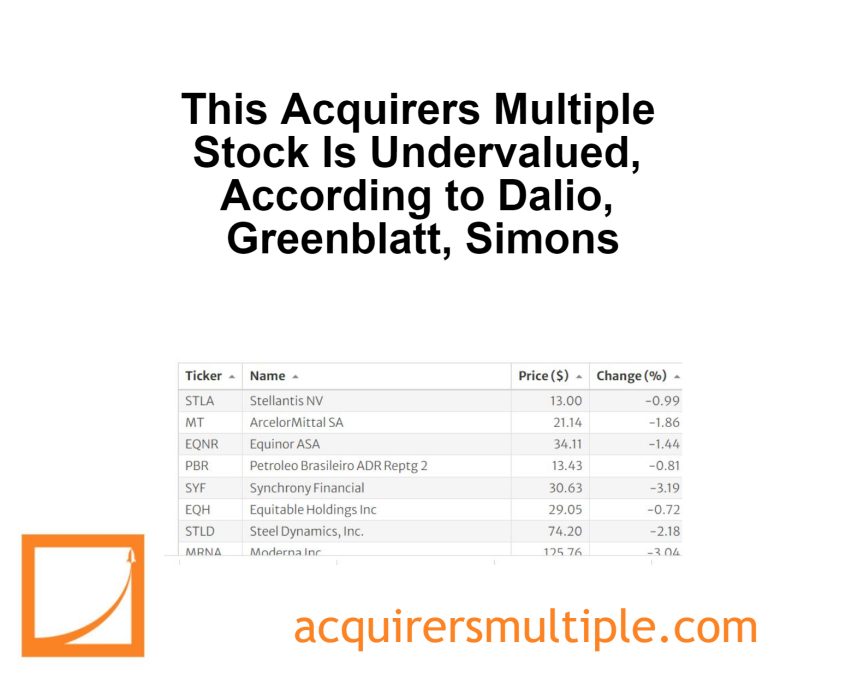

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, and Howard Marks. The top investor data is provided from their latest 13F’s. This week we’ll take a look at:

3M Co (MMM)

3M is a multinational conglomerate that has operated since 1902, when it was known as Minnesota Mining and Manufacturing. The company is well known for its research and development laboratory and it leverages its science and technology across multiple product categories. As of 2020, 3M is organized into four business segments: safety and industrial, transportation and electronics, healthcare, and consumer. Nearly 50% of the company’s revenue comes from outside the Americas, with the safety and industrial segment constituting a plurality of net sales. Many of the company’s 60,000-plus products touch and concern a variety of consumers and end markets.

A quick look at the price chart below shows us that the stock is up 2.10% in the past twelve months. We currently have the stock trading on an Acquirer’s Multiple of 12.30 which means that it remains undervalued.

(Shares)

Cliff Asness – 1,426,422

Steve Cohen – 1,378,840

Ken Griffin – 965,648

Jim Simons – 800,800

Tom Gayner – 293,750

Ray Dalio – 135,930

Joel Greenblatt – 50,637

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: