Here’s a list of this week’s best investing news:

Bubbles, Manias & Fraud (Jamie Catherwood)

100 Baggers: The Lost Chapter (Chris Mayer)

We Have No Idea What Happens Next (Collaborative Fund)

AMA? BITFD! (Epsilon Theory)

Should Warren Buffett Dismantle Berkshire Hathaway? (Mindset Value)

Zuckerman’s Curse and the Economics of Fund Management (Net Interest)

Timing the Value Reversion (Stockmarket Generalist)

A Stock Market Bubble? It’s More Like a Fire (Jason Zweig)

20:45 moat versus growth, payment processors value chain, accounting anomalies (Observing The Market)

Hole in the head (Buggy Humans)

Even At The Peak Of The Dotcom Mania Stock Market Sentiment Was Not As Euphoric As It Is Today (Felder)

Vaccines, Emotions and Investment Decisions (Behavioural Investment)

Wise Words from Philip Fisher (Novel Investor)

Reasoning Revenue Multiples (Tanay)

The Rolling Bubble Framework (Macro Tourist)

10 Best Books on Risk (Musing Zebra)

Mental Models for Career Changes (Farnam Street)

What is a Recession? (Barry Ritholz)

The FOMO Is Back…BUT…What If This Is The Start Of The Bull Market? (Howard Lindzon)

Pat Dorsey on competitive advantage (Prdctnomics)

Value Investing Links (Value Investing World)

The Charlie Munger Guide To Opportunity Cost (CMQ)

KR1 plc…The #Crypto #Alpha Bet (Wexboy)

Why is momentum dominating? (Klement)

Buffett & Matt Rose, Interview with Nvidia CEO (Liberty’s Highlights)

The Update Issue: Apple Cuts Prices, Spotify Doubles Down, More on Celebrity Booze (Whitney Tilson)

The stuff economy (I’m Late To This)

Could Google Soon Face… Competition? (BIG)

Who is the Biggest Investor in the Stock Market, and Why Should You Care? (Elm)

Social media predictions for 2021 (Late Checkout)

Timing the Markets: Dow Theory for the 21st Century (MOI)

Grahamian Value Week in Review (Grahamian Value)

Are Founders Allowed to Lie? (Alex Danco)

Real Estate Vs. Equities (Holiday Home)

Who allocates capital these days? (Real Returns)

The Idea Adoption Curve (Stratechery)

Why active will continue to underperform (EB Investor)

Weekly Earnings Calls 11.23.20 (The Transcript)

Long-Term Capital Market Assumptions (JP Morgan)

Grantham’s Bear Market Call Tests Patience of GMO Fund Investors (Bloomberg)

This week’s best value investing news:

Momentum may favour growth now, but value is a long-term play (AFR)

5 Reasons Why Value Investing is Safer than Investing in Index Funds (Vintage Value)

Is Value Investing Dead? (Podcast) (Excess Returns)

This week’s best investing research:

The top performing hedge funds over the last year (Whale Wisdom)

What Matters to Individual Investors? Evidence from the Horse’s Mouth (Alpha Architect)

The November momentum factor crash – Regime and crowd changes will shock (DSGMV)

Keynes vs. Markowitz ‘Thrilla in Portfolia’ (All About Alpha)

Why Have Electric Cars Taken So Long To Develop? (GMM)

This Was No Depression (UPFINA)

Technology Stocks Could Face Headwinds (III)

Hedge Fund Battle: Discretionary vs Systematic Investing (Factor Research)

Rotation Within Commodities Continues (All Star Charts)

This week’s best investing podcasts:

Howard Marks – Successful Investing Through Buying Things Well (Value Investing with Legends)

Joel Greenblatt – Common Sense for Value at Gotham Capital (Capital Allocators)

#97 Roger Martin: Forward Thinking (Knowledge Project)

Greg Fleming on Shaping Wall Street (MIB)

TIP324: The Great Reset w/ Luke Gromen (TIP)

Chris Bloomstran: What Makes a Quality Company (Invest Like the Best)

Chanos: How To Size Your Short Positions (Zer0es TV)

A Year of Disney+ (Science of Hitting)

Michael Mitchell (Business Brew)

Working With Tiger Cubs & Spotting Frauds w/ Stephen Clapham, (Episode 52) (Value Hive)

Ep. 149 – Closing the Gap: Building Generational Wealth with Impact and Discipline with Keith Beverly (Planet MicroCap)

The Art of Generating Stock Investment Ideas (Focused Compounding)

Crowdsourcing Ideas | Yellow and Red Flags When Analyzing a Company (Intelligent Investing)

How Bubbles and False Narratives Made Financial Markets, with Jamie Catherwood (Contrarian Investor)

Successful Investing: Charles Ellis, Timeless Advice (WealthTrack)

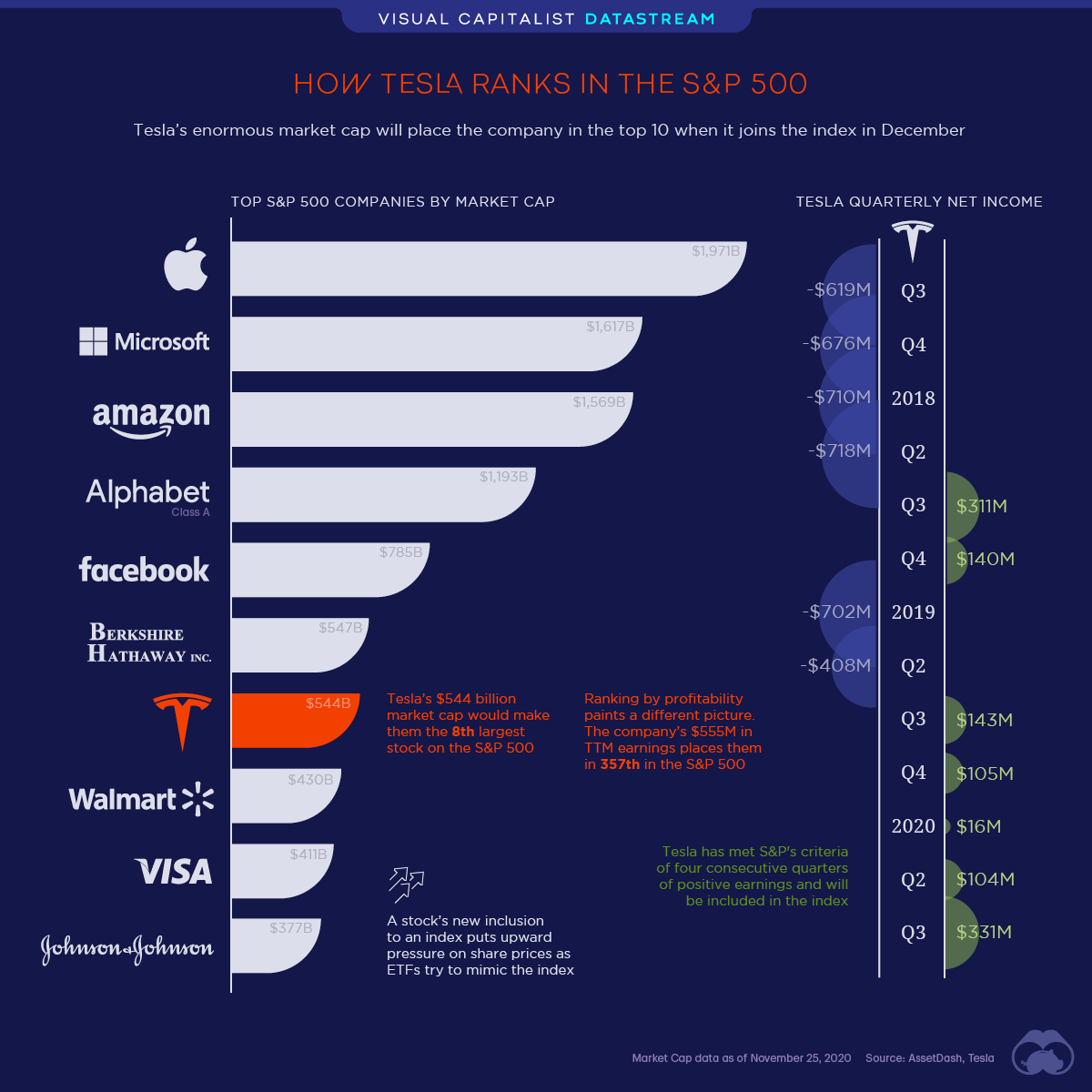

This week’s best investing graphic:

Tesla Set to Become a Top 10 Company in the S&P 500 (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: