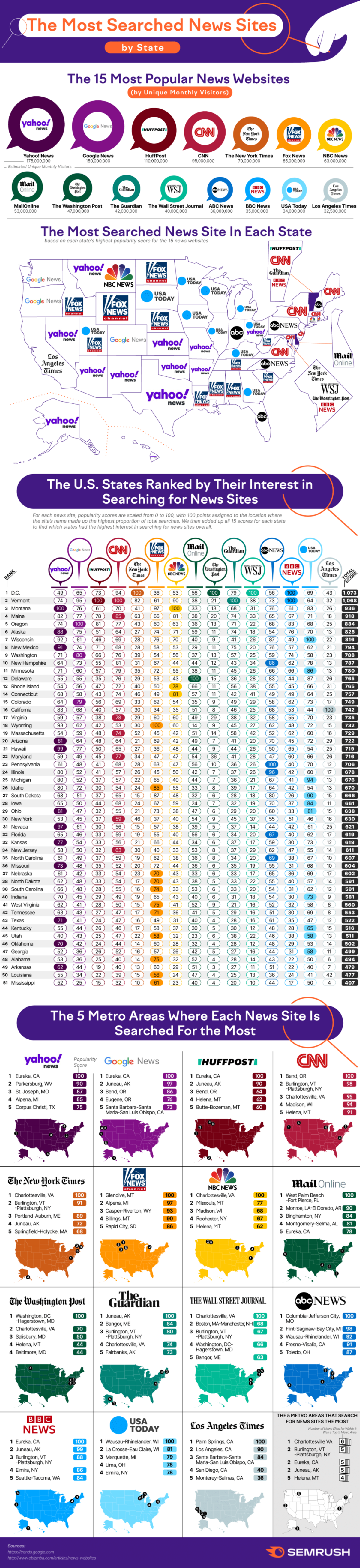

This week’s best investing graphic:

Ranked: America’s Most Searched and Visited News Sites by State (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: