Here’s a list of this week’s best investing reads:

Yes, It’s All Your Fault: Active vs. Passive Mindsets (Farnam Street)

The Market Won’t Provide High Returns Just Because You Need Them (A Wealth of Common Sense)

The Hidden Risk When You Own Stocks for the Long Run (Jason Zweig)

GMO’s Montier on the rise of the dual economy (FT)

Ask Any Stock Market Pro: Buying Is Easy, Selling Is Hard (Bloomberg)

Stock Analysis: The Most Important Things (Plus, A Case Study) (Safal Niveshak)

We All Make Mistakes (Of Dollars & Data)

You’re a Liar (The Irrelevant Investor)

How to Sell a Big Winner in the Stock Market (The Reformed Broker)

The Eye of the Beholder (Demonetized)

The Balance Between Simple and Complex in Investing (Validea)

Step (Collaborative Fund)

Twelve Principles (Humble Dollar)

Looking for Hope in the Rubble of Value Investing (WSJ)

Jamie Dimon: CEOs Optimistic About Business Outlook (YouTube)

Investing: Theory vs. Practice (Massimo Fuggetta)

A Mirror Onto Ourselves (Your Brain On Stocks)

Trend Following in Cash Balance Plans (Flirting With Models)

Active fund managers trail the S&P 500 for the ninth year in a row in triumph for indexing (CNBC)

Dr. James Simons – Fireside Chat Series (YouTube)

How’s Your Bracket? (Above The Market)

Risk premia versus hedge funds – Worth a look (Mark Rzepczynski)

Is Government Debt “Equity”? (Pragmatic Capitalism)

Raoul Pal in Conversation with Grant Williams | Interview (Real Vision)

Berkshire Hathaway 2018 Annual Letter: 6 Insights from Warren Buffett (Behavioral Value Investor)

Warren Buffett Is No Fan of Modern Monetary Theory (Bloomberg)

Rise of the Machines: Investment Jobs Now Redundant? (CFA Institute)

Pre-suasion (Barel Karsan)

Is There a Behavioural Explanation for the Quality Factor in Equities? (Behavioural Investment)

The Investor’s Cheat Sheet (Bps and Pieces)

This week’s best investing research reads:

Factor Investing in Practice (Alpha Architect)

Investing in Stock Market is Now Fool’s Errand (Price Action Lab)

How to Allocate Smartly to Smart Beta? (Factor Research)

Are Rising Labor Costs A Problem For Economy? (UPFINA)

A Different Way To Look At Market Cycles (Advisor Perspectives)

Lawrence Lepard: Gold and Silver Will Head to New Highs (Palisade Research)

In Search of Temperament V – Probabilistic Thinking (Investment Innovation)

Talk on Fragility and Optionality in Business Models (Fundoo Professor)

This week’s best investing podcasts:

Episode #147: The Stay Rich Portfolio (or, How to Add 2% Yield to Your Savings Account) (Meb Faber)

Annie Duke – Wanna Bet? – EP.125 (Invest Like The Best)

Jake Taylor of Farnam Street – Episode 2: Charlie Munger and The Rebel Allocator (The Acquirers Podcast)

TIP234: Mastermind Discussion 1Q 2019 (The Investors Podcast)

Doing the Enough Thing – Basecamp CEO and co-founder Jason Fried (The Knowledge Project)

Manny Friedman – EJF on Economic Opportunity Zones (EP.91) (Ted Seides)

Episode 73: The Expectations Gap (Animal Spirits)

i3 Podcast Ep 21: John Coombe (Market Fox)

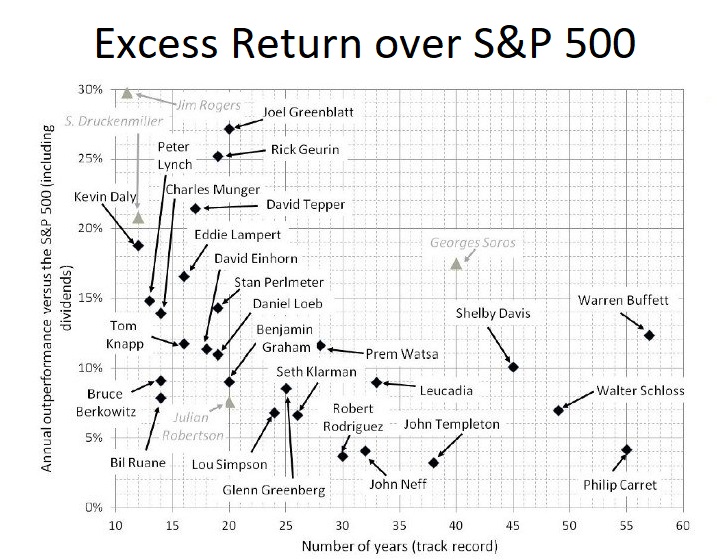

This week’s best investing chart:

Excess Return for Famous Investors Over Time (2014) (Imgur)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: