This week’s best investing news: Howard Marks Memo – 2023 In Review (OakTree) Ray Dalio – To Answer the Question of Why I Invest in China (Linkedin) The Overlooked Strategy of Dividend Growth Investing (Validea) Cliff Asness – Timely & Timeless Investment Wisdom (Meb Faber) Guy Spier & Monhish Pabrai: … Read More

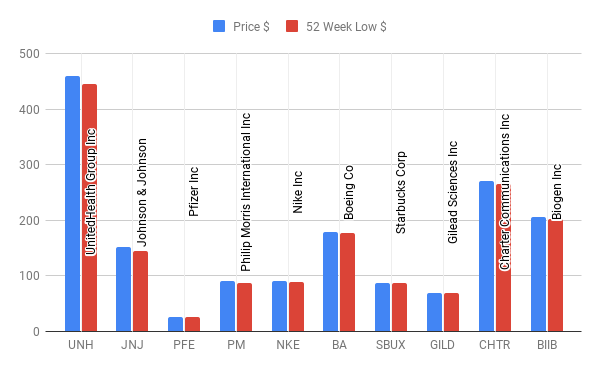

10 Big-Name Stocks Near 52-Week Lows: Are They A Buy?

Over the past twelve months a number of big named companies have been near or below their 52 week low price. Each week we’ll take a look at some of the biggest names currently close to their 52 week lows: Symbol Name Price $ 52 Week Low $ UNH UnitedHealth … Read More

Why Alphabet Inc (GOOGL) Stock Is A Buy? Acquirer’s Multiple Stock Screener Analysis

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: Alphabet Inc (GOOGL) Alphabet is a holding company. Internet media giant … Read More

Can Physics Explain Markets? A Look at EMH Through Four Forces

During their recent episode, Taylor, Carlisle, and Katsenelson discussed Can Physics Explain Markets? A Look at EMH Through Four Forces, here’s an excerpt from the episode: Tobias: What do you think, JT? You want to sneak in some vegetables before the top of the hour? There’s lots of demands for … Read More

Warren Buffett: Holding Onto Losers? Berkshire Hathaway’s Retention Strategy

In his 2011 Berkshire Hathaway Annual Letter, Warren Buffett explains why Berkshire keeps some of its underperforming businesses. The company believes in honoring its commitment to the sellers and doesn’t sell unless the business has a cash drain or labor problems. This approach may not be optimal in the short … Read More

Howard Marks: Building a Resilient Portfolio: The Art of True Diversification

In this interview with 3 Takeaways, Howard Marks discusses the different types of diversification in investing. Ideally, these investments should react differently to various situations. For example, having many stocks in companies that all rely on China is not true diversification. True diversification is a trade-off between risk and reward. … Read More

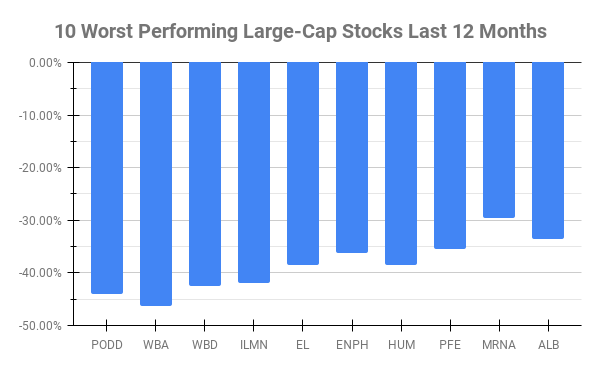

Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers Over The Past 12 Months

Over the past twelve months ten Large-Cap stocks have underperformed all others. Large-Caps are defined by $10 Billion Market Cap or more. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Symbol Name 1 Year Price Returns (Daily) PODD Insulet Corp -43.95% WBA Walgreens Boots Alliance … Read More

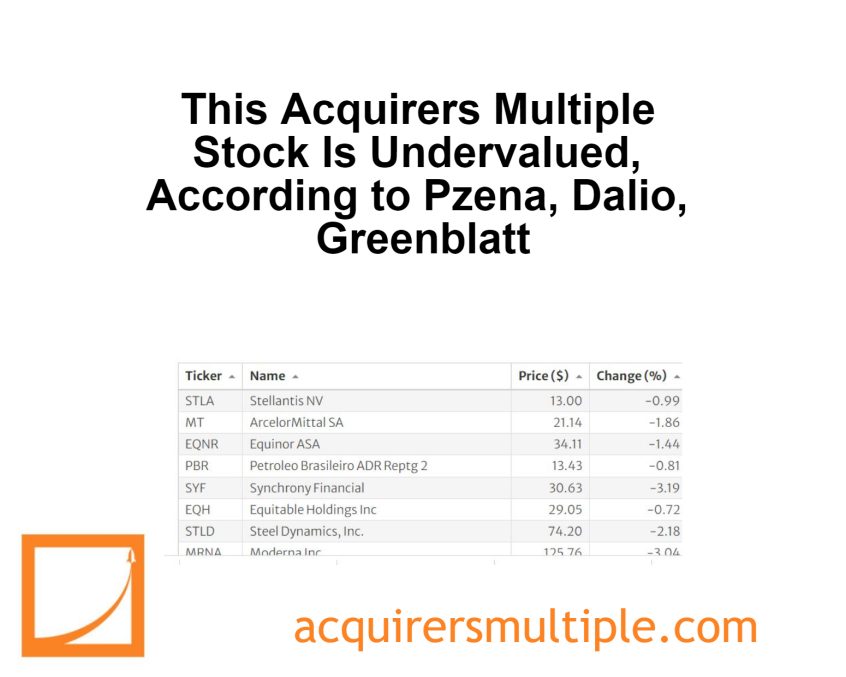

This Acquirers Multiple Stock Is Undervalued, According to Pzena, Dalio, Greenblatt

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

How Social Media Creates a Global FOMO Frenzy

During their recent episode, Taylor, Carlisle, and Katsenelson discussed How Social Media Creates a Global FOMO Frenzy, here’s an excerpt from the episode: Jake: Buffett did say in his last letter like, that he thinks today has more of a speculative element to the market, like more of a gambling … Read More

Jamie Dimon: Reduce Risk, Maximize Gains: The Art of Investment Decision-Making

In his latest letter to shareholders, Jamie Dimon discusses the importance of decision-making and taking action. He highlights the need to find a balance between careful consideration and taking initiative. Dimon says that some decisions require thoroughness while others are better suited for a quicker approach. He also addresses the … Read More

Howard Marks: 2024 Market Rollercoaster: Prepare for the Unexpected!

In his latest memo titled ‘2023 in Review’, Howard Marks argues that the future is uncertain, especially in economics and investing. Most experts are unsure about what will happen with the economy, interest rates, and geopolitical events. This uncertainty is a good thing, because it means people are acknowledging they … Read More

The One Stock That Superinvestors Are Dumping: Is It Time to Sell?

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

Tesla’s Future: Beyond the Hype: A Look at Battery Tech and Infrastructure

During their recent episode, Taylor, Carlisle, and Katsenelson discussed Tesla’s Future: Beyond the Hype: A Look at Battery Tech and Infrastructure, here’s an excerpt from the episode: Tobias: Vitaliy, can we talk about Tesla for a little bit, because I know that you did a write up about Tesla. Tesla … Read More

Warren Buffett: The Role of Consumer Loyalty and Emotional Connections in Investing

During the 2018 Berkshire Hathaway Annual Meeting, Warren Buffett discusses the importance of investing in companies that create products that engender positive emotional responses (like getting a kiss for giving See’s Candy) versus negative ones. Using Apple’s ecosystem led by the iPhone as an example of such an investment. The … Read More

Bill Nygren: How To Avoid Value Traps

In this interview with John Rotonti, Bill Nygren defines a value trap as a company that looks cheap (low multiples) but won’t actually become more valuable over time, typically due to structural problems. To avoid these, Nygren’s firm requires analysts to project future growth and only buy stocks with strong … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

The Danger of One-Decision Stocks

During their latest episode of the VALUE: After Hours Podcast, Carlisle, Taylor, and Vitaliy Katsenelson discussed The Danger of One-Decision Stocks. Here’s an excerpt from the episode: Tobias: I was at an Easter lunch over the weekend, and one of the guys, they said, “I’ve traded three crypto cycles.” We’re … Read More

Cliff Asness: Today’s Market Is Less Efficient Than Ever Before

In this interview with Meb Faber, Cliff Asness argues that the market has become less efficient despite advancements in technology and information access. He believes the abundance of information can lead to overconfidence and create situations like the meme stock craze. He proposes that the ease of communication can turn … Read More

Ray Dalio: China Investing: A Proven Path to Success in Bull & Bear Markets

In his latest article titled ‘To Answer the Question of Why I Invest in China’, Ray Dalio explains why he invests in China: Experience and Success: He has a long history of successful investing in China, and believes his approach can handle both good and bad markets Love for China: … Read More

Michael Burry – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More