This week’s best investing news:

The Golden Constant (Verdad)

“Yay, Stock Buybacks!” (Epsilon Theory)

Investment Styles and Personality Type (Validea)

Oaktree’s Marks Sees Opportunities Abroad in ‘Downtrodden’ Debt (Bloomberg)

Portfolio Acid Test (Humble Dollar)

Li Lu – The stock market is not created for Value Investors” (WeLoveValue)

How Cash Flow Based Value Metrics Performed this Century (Novel)

Bill Ackman Sent a Text to the CEO of Mastercard (institutional Investor)

Local Champions: The Upside Potential in Chinese Companies (Causeway)

Seizing The Middle: Chess Strategy in Business (Farnam Street)

Paul Tudor Jones: ‘Go all in on inflation trade’ if Fed keeps ignoring higher prices (CNBC)

Harder Than It Looks, Not As Fun as It Seems (Collaborative Fund)

GMO – Quality Investing And Inflation (GMO)

Asset Class Scoreboard: May 2021 (RCM)

David Tepper says ‘the stock market is still fine’ after Fed announcements (CNBC)

Weighing U.S. Inflation Risks and Investment Implications (Dodge & Cox)

BBRG: Market Narratives Have Pushed Aside Fundamentals (Barry Ritholz)

Worker Shortage, Inflation, Rates, Biden-Putin (Brian Langis)

First Eagle – Views From Global Value Team (FEIM)

Advice to Grads: Be Warriors, Not Wokesters (Scott Galloway)

What does history tell us about the value rally? (EB)

Jeremy Siegel – I’m not sure market is ready for a Fed policy shift (CNBC)

The Broken Window Fallacy (Frank Martin)

Etsy’s Growing Network Effect (Saber)

143: My Trick to Fight Hyperbolic Discounting, Do You Live in the Past? (Liberty)

Reinventing the Financial System (Net Interest)

Investing in a High Pressure Economy (Intrinsic Investing)

Feels Like 1977: Inflation Too High, Money Too Loose (GMM)

Without Memes (Alex Danco)

The impact of low inflation on bank lending (Klement)

This week’s best value Investing news:

John Rogers – Value And Small Stocks Will Lead (Kiplinger’s)

A Short History of Value Investing and its Implications (Advisor Perspectives)

Why small- and mid-cap value stocks are suddenly back in vogue (CNBC)

Why You Should Consider Value Stocks (Forbes)

This week’s Fear & Greed Index:

Fear.

This week’s best investing podcasts:

Staley Cates: Where Value Investors are Finding Opportunities (Gaining Perspectives)

Episode #321: Rajiv Jain, GQG Partners, “The Only Way To Survive Long-Term Is To Be Adaptive” (Meb Faber)

Ep. 179 – Distressed Securities: Finding Joy in the Junk with Dominique Mielle, Author of “Damsel in Distressed: My Life in the Golden Age of Hedge Funds” (Planet MicroCap)

Rick Van Nostostrand – Consistently Hunting For Real Value (Business Brew)

TIP353: The Best Performing Asset Is Not Bitcoin w/ Marin Katusa (TIP)

Inflation Is Temporary: Bullishness on the Economy & Markets Is Wrong [2021] (WealthTrack)

How We Invest in Inflation – Ep 129 (Intellectual Investor)

On Being an Emerging Manager: Experiences, Lessons Learned, Success Factors (Intelligent Investing)

#113 Sarah Tavel: The Value of Intellectual Rigor (Knowledge Project)

S11 E1 Jim Reid Discusses a New Economic Orthodoxy Under QE (Sherman)

Katy Milkman – How to Change (Capital Allocators, EP.199) (Capital Allocators)

Be Like Buffett: Buy The S&P 500 Index & Beat Your Stock-Picking Buddies (CMQ)

Short selling across the pond (Grant’s)

Litquidity — Up Close with the Meme King of Wall Street (EP.52) (Infinite Loops)

John Harris – Resilience and Imagination (Invest Like The Best)

Brad Stone on Big Tech Companies (MIB)

All Eyes On The Fed: Will The Market Hear Some Taper Talk? (Real Vision)

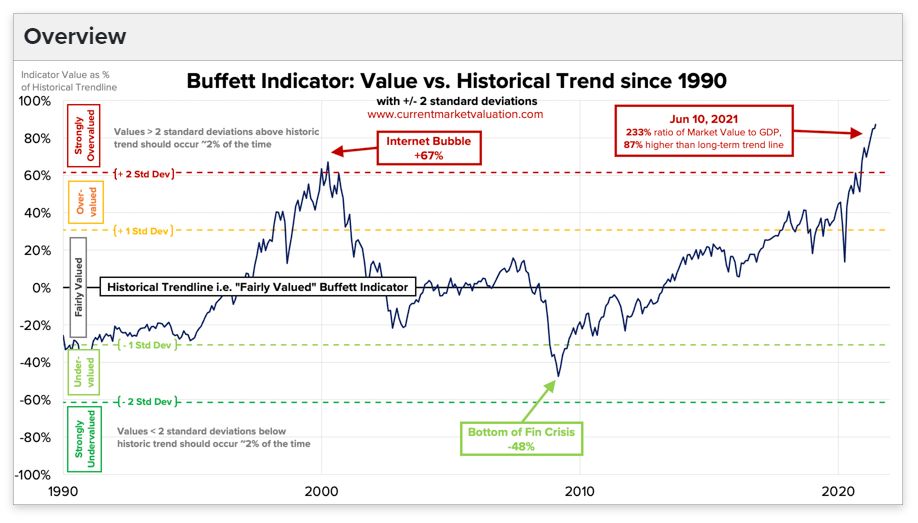

This week’s Buffett Indicator:

Strongly Overvalued.

This week’s best investing research:

The Performance of Volatility-Managed Portfolios (AlphaArchitect)

Putting The Recent Surge In New Highs Into Context (AllStarCharts)

Picking Top Performers: Does History Tell Us the Future? (AllAboutAlpha)

Inflation and sector returns – Investors can exploit the differences (DSGMV)

Can The 10 Year Yield Fall Further? (UPFINA)

This week’s best investing tweet:

This week’s best investing graphic:

The Biggest Business Risks in 2021 (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: