Silvercorp Metals Inc. (NYSE:SVM) is the seventh cheapest stock in the All Investable Screener with an acquirer’s multiple of 5.53. At $1.10, it has a $188 million market cap, an enterprise value of $172 million, and has generated $31 million in operating income over the last twelve months. It trades at a discount to tangible book (0.8x), generates a little free cash flow (FCF/EV = 2.9 percent), and pays a little dividend yielding about 2 percent here. It’s the cheapest silver miner available, likely because its mines are in China, but it has an authorization to buy back 10 percent of its stock before December 22. Now would be a good time to exercise that power.

The main thing to know about Silvercorp is that the company is profitable, even with silver below $17 per ounce, as it produces silver at extremely low cash costs. Part of the reason for this is the company’s reserve grades are pretty high, averaging over 200 g/t at the Ying Mining District. Cost cutting efforts at the district have also clearly been paying off, as the company has reduced its head count and lowered its general and administrative costs; this has helped reduce all-in costs by nearly 33% in the most recent quarter.

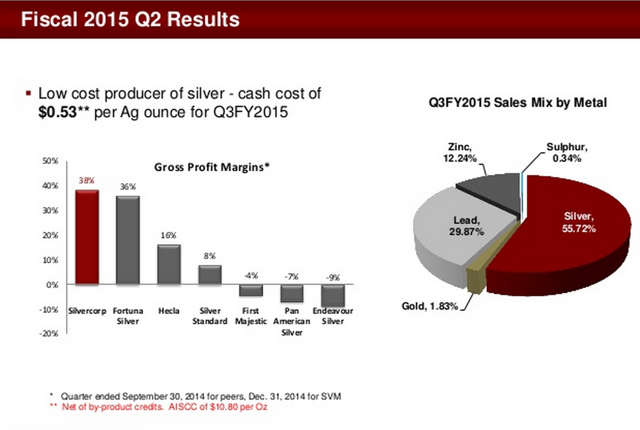

For the nine months fiscal year 2015 (which ended on Dec. 31, 2014), the company reported $49.3 million in cash flow from operations and $21.3 million in net income, ending the year with $83.7 million in cash, or $.49 per share. With a $.02 per share annual dividend, shares yield 1.3%.All-in sustaining costs per ounce fell 33% to $8.64 in the last quarter, and the company has guided for costs of $7.46 for the current year. Gross profit margins for the company’s fiscal second quarter were 38%, which is better than peers Fortuna Silver (NYSE:FSM) at 36% and Hecla (NYSE:HL) at 16%. [See above]

How are the peer comps?

The company remains very undervalued compared to its peers on several other metrics. Shares currently trade at an EV/EBITDA of 2.64, which is far lower than Silver Standard (NASDAQ:SSRI) at 6.84, Coeur Mining (NYSE:CDE) at 10, and First Majestic (NYSE:AG) at 11.56, according to figures at Yahoo Finance. The company’s 2015 price to cash flow (P/CF) is right around 4, which is also far lower than all of its peers, according to its corporate presentation.

The company is undervalued and looks to be taking action:

Besides a decent-sized dividend, the company is also returning capital to shareholders through a share repurchase program – the company can acquire up to 16.5 million shares, or 10% of the public float, from Dec. 23, 2014 to Dec. 22, 2015.

This move would reduce Silvercorp’s share count from 170.88 million shares to 154.38 million shares, and cost the company $20.79 million at the current share price. I believe this is a very smart move as shares remain pretty undervalued; buying back shares if the stock was overvalued would be the wrong move.

The bottom line: Silvercorp should offer investors outstanding leverage to rising silver prices, but also a safety net if prices fall, since it produces silver at low costs and has so much cash on its balance sheet. The stock remains extremely undervalued, but a share repurchase program should certainly help provide support. I look forward to buying shares in the coming weeks.

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: