I love it when I get the chance to write about a high-profile stock, particularly when it’s owned by David Einhorn–one of the smartest guys around–and it’s dirt cheap. Poor old Micron Technology, Inc. ($MU). I’ve bought and sold it so many times over the last decade. It was a net net in 2009 before running away. It got cheap on an acquirer’s multiple basis (and close to net net territory) in 2011 and again in 2012 before running away. And here we are again. It’s cheaper now than it has been at any time in the last two years, down 60 percent (!) from its 52-week high, and 8 percent from its 52-week low.

At the time of writing MU’s trading at $14.56, putting it on a market cap of $15.7 billion. Add in the $3.6 billion of net debt and its enterprise multiple swells to $19.3 billion. On trailing twelve month operating earnings of $3.4 billion, it trades on an acquirer’s multiple of just 5.7x. It’s cheap on other measures too: The PE ratio is a paltry 5, and free cash flow / enterprise value yield is 11 percent. It’s a net issuer of stock to the tune of 2 percent over the last twelve months, and doesn’t pay a dividend, both of which are less than ideal.

Micron Technology, Inc., founded in 1978 and is headquartered in Boise, Idaho, manufactures semiconductors. The company sells dynamic random access memory (DRAM), NAND flash, and NOR flash memory products; and packaging solutions and semiconductor systems. It operates in four segments: Compute and Networking Business Unit, Mobile Business Unit, Storage Business Unit, and Embedded Business Unit. MU markets its products to original equipment manufacturers and retailers.

MU’s a reasonably safe company, scoring well on the Z, F and M scores–the statistical measures I like to examine to detect fundamental strength, financial distress, and earnings manipulation respectively. MU scores worst on its Altman Z-Score. At 2.43, it is in the grey zone, which means it is not financially distressed (below 1.81), but neither is its clearly safe (above 2.99). MU has seemed to flit between distressed and safe over the last decade with no appreciable damage, but it’s worth watching. Its Piotroski F-Score is 6 of 9, which indicates fundamental stability. Its Beneish M-Score of -2.68 indicates the company is not an earnings manipulator (less than -2.22 is not a manipulator). Taken together, MU is in reasonably good shape, but its debt load and financial distress grey zone mean that its safety isn’t unalloyed.

It has an unusually smart collection of investors as shareholders, all of whom are buying hand over fist. David Einhorn, Joel Greenblatt, David Dreman, and First Eagle have all added to existing positions in the last 6 months. Einhorn, in particular, has been vocal about MU’s prospects, writing in his July 2015 investor letter that MU–then trading at ~$19, or $20 billion market cap–would be worth more than Netflix at $40 billion (which is also a comment on NFLX’s overvaluation):

Most companies are still held accountable to current performance. Micron Technology (MU), which fell from $27.13 to $18.84 during the quarter, was our biggest loser. It’s a cyclical business and, regrettably, we missed the turn of the cycle. Long production lead times make it difficult to match supply with demand, and when demand falls short (as it has recently), shortages can turn into surpluses. Prices (and profits) fell, and MU disappointed. MU also had manufacturing problems that will impact earnings for the next couple of quarters.

With only three remaining players, the industry is behaving more rationally. Manufacturers are redirecting capacity away from computer DRAM to other segments, and we believe that the excess computer DRAM inventory created earlier this year is now being absorbed. Our assessment is that MU shares have fallen too far. Peak quarterly earnings last year were $1.04 and we expect the cyclical trough to be around $0.40 in the August quarter. At $18.84, the company trades at less than 12x annualized trough earnings and less than 5x prior peak earnings. We expect future cycles will have higher peaks and higher troughs, as the technology story for both DRAM and NAND (including 3D memory) is bright for the next several years.

Our long-term outlook is that sometime in the next few years, MU (currently valued at $20 billion with $3.7 billion of trailing net income) will be worth more than NFLX (currently valued at $40 billion with $240 million of trailing net income). It’s a contrarian view, but we don’t think the movie is over.

MU has also attracted attention from a potential suitor in China’s Tsinghua Unigroup. China is the world’s largest semiconductor consumer, accounting for almost half of computer chip demand (for domestic and export markets) and has to import 90 percent of its integrated circuits. It has been reported that Zhao Weiguo, president of Tsinghua Unigroup, has already met Micron’s board members to gauge the feasibility of an acquisition with U.S. authorities:

Should it be rejected on national security grounds, as noted by Senator John McCain, Tsinghua could still ally with Micron to enable it to develop its sales in China while negotiating a production on Chinese soil of flash memory drives and other devices.

The rumors are that if Tsinghua were to acquire Micron, it would pay some $21.0 billion. Micron has suffered over the past two years for the first time due to weaker demand for dynamic random access memory (DRAM) chips used in PCs. But it now has the new technology to benefit from the smartphone market as well as servers and other chips used as storage on mobile devices and computers.

MU is imperfect. It carries a substantial slug of debt, is in a financial grey zone, doesn’t pay a dividend, and it’s a net issuer of stock. But it’s also very cheap, trading on an acquirer’s multiple of 5.7x, a PE of 5 and a FCF/EV yield of 11 percent. Einhorn makes mistakes, but he’s one of the smartest investors around and he’s very tenacious. MU announces earnings after the close today. I don’t know, but I’d guess that anything less than a disaster will be viewed very positively.

Long/short equity, event-driven, activist, research analyst Scott Tzu at Orange Peel Investments likes it too. Here’s his take:

We believe the semiconductor sector is bottoming, and we believe that stabilization of the sector will result in the company taking on as much as 50% upside from these levels. We also believe that genuine buyout interest in the company continues to exist at these compressed multiples.

The company is going to be reporting next week, and we’re likely to get a firsthand look at why quantitative investors are drawn to Micron. The company is expected to post earnings of $0.35 on revenue of $3.567 billion.

For the full year, the company is expected to earn $2.68 and even for next year, the company is expected to earn $2.20. Despite the EPS decline, Micron still remains attractively valued from a fundamental basis.

MU PE Ratio (Forward) data by YCharts

…

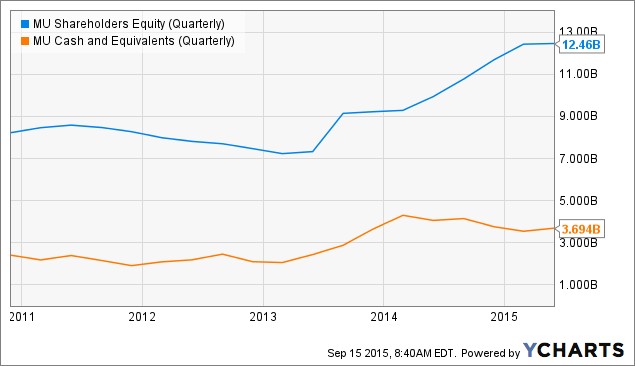

In addition to the earnings, the company’s balance sheet continues to get better and better. Management is setting up the company to withstand these types of ebbs and flows in the sector by building a company that’s rich in assets and resources and isn’t leveraged too far.

MU Shareholders Equity (Quarterly) data by YCharts

The company now has a book value of $11.59 per share, with $4.8 billion in cash in the bank versus the $7.6 billion in debt that the company is carrying. The company has done about $5.5 billion in operating cash flow over the ttm period and it continues to generate, and then stock away, cash.

MU EV to EBITDA (TTM) data by YCharts

From a valuation standpoint, the company is extraordinarily cheap. With a trailing 5.5x EPS and a forward EPS of 7.5x, it’s a race to try and buy cheap versus timing the decline and bottom of the semiconductor industry.

We continue to think the company’s EV/sales of 1.2x and EV/EBITDA make it an attractive buyout candidate.

…

You have to assume that there is genuine interest in buying out the company. The potential buyers of the Tsinghua group are legitimate buyers that have shown enough interest in buying the company to make a trip to the United States in order to discuss it. This is a question of whether or not the company’s valuation is going to get low enough for people to buy the company while the market continues to be in decline.

Read more: Many Reasons To Like Micron

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple:

9 Comments on “Micron Technology, Inc. ($MU): Cheap and a Takeover Target”

Tobias,

Very nice piece and I agree with your assessments. Until any of the 3 big players start acting irrationally and adding excess capacity I find it hard to see how Micron (also Samsung and Hynix) aren’t making much more money in future years.

Not that I can predict the crowd….. but with the history of the industry it makes me wonder if some investors in Micron have gotten burned before in semiconductors and are more skittish than normal.

I think the screener may be misplacing this stock by showing it as having a positive Cash – Debt balance and not taking into account non-controlling interests.

I am finding the Acquirers Multiple is approx 7.8x at mid-afternoon on 10/6.

The article is right but the screener is screwy. Thanks for the heads up.

It’s a data issue. For whatever reason, the data provider hasn’t caught the total debt figure. The enterprise value calculated here captures prefs and minorities. Thanks for alerting me.

Sorry. I should have clarified that I think the screener is messing up numbers from the 8-K they just filed. And I was using that 8-k to make my calculations.

I agree with the article when using TTM numbers from the 3rd qtr 10-Q.

Tobias,

I’m surprised MU hasn’t shown up on the screener lately.

It’s 36th in the Large Cap Screener with an acquirer’s multiple of 7.1. It wouldn’t need to fall far to appear in the screener.

Thanks. Picking up some MU and HPQ long dated options might make sense here.

Micron ended up having a cameo on the screener 😉