Gold Resource Corporation (NYSEMKT:GORO) is up almost 9 percent today, but it remains one of the cheapest stocks in the All Investable Screener with an acquirer’s multiple of 4.8 (it’s run from third cheapest to fifth cheapest today). There’s a lot to like about it: Lots of cash on the balance sheet, no debt, a PE of 10.6, and a fat 4 percent dividend yield.

GORO is a mining company engaged in the exploration of precious and base metal properties. It is a producer of metal concentrates that contain gold, silver, copper, lead and zinc. The company has 100% interest in six potential high-grade gold and silver properties at its producing Oaxaca, Mexico Mining Unit and exploration properties at its Nevada, the United States, Mining Unit. Its flagship project is the El Aguila Project, where the La Arista underground polymetallic deposit is in production. The La Arista deposit produces gold and silver, as well as the base metals copper, lead and zinc. The mill production totaled approximately 83,903 ounces of precious metal gold equivalent from the La Arista mine. The El Aguila Project comprises 17 mining concessions aggregating to approximately 30,074 hectares. The company’s mineral properties are classified into two categories: Operating Properties and Exploration Properties.

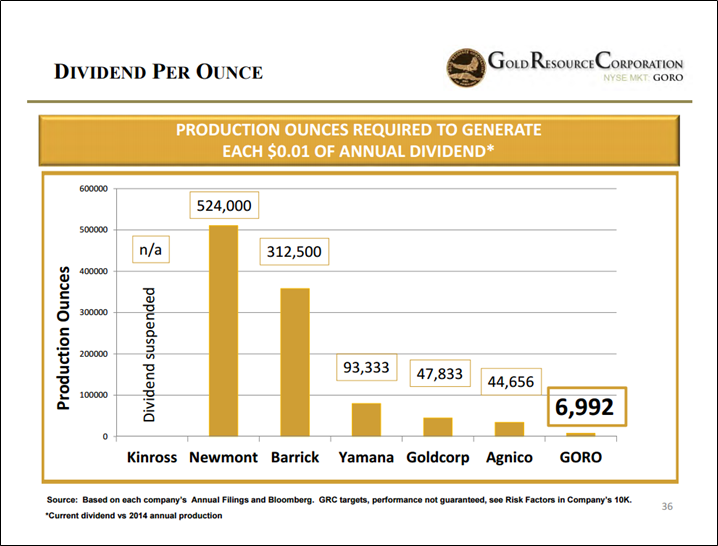

It’s also one of the most efficient gold miners in the industry, as this slide from the investor presentation demonstrates.

Hedge fund manager, deep value, gold and precious metals long/short investor Regal Point Capital explains:

Getting back to the dividend, (what we ACTUALLY get paid) let’s see if our confidence is warranted. In other words, how many tons of ore (valuable dirt and rocks) does GORO have to dig out of the ground in order to pay and/or sustain that dividend?

As you can see from the chart above, some of the largest precious metals mining companies must produce hundreds of thousands of ounces of ore to generate just a penny of annual dividend. Even the more efficient producers still need to produce tens of thousands of ounces of ore to support that same one penny of annualized dividend. Fortunately for us, GORO only needs to produce a small fraction of that.

As a fiduciary, I learned early on that Rule #1 is: Don’t Lose Money…And we all know what Rule #2 is. That is what inspired me to take a field trip over to southern Mexico so I could actually see the shiny rocks for myself. I was fortunate enough to be able to tour GORO’s mining operations up close and personal. Guys, the rocks are there and they are very shiny! Many have forgotten that it wasn’t too long ago that GORO was able to pay a dividend of $0.06/share and we expect that milestone to be re-achieved sooner than later. This dividend growth potential stems from growing margins, increasing production, and especially from the potential for higher precious metals prices. Most importantly, a strong and sustainable dividend program is EXTREMELY important to management which GORO’s actions have shown over the past few years.

Regal Point Capital also has an open letter to the board calling for a buyback.

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: