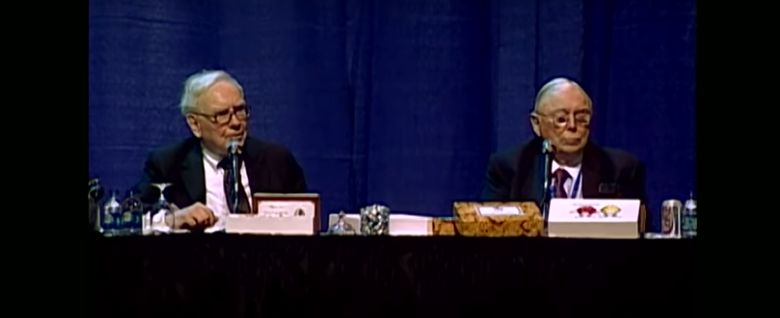

Here’s an excerpt from the 2008 Berkshire Hathaway Meeting in which Munger and Buffett discuss how not to invest like a lemming, saying:

WARREN BUFFETT: So with that, we’ll go right over to post number 1 and start in with the first question.

AUDIENCE MEMBER: Very good morning to Mr. Buffett and Mr. Munger. My name is Rajesh Furor (PH) from Bombay, India. I have been learning a lot from letters of yours. It’s been a great insight into investment philosophy that I haven’t learned from anywhere else. Great job.

That’s on the mind side. But on the heart side, what touches me the most is what you have achieved all these years is through a hundred percent honesty, and I salute to that. Thanks.

WARREN BUFFETT: Thank you.

AUDIENCE MEMBER: Now, my question is on what key steps would you recommend to correct the mind set of typical investor like me, which is what you noted as lemmings-like, the crowd mindset?

WARREN BUFFETT: What would we recommend — we got the question being repeated here — about the mindset of an investor? Is that —?

CHARLIE MUNGER: He wants you to advise him as to how he can become less like a lemming. (Laughter)

WARREN BUFFETT: Well, since you repeated the question, I’m going to let you give the first answer to that, Charlie. (Laughter)

Until he eats about a thousand calories, it — (Laughter)

CHARLIE MUNGER: He wants to invest less like a lemming.

WARREN BUFFETT: Oh, I understand that. I was giving you the first shot at it. Well, I will tell you what changed my own life on investing.

I started investing when I was 11. I first started reading about it — I believe in reading everything in sight. And I first started reading about it when I was probably six or seven years old.

But for about eight years I wandered around with technical analysis and doing all kinds of things, and then I read a book called “The Intelligent Investor.” And I did that when I was 19 down at the University of Nebraska.

And I would say that if you absorb the lessons of “The Intelligent Investor”, mainly in — I wrote a forward and I recommended particularly Chapters 8 and 20 — that you will not behave like a lemming and you may do very well compared to the lemmings.

We have here in the Bookworm, copies of “The Intelligent Investor”, and I think it’s as great a book now as I did when I read it early, I guess, in 1950.

You will never — you can’t get a bad result if you follow the lessons of — Ben Graham taught in that book.

I should mention that there’s a book out there also that I did not know it would be completed by this time.

My cousin, Bill Buffett, has written a book about our grandfather’s grocery store called “Foods You Will Enjoy.” And Bill will be out there. He’s signing books.

I just got my first copy a couple days ago. Read it, and I enjoyed it a lot.

Charlie worked at the same grocery store — how many years ago? Probably a good 70 years ago in Charlie’s case. Neither one of us was very good. (Laughter)

But my grandfather — you don’t want to pay much attention to his advice on stocks. He wrote a lot of letters, and he was very negative on the stock market and big on hard work at the grocery store.

So we quit listening to him. (Laughter)

Instead, read The Intelligent Investor. That’s the book that gave me the philosophy that has taken me now for a lot of years.

And there’s three big lessons in there which relate to your attitude towards stocks generally, which is that you think of them as parts of a business; and your attitude toward the market, which is that you use it to serve you and not to instruct you; and then the idea of a margin of safety, of always leaving some extra room and things.

But the people in this room, I think, have learned that important first lesson. I mean, I think most people that own Berkshire do not see themselves as owning something with a little ticker symbol or something that may have a favorable or unfavorable earnings surprise or something of the sort, but they’d rather think of themselves as owning a group of those businesses that are out there in the other room.

And that’s the way to look at stocks. You’ll never be a lemming if you do that.

You can watch the entire morning session here:

(Source: YouTube)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: