RPX Corp is an unusually cheap stock with an unusual business model. With an $888 million market cap, and $376 million in net cash, RPXC has an enterprise value of $512 million, against which it has earned $76 million in operating income over the last twelve months, giving it an acquirer’s multiple of 6.7. It has generated $199 million in free cash flow over the last twelve months, which equates to a 38 percent FCF/EV. It has authorized a $75 million buyback, which is material relative to its market cap.

RPXC helps companies reduce their exposure to litigation from patent trolls, a multi-billion dollar industry. RPXC solution is ingenious: It have aggregated its own patent portfolio, which it licenses to companies, offering along with it litigation insurance to cover the costs of patent litigation. The business makes money through subscription fees collected from its clients from the licensing of patent assets.

Patent trolls, as they are pejoratively named, discovered that they could purchase a portfolio of patents, initiate lawsuits on the basis on patent infringement, and pocket the settlement offered by the defendant. Typically, the patent troll purchases patent from financially-distressed companies, thus allowing the patent troll to acquire intellectual property at cheap prices, due to the presence of a cash-strapped and highly motivated seller. This practice was highly lucrative resulting in a flood of patent trolls adopting a similar modus operandi. Suffice to say, as the number of patent trolls increased, patents became more expensive. Regardless, the practice remains feasible from a financial standpoint.

Successful infringement lawsuits are rare, but the outsized payouts motivate patent trolls. Companies began to suffer from lawsuits initiated by patent troll. Apple (NASDAQ:AAPL) is the #1 target for patent trolls receiving over a hundred lawsuits in recent years.

Can’t companies defend against these lawsuits? Yes, but…

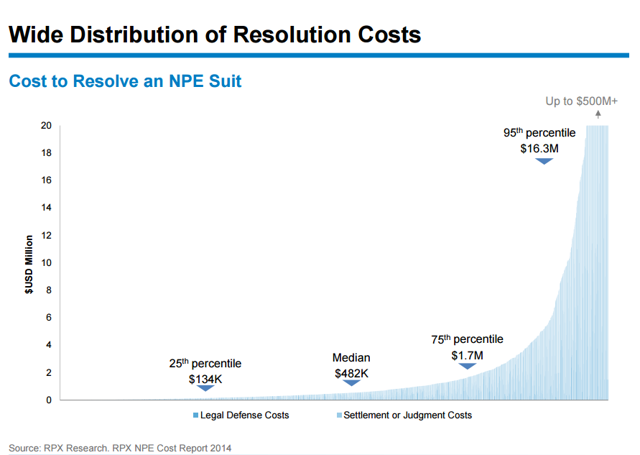

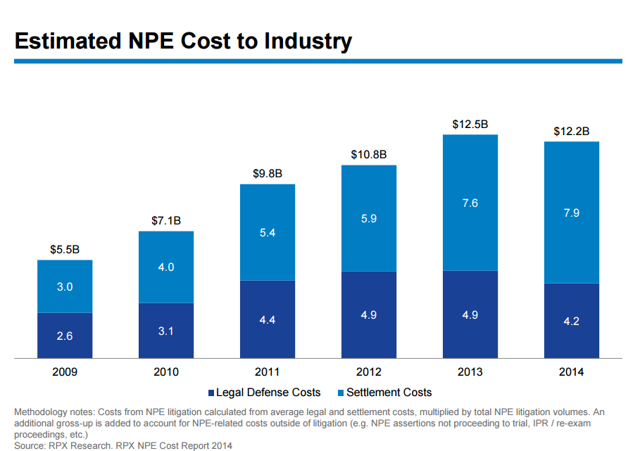

[N]ot only does legal defense not come cheap, patent lawsuits tend to distract management from their core operations. Additionally, settlement costs are equally huge. Combined, legal defense and settlements costs to the industry have grown from $5.5b in 2009 to $12.2b in 2014 (as seen below).

Furthermore, the defendant is in no position to counter-sue, given that the plaintiff (patent troll) typically does not create or sell their own products and services. Hence, there is no legal basis for a countersuit.

RPXC’s solution is aggregate its own patent portfolio, license it to companies, and offer litigation insurance.

The company’s business model is rather simple to understand. RPXC offers two solutions:

- a defensive patent aggregation solution,

- and insurance to cover the costs of patent litigation.

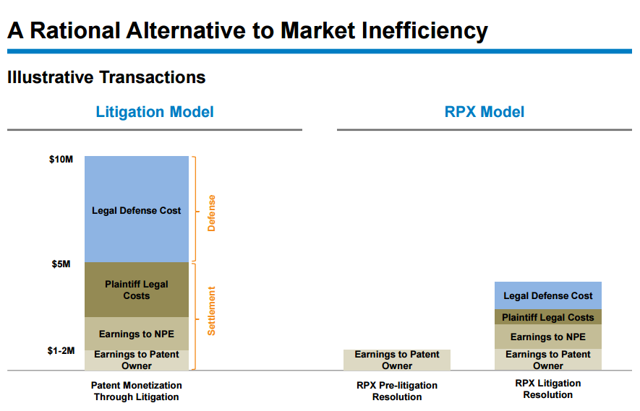

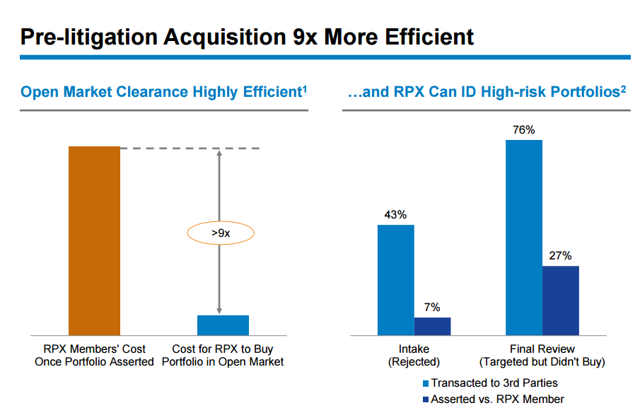

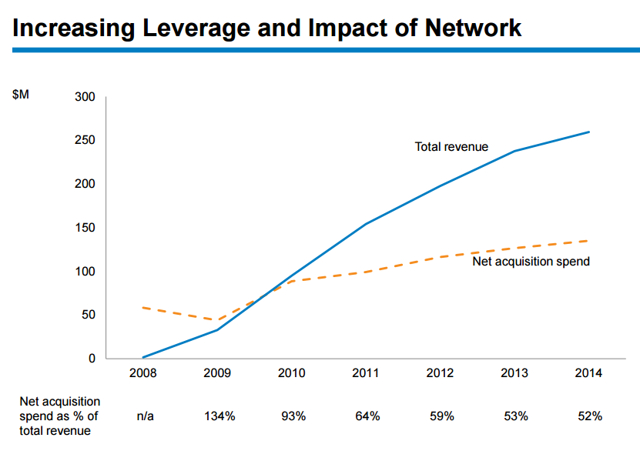

Simply put, RPXC first acquires a portfolio of patents (thus aggregating them) and then provides their clients with licenses to these patent assets, hence protecting said clients from potential litigation exposure. In a nutshell, the company acts as a middleman between its clients and patents. Additionally, the company also offers patent litigation insurance, which serves as a natural add-on to its core patent risk management solution.

Source: RPX Corporation

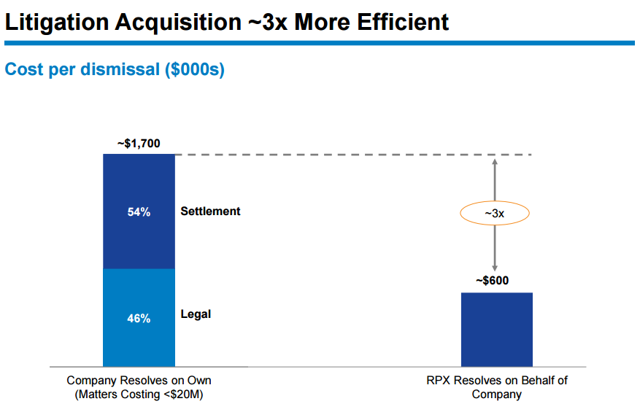

The firm’s core patent risk management solution is a tremendous value-add to its clients. The rationale here is simple. Essentially, RPXC helps its clients dramatically reduce the cost of patent litigation. The patent market is highly irrational due to the presence of huge deadweight losses (primarily legal costs). Non-practicing entities (“NPEs”, a more palatable term for patent trolls) use litigation to transfer value between patent owners and users. Litigation costs are substantial.

Source: RPX Corporation

Source: RPX Corporation

The business makes money from its patent risk management solution through subscription fees collected from its clients from the licensing of patent assets. These fees are typically calculated as a percentage of the client’s top-line or operating income, thus allowing RPXC to not only participate in the financial success of its clients but also ensures the alignment of interests for both parties. As for the insurance solution, RPXC adopts a cookie-cutter insurance model, collecting premiums upfront and distributing payouts contingent on certain events.

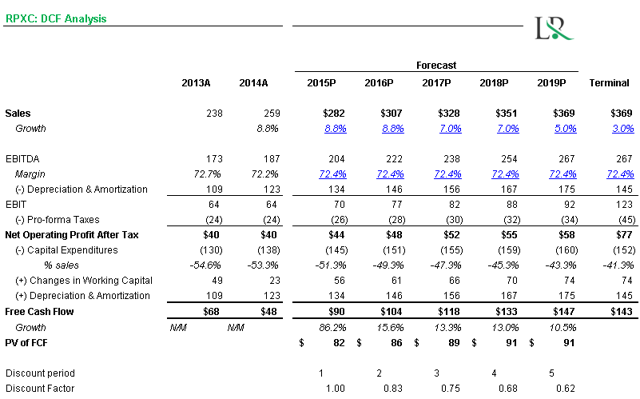

Here’s Lester’s valuation:

Note that capital expenditures are not assumed to be constant thus it is left blank in the key assumptions tab, and varied within the model itself.

I have modeled out the company’s free cash flows as seen above. FY15 revenue growth is expected to be in the high single-digits, which is in-line with management estimates. From FY16-18, I expect RPXC to be able to continue growing revenue at mid to high single-digit growth rates. I believe this growth will be driven by greater penetration within the markets (patent risk management & insurance) that the firm serves, along with client operating performance improvements. EBITDA margins are expected to be flat at ~72%. This is due to the fact that formidable barriers to entry (as outlined earlier) are able to deter new entrants for entering the space and forcing margins down. I will address this point further in a later section. I believe this is a conservative estimate as the company managed 40% operating margins in Q1 FY15, compared to the normal 32% in prior quarters. If this margin expansion is sustainable, upside potential will be far greater.

Source: RPX Corporation

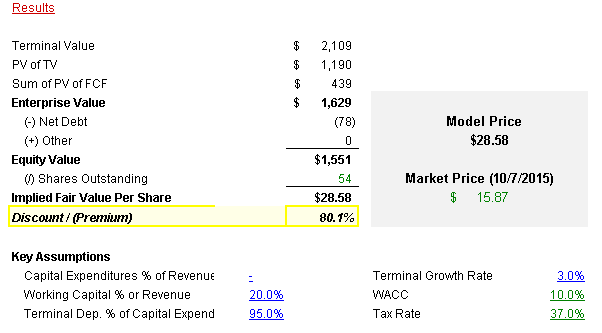

RPXC is a cheap stock with a compelling business. It has strong cash flow conversion, the firm should offer solid FCF yield even at higher multiples. The firm is substantially undervalued at current levels with 80% upside per Lester’s DCF.

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple:

One Comment on “RPX Corp: Unusually cheap stock with an unusual business model”

Very interesting company. I read up on it last night after seeing this article. My two questions, or really concerns, are: (1) why is there so little insider ownership? Insider’s are constantly selling with newly issued shares. All these new shares are diluting ownership interests (2) isn’t it hard to predict how much cash they will need to continue to purchase patents? Although there is a ton of cash on the balance sheet, couldn’t that be gone at any moment to purchase new patents?

Besides the above, the business model is really ingenious and the balance sheet is great.