We run three screens here at The Acquirer’s Multiple.

The All Investable Screener

This screen shows the top 30 companies in The Acquirer’s Multiple® All Investable Stocks universe, which includes the largest half of U.S. exchange-traded stocks and ADRs. The screen excludes financials and utilities.

The Small & Micro Cap Screener

This screen shows the top 30 companies in The Acquirer’s Multiple® Small and Micro Cap Stocks universe, which includes the smallest half of U.S. exchange-traded stocks and ADRs. The screen excludes financials and utilities.

The Large Cap Screener

This screen shows the top 30 companies in The Acquirer’s Multiple® Large Cap 1000 universe, which is drawn from the largest 1,000 U.S. exchange-traded stocks and ADRs excluding financials and utilities.

While the screens provide loads of great information, this week I pulled out some interesting performance statistics on the Top 30 Deep Value Large Cap US Stocks. Here’s an overview:

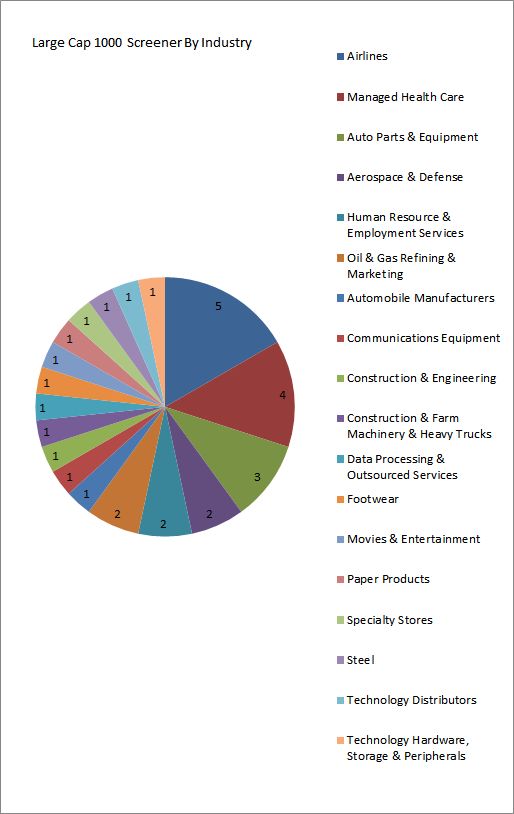

Industry Analysis

The Large Cap Screener has been dominated this week by Airlines (20%), Managed Health Care (13.33%) and Auto Parts & Equipment (10%).

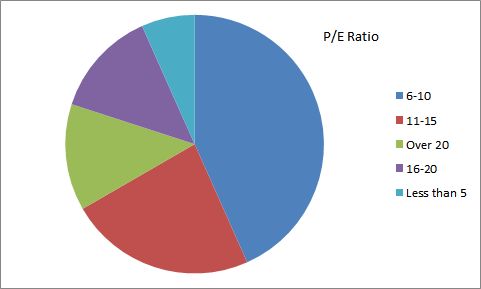

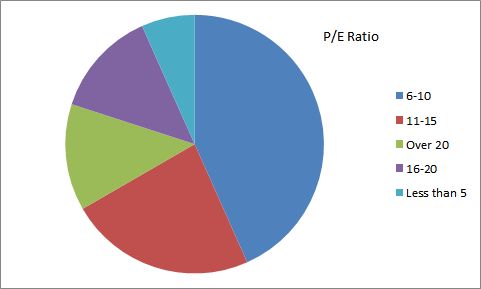

P/E Ratio Analysis

In terms of P/E Ratio in The Large Cap Screener, 43% of stocks have a P/E Ratio of 6-10%, 23% of stocks have a P/E Ratio of 11-15%, and 13% of stocks have a P/E of Over 20%.

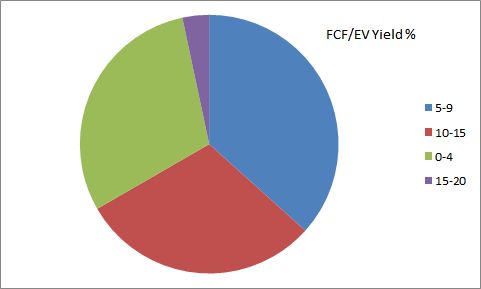

Free Cash Flow/ Enterprise Value Yield

In terms of Free Cash Flow/EV Yield in The Large Cap Screener, 37% of stocks have a FCF/EV Yield of 5-9%, while 30% of stocks have a Free Cash Flow/EV Yield of 10-15% and 0-4%.

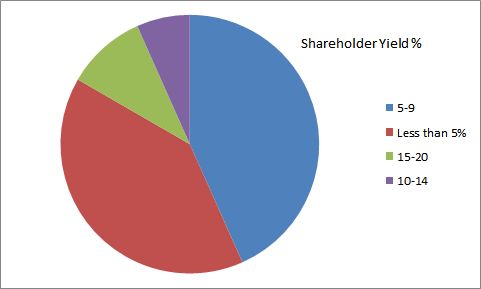

Shareholder Yield

Finally, In terms of Shareholder Yield in The Large Cap Screener, 43% of stocks have a shareholder yield of 5-9%, 40% of stocks have a shareholder yield of less than 5%, and 10% of stocks have a shareholder yield of 15-20%.

So, what are the Top 30 Deep Value Large Cap Stocks in the US this week, find out here. (FREE for seven days).

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: