This week’s best investing news:

Warren Buffett & Charlie – “A Wealth of Wisdom” – Full Transcript (CNBC)

How to Work Hard (Paul Graham)

The Most Ignored Investing Premium (Validea)

On Low Treasury Yields (Verdad)

I’m So Tired of the Transitory Inflation “Debate” (Epsilon Theory)

Howard Marks: The Truth About Investing – Full lecture pt. 1 (video) (Think Invest)

Casualties of Perfection (Collaborative Fund)

Rob Arnott, founder of Research Affiliates, on Inflation, Bubbles and the Future of Value Investing (video) (Excess Returns)

SPAC(e) (Scott Galloway)

What Financial Rules Matter Most? (Barry Ritholz)

The Bowdoin Endowment, with Paula Volent and Stan Druckenmiller ’75, H’07 (video) (Bowdoin College)

Warren Buffett Filing Indicates Berkshire Hathaway Bought Back $6 Billion of Stock in 2nd Quarter (Barron’s)

The SEC Punts (for now) (Roger Lowenstein)

How EV Value Metrics Performed This Century (Novel)

Aswath Damodaran, ‘Dean Of Valuation’, Take On Markets, Cryptos, IPO (video) (moneycontrol)

For Inflation Protection, Commodities Belong in the ‘Too Hard’ Pile (Morningstar)

The Method of Loci: Build Your Memory Palace (Farnam Street)

The Impact of Intangibles on Base Rates (Michael Mauboussin)

Leon Cooperman: FANG stocks are not expensive given interest rates (video) (CNBC)

Herd and Illusory Superiority Bias: Why Even Seasoned Investors Succumb (CFA)

Is the stock market in a bubble? | Ray Dalio (video) (Ray Dalio)

How Should We Judge The Quality of a Sell Decision? (Behavioural Investment)

Weitz Investment Management 2021 Annual Shareholder Meeting (Weitz)

Inflation Expectations Are Up Greatly, But Aren’t So Great (Brinker)

Companies Trying to Do Unsustainable Things Sustainably (Intrinsic Investing)

Banks Raising Dividends After Passing the Fed Stress Tests (DGI)

5 Lessons Learned About Investing In Dividend Growth Stocks (DGS)

Shopify Audiences (Tanay)

Mimetic Desire and Why Price Action Matters (Mindset Value)

Short-term reversal or short-term momentum? (Klement)

They’re Real and They’re SPACtacular. (Petition)

What is “Fractional Reserve Banking”? (PragCap)

2Q 2021 In Review (Bason)

This week’s best value Investing news:

Value vs. Growth: Where Do We Go from Here? (Marquette)

Value in a Reopening World with Bill Nygren (Natixis)

Investors see value stocks like banks leading the way in the second half, CNBC survey finds (CNBC)

Nick Kirrage – The value of a consistent approach (Investors Chronicle)

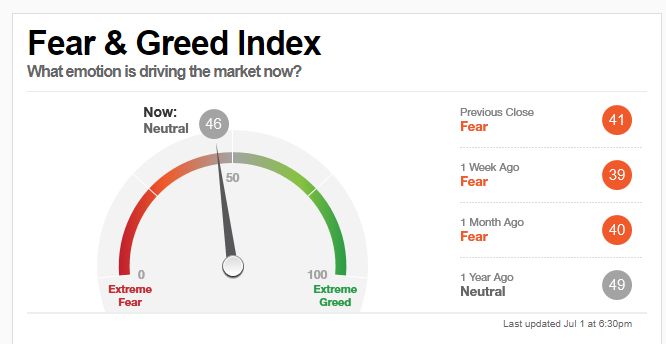

This week’s Fear & Greed Index:

Neutral.

This week’s best investing podcasts:

Tobias Carlisle – Realism Over Idealism in Value (S4E9) (FlirtingWithModels)

TIP356: Investing Mastermind Q2 2021 (TIP)

Jason Zweig: Temperament Is Everything for Most Investors (LongView)

Daniel Kahneman’s “Noise” | Is Customer Acquisition Cost the New Rent? (IntelligentInvesting)

Marc Andreessen – Making the Future (InvestLikeTheBest)

Is the 60/40 Portfolio Dead? (Take15)

Private Equity Master 2: John Connaughton – Bain Capital (CapitalAllocators)

A Quant’s Take on Meme Stocks (WhatGoesUp)

Sideways Market – Ep 131 (IntellectualInvestor)

Hands-Off Strategies and Top Manager Stock Picks (Morningstar)

Ep. 181 – Do Cult Companies Make Good Cult Stocks with Brandon Beylo, Host of the “Value Hive Podcast” (PlanetMicroCap)

EP 317. Fintech, Sourcing Ideas, Investing Books, and Other Questions From Twitter (FocusedCompounding)

The Biggest Lessons From Our First 100 Episodes (ExcessReturns)

Joe Moglia on Going From Football to Wall Street (MIB)

How Warren Buffett Got Richer Than The Competition (By Redefining Risk) | Episode #16 (CMQ)

John Chambers – Former Executive Chairman and CEO of Cisco Systems (CWTG)

#114 Noreena Hertz: The Crisis of Loneliness (KnowledgeProject)

Behind The Markets Podcast: Randy Watts (BehindTheMarkets)

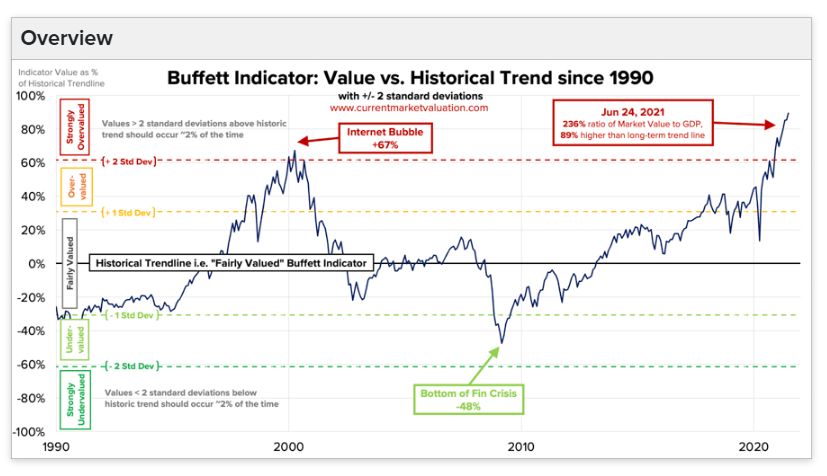

This week’s Buffett Indicator:

Strongly Overvalued.

This week’s best investing research:

Can Investors Beat Active Mutual Funds with Cheap ETFs, YUP! (AlphaArchitect)

Breadth Thrusts & Bread Crusts: Cast Iron Investing (AllStarCharts)

Yield curve term premia for 2021 – From negative to a positive and possibly back again (DSGMV)

Gold as a Strategic Inflation Hedge (AllAboutAlpha)

No Corrections In 2021? (UPFINA)

The Fallacy of the Persistent IPO Investor (PAL)

INDIA: Time To Buy (Part 1) (MT)

Factors in focus: Value (1/5) (EB Investor)

This week’s best investing tweet:

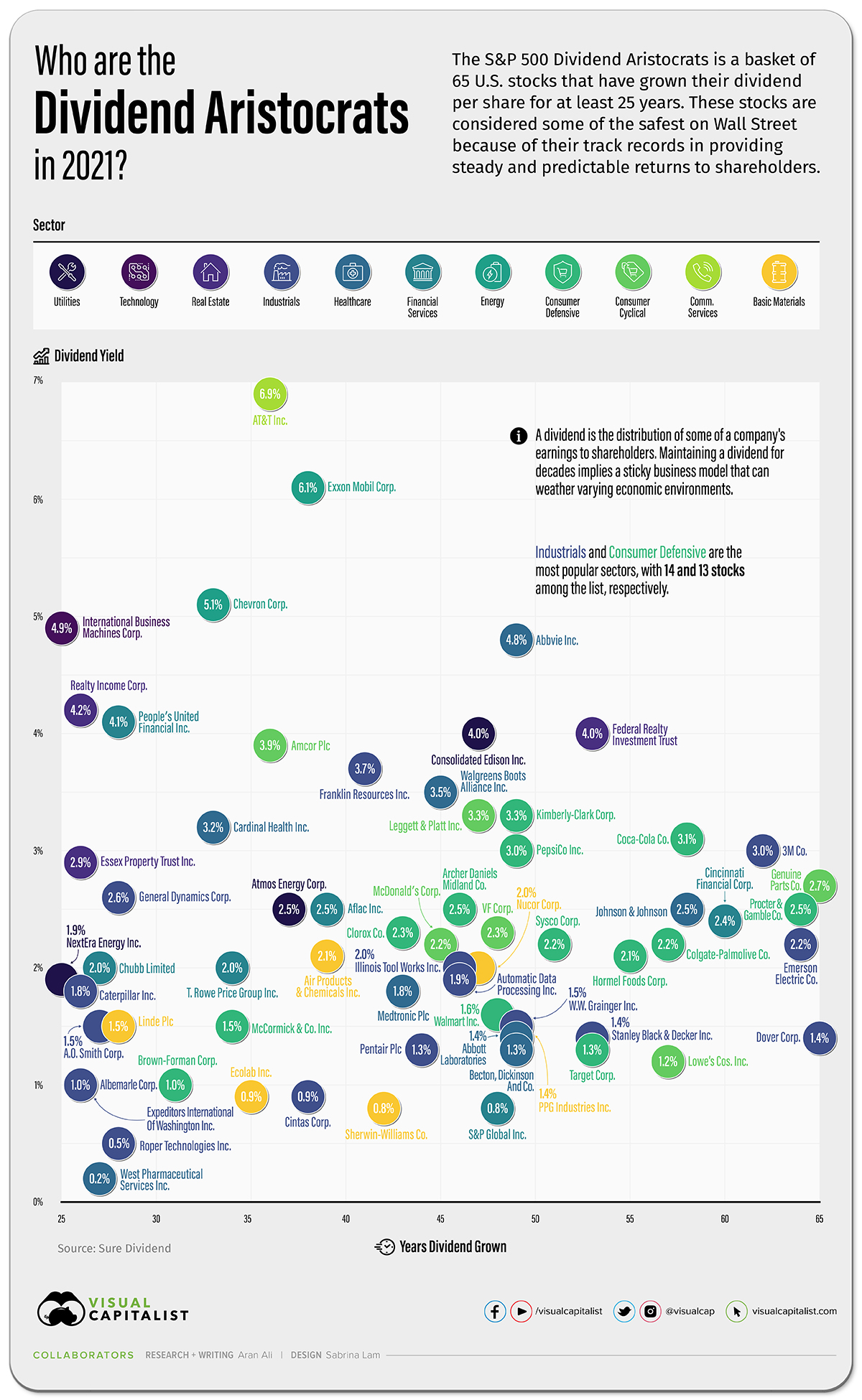

This week’s best investing graphic:

Who are the Dividend Aristocrats in 2021? (Visual Capitalist)

(Source: Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: