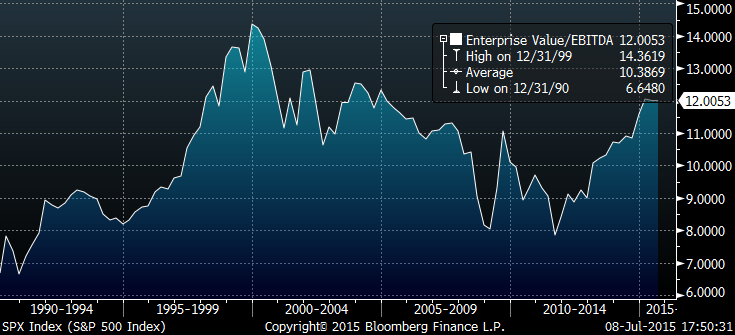

I like to check in occasionally to see where the S&P500’s average enterprise multiple stands. Right now it’s trading on just over 12x, where it’s been since the start of the year. It’s rarely been this expensive. Indeed, the average for the full period is 10.4, and it’s only exceeded this level in the late 1990s and briefly in the early-2000s.

The chart below shows enterprise value/trailing EBITDA for the S&P500 for the period 1990 to date:

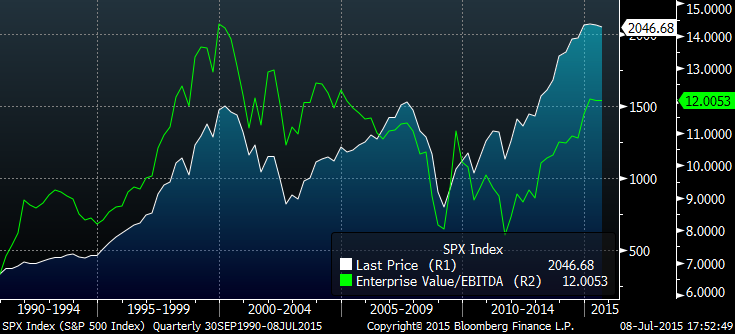

The chart below shows enterprise value/trailing EBITDA for the S&P500 for the period 1990 to date compared to the S&P500:

One thing clear from the charts is that the level of the S&P500’s enterprise multiple is not particularly predictive of anything. Sure, it peaked in 1999 along with the market, but it also bottomed in late 2011, while the market bottomed in early 2009.

I prefer to use it as a rough estimate of the likely upper end of valuations for my basket of stocks. While they aren’t directly comparable (the acquirer’s multiple uses enterprise value-to-operating income, not EBITDA), they are close enough. The median of the stocks in the Large Cap 1000 screener currently sits around 7.9x (the most expensive sits at 9.3x, and the cheapest at just over 5x). That’s plenty of room for bigger acquirers to pay a premium and take them out.

Click here if you’d like to see a current list of deeply undervalued takeover and activist targets using The Acquirer’s Multiple® (it’s free!), subscribe to The Acquirer’s Multiple® or connect with Tobias on Twitter, LinkedIn or Facebook.

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple:

2 Comments on “S&P500 enterprise multiple 1990 to date”

Tobias

Firstly, thank you for providing an excellent resource with this site, as well as your books and writing generally.

Can I ask what data service provider you use for your screeners?

Please keep up the excellent work.

Cheers

Conor

Hi Conor,

Thanks for the kind words. The screeners use a combination of CapIQ and Google Finance (for 20-minute delayed prices).

Best,

Tobias