Earlier this month The Washington Post published an article titled – Warren Buffett’s $100 Billion Problem. The article was reporting on the $100 Billion that Berkshire has accumulated in cash over the years, stating: Warren Buffett celebrated his 87th birthday a few days ago, but the bigger number in his life … Read More

Great Investors Create Their Own Version Of Omaha – Buffett, Munger, Klarman, Pabrai

One of the biggest problems facing investors is the amount of ‘noise’ that we get from the financial media and commentators. Financial news sections, the internet, and podcasts are continually bombarding us with the latest ‘hot stock’ or miracle investing strategy. Meanwhile investors get caught up in the noise checking … Read More

The Definitive Guide On Identifying Companies With An Economic Moat – Warren Buffett

With so much talk about a company’s economic moat it’s important to recognize how to clearly identify a moat, understand how wide it is, and figure out how long it will remain in place. One of the best papers ever written on the subject is Michael Mauboussin’s – Measuring the … Read More

How Does Warren Buffett Stay At The Top Of His Game

So it appears that if you want to best investor in the world you have to have a few quirks. As you can see from this video on CNBC: However, while he may be a little quirky that’s not the main reason that sets him apart from other great investors … Read More

Here’s How Charlie And Warren Calculate Intrinsic Value Differently To Everyone Else

One of the biggest problems facing investors is the calculation of intrinsic value. There has been much written about the correct way to calculate intrinsic value but one of the best explanations can be found in the book Charlie Munger: The Complete Investor, by Tren Griffin. The book provides the essential … Read More

Buffett Nears a Milestone He Doesn’t Want: $100 Billion in Cash

One of our favorite investors here at The Acquirer’s Multiple is of course Warren Buffett. This week Bloomberg reported that Buffett’s Berkshire Hathaway is sitting on $100 Billion at the end of its second quarter. The question is, what he is going to do with it? Here’s an excerpt from … Read More

Henry Singleton – (“The Best Capital Deployment Record In American Business” – Warren Buffett)

One of my favorite investing books is The Outsiders: Eight Unconventional CEOs and Their Radically Rational Blueprint for Success, by William N. Thorndike. In fact it’s also the top choice on Warren Buffett’s reading list. The book provides stories on eight of the most successful CEOs in history who were great capital allocators. … Read More

Warren Buffett – How To Become An Intelligent Investor

The Berkshire Hathaway letters are one of the most valuable resources for value investors. One of my favorite letters is the 1996 letter in which Buffett provides some principles for becoming an intelligent investor. It provides some great insights into the types of businesses you should search for, how to … Read More

Just How Did Warren Buffett Make A Quick $12 Billion On Bank Of America

CNBC recently announced that Warren Buffett just made a quick $12 billion on a clever Bank of America investment. Because of an astute investment made in Bank of America six years ago while the bank was struggling, Warren Buffett is about to make a quick $12 billion and become the … Read More

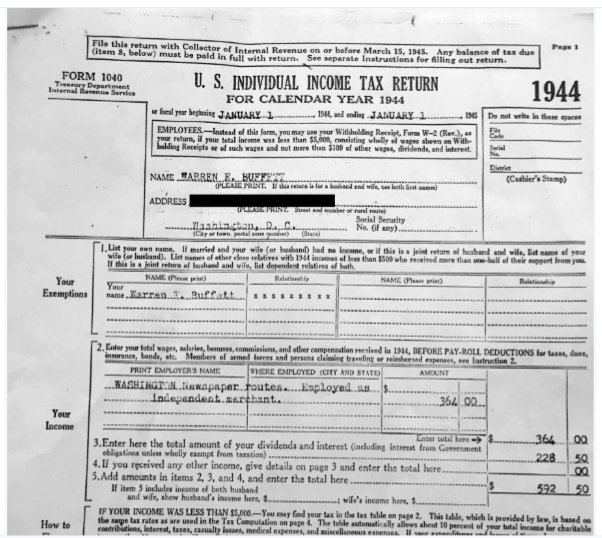

Here is Warren Buffett’s First Tax Return From 1944 (Age 14)

PBS Newshour recently released a copy of Warren Buffett’s first tax return which he filed in 1944 at the age of 14. When Buffett arrived for his PBS NewsHour interview with Judy Woodruff, he pulled out his first tax return while he was in the makeup chair. Buffett’s income in … Read More

How To Develop A Superinvestor Mindset Like Buffett, Munger, Neff, Loeb, Lynch and Soros

One of my favorite investing books is How To Think Like Benjamin Graham and Invest Like Warren Buffett, by Lawrence A Cunningham. One of the best pieces in the book looks at the principles applied by some of the greatest superinvestors of all time. Here’s an excerpt from the book: The … Read More

How Warren Buffett Turned $10.6 Million Into $221 Million While Others Were Embracing The EMT

As a value investor it is important that you read every word of every letter ever written by Warren Buffett in his Berkshire Hathaway Shareholder Letters. One great example of what you can learn comes from his 1985 Chairman’s letter in which he discusses his intrinsic value calculation of The … Read More

The Investment Strategy Pioneered By Warren Buffett Is In Crisis (CNBC)

CNBC reports that Warren Buffett’s value investing long/short strategy generated a 15 percent cumulative loss in the past decade and negative returns in 6 out of the last 10 years, according to Goldman Sachs. Before that, the value strategy had a successful run of more than 70 years. Here’s an … Read More

Warren Buffett: Berkshire Hathaway Has An Unprecedented $100 Billion In Cash, Here’s Why

Great article by Jeff Nielson at sprottmoney.com that highlights Buffett’s equity portfolio is valued at $135 billion. With $100 billion in cash, that means more than a 40% cash component, an unprecedented mountain of cash in the history of Berkshire Hathaway. The question is why? Here’s an excerpt from that article:

Warren Buffett: Classic Investing Wisdom From The Man Who Was Rejected By Harvard & Initially By Ben Graham

One of the best Buffett interviews was one he did with Economic Club President David M. Rubenstein, honoring the 25th Anniversary of The Economic Club of Washington, D.C.. This is classic Buffett, filled with humor and loads of investing nuggets:

Warren Buffett: It’s A Huge Bargain To Buy Stocks Now If Interest Rates Stay Where They Are, Here’s Why

In a recent CNBC interview Warren Buffett said, “The most important item, over time, in valuation is interest rates”. He added, “It’s a huge bargain to buy stocks now if you knew interest rates would stay at this level”. In terms of investing in bonds Buffett said, “Anybody that prefers … Read More

1300 Miles From Wall Street – Warren Buffett, Todd Combs, and Ted Weschler

Warren Buffet, Todd Combs and Ted Weschler of Berkshire Hathaway recently did an interview in Omaha, 1300 Miles from the hustle and bustle of Wall Street. In this interview Buffett discusses why he and Munger chose Combs and Weschler for their positions at Berkshire. The three also discuss what it’s like … Read More

Warren Buffett: Berkshire’s Earnings Aided By America’s Economic Dynamism

One our favorite investors here at The Acquirer’s Multiple – Stock Screener is of course Warren Buffett. One of the best resources for investors is Berkshire Hathaway’s Annual Reports and the associated Chairman’s Letters which are are full of investing nuggets. Berkshire’s recently released 2016 Annual Report provides lots of great … Read More

Warren Buffett – Wall Street Makes Billions From Wealthy Investors With A ‘Superiority Complex’

(Image Source, Huffington Post, http://www.huffingtonpost.com/john-g-taft/the-warren-buffett-effect_b_5577685.html, [Accessed 8 Mar, 2017]) One of our favorite investors at The Acquirer’s Multiple – Stock Screener is Warren Buffett, and one of the best resources for any investor are the Berkshire Hathaway Inc. Shareholder Letters. In his 2016 letter Buffett explains how Wall Street firms generate … Read More

Warren Buffett – Bubbles Happen When Price Action Overtakes Common Sense

(Image Source, Huffington Post, http://www.huffingtonpost.com/john-g-taft/the-warren-buffett-effect_b_5577685.html, [Accessed 7 Mar, 2017]) One of our favorite investors at The Acquirer’s Multiple – Stock Screener is Warren Buffett. I recently re-read an awesome interview that Buffett did with the Financial Crisis Inquiry Commission back in 2010, where the commission was charged with the task of understanding … Read More