Industrias Bachoco, S.A.B. de C.V. (NYSE:IBA) is another stock on a great run that remains too cheap. I’ve owned it since Q3 2011, and I still hold it because it’s the third cheapest stock in the All Investable Screener. It has a market cap of $2.7B, an enterprise value of $2B, and generated $410 million TTM to give it an acquirer’s multiple of 5.1, a PE of 9.1, and a FCF/EV yield of 19.6 percent. The company is a poultry producer in Mexico and the United States.

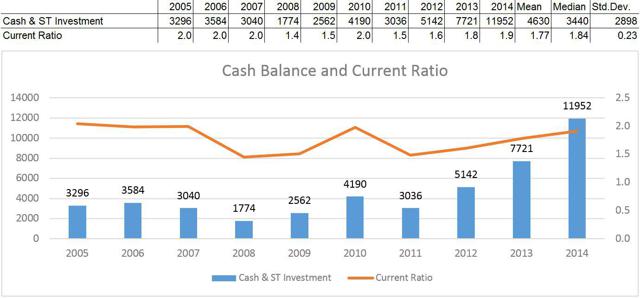

2. Strong balance sheet with growing cash balance

IBA has increasing cash balance, with its latest 2014 number being $12bn. This cash balance is significant considering the firm’s market capitalization of $38bn. As a mature firm with modest capital expenditure needs, this significant cash balance sets up the stage for share repurchase and/or special dividend.(click to enlarge)

(Source: Capital IQ)

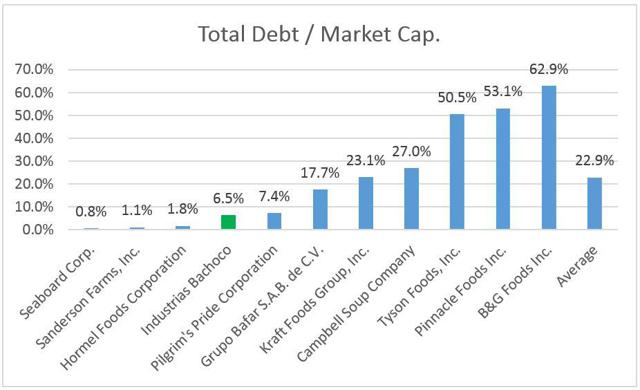

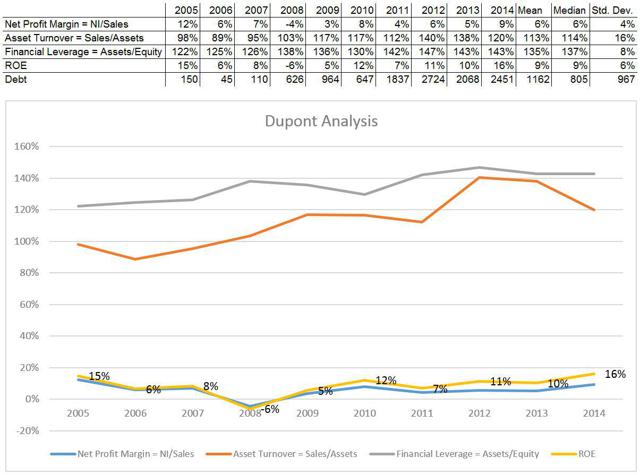

3. IBA is underleveraged and more debt will improve ROE

Compared to the average peer’s D/Market Cap. of 22.9%, IBA’s 6.5% is significantly underleveraged. Dupont analysis shows that IBA’s growing ROE in recent years is due to increasing net profit margin. However, taking on additional financial leverage can also significantly improve ROE and shareholder value. A few key points:Out of $38bn in market cap, the company only has $2.5bn in debt.Dupont analysis shows that the company’s ROE has had an increasing trend. The company can improve ROE by taking on greater leverage.Since the company generates significant free cash flow and it has a strong AA+ rating (by Fitch), it can afford to take on additional debt to improve ROE with minimal cost of financial distress.The fact that the company has been increasing its debt is a good sign but I believe they can be more aggressive with it.(click to enlarge)

(Source: Capital IQ)

(click to enlarge)

(Source: Capital IQ)

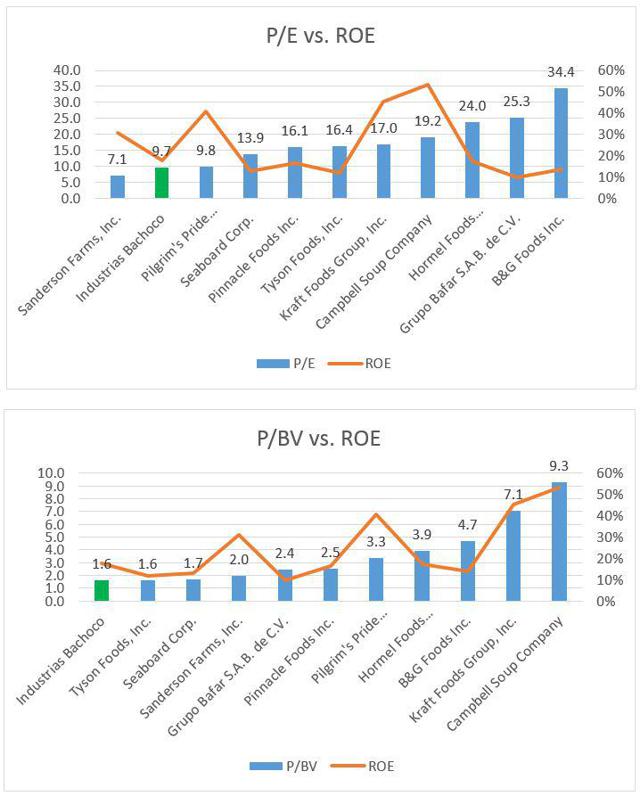

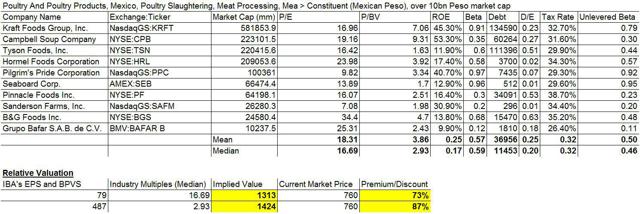

Relative Valuation

To come up with comps, I used Capital IQ and searched for packaged food, meat processing, and poultry slaughtering companies that operate in Mexico and US with more than $10bn in market cap. There are a total of 10 results. Using LTM P/E and P/BV measures, IBA appears to be significantly undervalued.

(click to enlarge)

(Source: Capital IQ)

(click to enlarge)

(Source: Capital IQ)

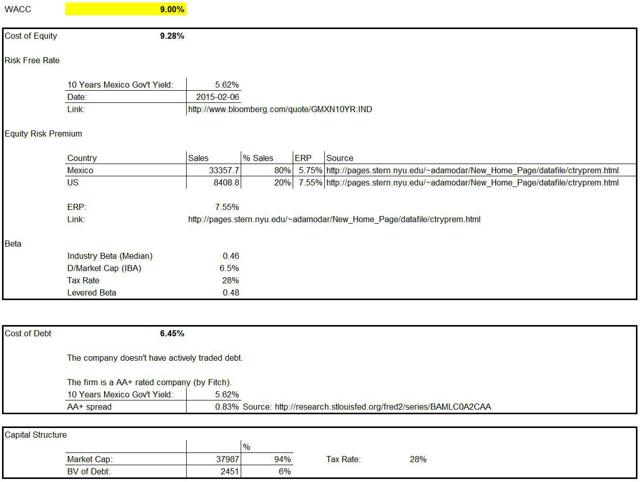

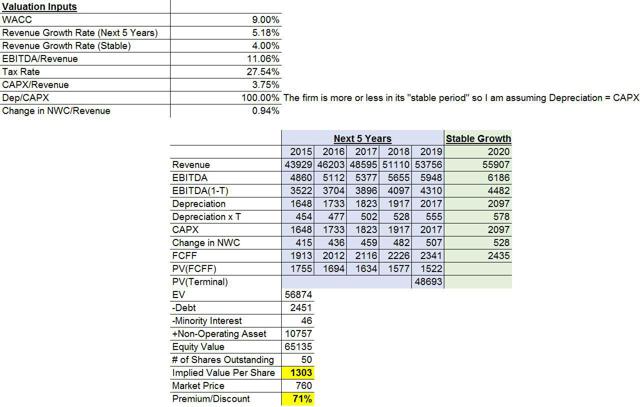

Intrinsic Valuation

DCF (FCFF) model is used in valuing the firm. Key assumption includes the WACC of 9% (based on bottom-up beta method), revenue growth of 5.18% for the next 5 years and a perpetual revenue growth rate of 4%. You may feel that the perpetual growth rate of 4% is aggressive relative to the 2-3% we normally see for valuation in US and Canada. However, the valuation is based on Peso and the 10-year Mexico government bond has a yield of 5.62% as of February 6, 2015.

(click to enlarge)

(Source: Capital IQ)

(click to enlarge)

(Source: Capital IQ)

Conclusion

In summary, IBA has a strong balance sheet and strong and resilient revenue growth. Its low D/E ratio and high AA+ debt rating allow the management to improve its ROE and shareholder value by taking on greater leverage (i.e. change in capital structure enhances value). Relative analysis shows that the firm is significantly undervalued compared to its peers. Intrinsic valuation also shows that the firm has up to 71% upside.

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple:

(Source: Capital IQ)

(Source: Capital IQ) (Source: Capital IQ)

(Source: Capital IQ) (Source: Capital IQ)

(Source: Capital IQ)