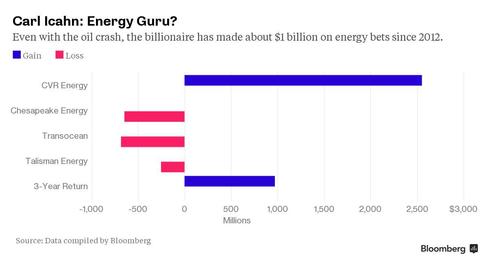

Oil’s crash would have been every bit as cruel to Carl Icahn as it was to other investors, except the billionaire had a very important ace in the hole: a little-known refiner and fertilizer maker based in Sugar Land, Texas. Icahn’s 2012 purchase of CVR Energy Inc. has returned more than $2.5 billion to the activist hedge fund manager from market gains and dividends, according to data compiled by Bloomberg.

That more than makes up for the $1.6 billion in paper losses that have piled up from his other bets on oil and gas companies as the shale revolution helped bring about a global glut. All told, Icahn’s major forays into energy have brought him a net gain of almost $1 billion since 2012, according to investment data compiled by Bloomberg based on public filings and average quarterly share prices. That’s an annualized return of more than 5 percent.

Source: One Good Icahn Energy Bet Undoes Several Years of Bad Calls – Bloomberg Business

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: