Mobile TeleSystems (NYSE:MBT) has been beaten up over the last month (off 12.5 percent) and at $9.69 is now the sixth cheapest stock in the Large Cap 1000 Screener (it’s free if you register). With a $9.7 billion market cap and $4.4 billion in net debt, MBT doesn’t have the usual net cash balance sheet that I prefer. What it does have is $2 billion in trailing twelve month operating income, which makes it a reasonably secure proposition from a financial perspective. It has a huge 9 percent dividend yield at current prices. It is unlikely to be sustainable at these levels in the short term for the reasons below, but should recover in due course. The underlying business is steady. MBT’s problems stem from the macroeconomic and political climate in Russia.

Long/short equity, value, growth at reasonable price investor Nick Cox believes that the high dividend payout looks fairly assured and the upside potential for the share price is quite high based on MBT’s expected steady financial performance. He cautions, as I do, that MBT is a higher risk proposition than other positions I have written about on the site.

2015 Outlook

At the conference call, MBT forecast a relatively conservative increase in Group Revenue of 2% (3% in Russia) and Group OIBDA margin of over 40%. As might be expected Dubovskov cited “macroeconomic issues and currency stability” as the key factors for the coming year, while capex spending was due to reduce slightly. For investors worried about the transparency of economic reporting of Russian companies, MBT has committed to reporting under the standards set by IFRS (International Financial Reporting Standards) as from this year.

The position on dividends has been the subject of some questioning, and of course how much they are worth to overseas holders of MBT ADR’s will depend upon the currency situation. Dubovskov clarified however, “Our dividend policy implies that at least 75% of our free cash flow ought to be distributed in the form of dividends … it’s stable, pretty much stable level of dividends in 2015 comparatively to 2014.” This should come as a relief to investors. Some doubts have been expressed over dividends after rival Vimpel Com (NASDAQ:VIP) slashed its dividend last year, evidently due to debt problems.

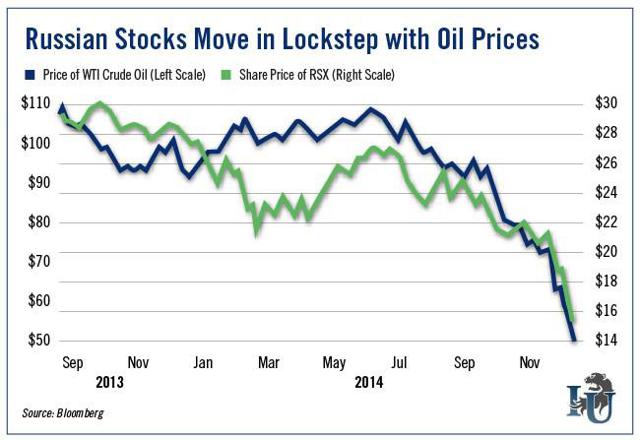

The two key factors for the coming year will be currency movements and the oil price. The graph below shows the close connection between oil prices and the Russian stock market as a whole.

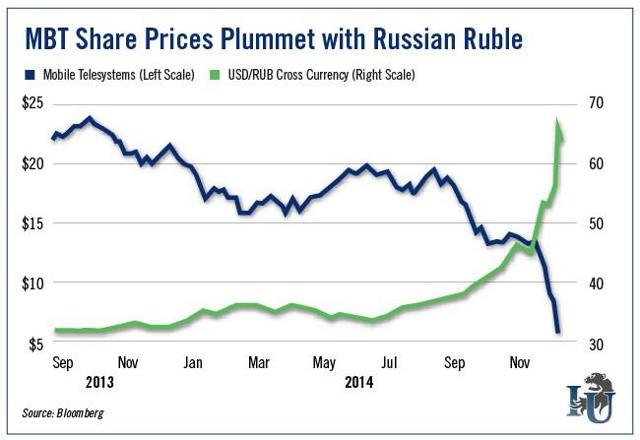

The next graph shows the specific correlation between the share price of MBT and the value of the rouble.

Despite being a telecoms company, MBT’s performance this year will be affected primarily by the price of oil and the value of the rouble, which has declined 40% against the US$ since mid-2014. Putin has floated the idea of a currency union with Belarus and Kazakhstan but this seems unlikely to get off the ground, at least in the short run.

MBT’s share price is currently at US$9.95 with a 52 week range of US$5.85 to US$20.03. It seems that its downside risk is very limited in economic terms: people will still make phone calls, go on the Internet if they can get a clear connection, and buy phones.

Importantly,the LTE roll-out will continue for MBT, in a country where many areas still rely on 3G or even 2G. MBT has LTE networks now in 77 of Russia’s 85 regions, and plans continued LTE roll-out in a country where many rural areas have little or no fixed-line Internet connectivity.

The ultimate political risk is that relations sour with the West so dramatically that some sort of restriction is placed on Western investors being able to trade Russian ADR’s, but that seems unlikely and questionable in legal terms. The high dividend payout looks fairly assured and the upside potential for the share price is quite high based on MBT’s expected steady financial performance, though any investor should probably only invest funds he can afford to leave for quite some time should the market deteriorate.

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: