In his book Investing for Growth, Terry Smith makes a simple but powerful point about what makes a great business: “A good company is one which creates value for its shareholders by making a high return on capital – significantly above its cost of capital – across the business and … Read More

VALUE: After Hours (S07 E12): Buyout and venture capital investing in Japan and China: Our trip to Tokyo and Shanghai

In their latest episode of the VALUE: After Hours Podcast, Tobias Carlisle, Jake Taylor discuss: Reflections on Japan: Investing Culture & Net-Nets Capital Allocation & Tokyo Stock Exchange Reforms Buyout Firms in Japan: An Undervalued Opportunity Long-Only and Activist Investors in Japan Cultural Philosophy & Long-Term Thinking Transition to Shanghai: … Read More

Howard Marks: Tariffs, Turmoil, and Where to Find Opportunities

Howard Marks’ latest memo, “Nobody Knows (Yet Again),” is a stark reminder of how unpredictable the world—especially the economy—can be. Drawing parallels to the 2008 financial crisis and the COVID-19 pandemic, Marks emphasizes that certainty is a luxury we rarely have, especially during upheavals. “There’s absolutely no place for certainty … Read More

Howard Marks: Why Do Investors Repeatedly Make The Same Mistakes?

Howard Marks has long warned of the dangers of short memories in finance. In his memo Hindsight First, Please (or, What Were They Thinking?), he underscores how easily investors repeat mistakes by ignoring history. As Marks puts it, quoting John Kenneth Galbraith, “the extreme brevity of the financial memory” is … Read More

Terry Smith: Key Lessons from Fundsmith’s Latest Annual Meeting

Terry Smith’s latest shareholder meeting offered a refreshing dose of straight talk for investors. His candid reflections cut through the usual market noise and provided some lessons worth remembering. Even top performers have off years, as Smith openly admitted when discussing Fundsmith’s recent performance: “Last year wasn’t our finest hour. … Read More

Mohnish Pabrai Explains Why Most Investors Should Stick with Index Funds

If you’ve ever wondered whether you should stick with index funds or try picking a few individual stocks, Mohnish Pabrai has some thoughts—and they’re worth listening to. In his book Mosaic: Perspectives on Investing, Pabrai dives into this debate with the help of some wisdom from Warren Buffett and Charlie … Read More

Warren Buffett: Why Concentration Beats Diversification

In his 1993 Berkshire Hathaway Annual Letter, Warren Buffett explained how he and Charlie Munger figured out early that trying to make dozens of brilliant investment decisions is a losing battle. As Buffett puts it, “Charlie and I decided long ago that in an investment lifetime, it’s just too hard … Read More

François Rochon: The Optimal Portfolio Strategy

In a recent interview with The Investor’s Podcast, one of my favorite value investors, François Rochon from Giverny Capital, shared some straightforward advice about building a smart investment portfolio. His main takeaway? Owning between 20 to 25 high-quality stocks gives you the right mix of diversification and concentration for long-term … Read More

Mohnish Pabrai: How To Identify Bullet-Proof Businesses

Capitalism isn’t just competitive—it’s downright ruthless. Most businesses don’t just struggle to turn a profit; they vanish entirely within a few decades. As Mohnish Pabrai explained in this interview, “Most businesses are not going to be around… forget even making a lot of money or not making money—they’re not even … Read More

Warren Buffett: The Problem With Today’s ‘Electronic Herd’

The stock market today feels like it’s running on caffeine – jittery, reactive, and prone to wild mood swings. Warren Buffett saw this coming way back in 2007 during the Berkshire Hathaway annual meeting when he described what’s fundamentally changed in markets. “There is an electronic herd of people around … Read More

Jim Chanos: How Passive Investing Broke Capitalism’s Signaling Mechanism

In a recent interview with Bloomberg, legendary short-seller Jim Chanos delivered a sobering assessment of today’s financial markets, warning investors about unchecked speculation, political volatility, and the hidden dangers of disruptive technologies like AI. Known for his skepticism, Chanos cautioned that the current environment resembles past bubbles—where promises overshadow reality—and … Read More

One Stock Superinvestors Are Dumping: Is It Time to Sell?

As part of the weekly research here at The Acquirer’s Multiple, we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13Fs. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray … Read More

One Stock Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple, we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13Fs. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Prem Watsa, Jeremy Grantham, Seth Klarman, … Read More

Michael Burry’s High-Conviction Bets: 50%+ of His Portfolio in 4 Stocks

Michael Burry, the legendary investor known for predicting the 2008 financial crisis, has concentrated a significant portion of his portfolio in four major holdings. His top position is Alibaba Group Holding Ltd (BABA), with 150,000 shares valued at $12.72 million, making up 16.42% of his portfolio. Alibaba, a Chinese e-commerce … Read More

Weekly Investing Roundup – News, Podcasts, Interviews (03/14/2025)

This week’s best investing news: Howard Marks – Unlocking Investment Wisdom (Money Maze) Ray Dalio: The U.S. government’s debt problem will lead to ‘shocking developments’ (CNBC) Bill Nygren – A Modern Approach to Value Investing (FinChat) GMO: Trade: The Most Beautiful Word In The Dictionary (GMO) The Last Lecture of … Read More

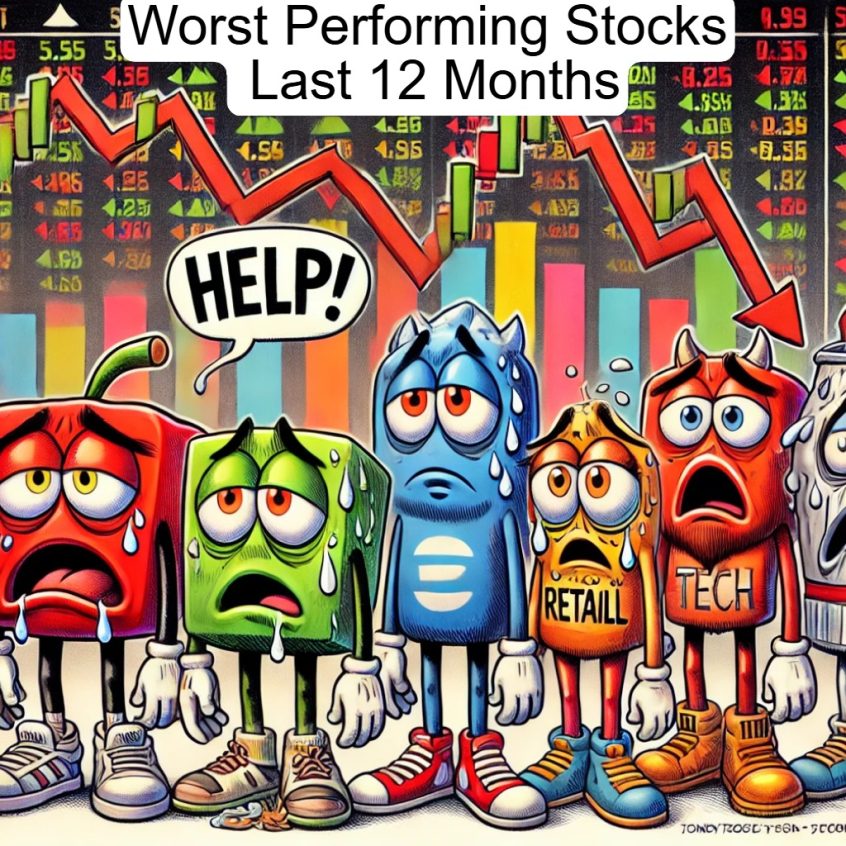

10 Worst Performing Large-Caps Last 12 Months

Over the past twelve months ten Large-Cap stocks have underperformed all others. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Name 1 Year Price Returns (Daily) Moderna (MRNA) -69.43% Celanese (CE) -64.61% Super Micro Computer (SMCI) -64.45% Intel (INTC) -55.10% Estee Lauder Companies (EL) -53.65% … Read More

Stock Market Returns: Five-Factor Analysis and What Lies Ahead

In their latest episode of the VALUE: After Hours Podcast, Tobias Carlisle, Jake Taylor, and John Rotonti Jr discussed Stock Market Returns: Five-Factor Analysis and What Lies Ahead: Tobias: JT, you want to do- John: Veggies. Tobias -veggies? Jake: Veggies time. Absolutely. Tobias: Market boys, six minutes past the hour. … Read More

Berkshire’s Role in America’s Future and Financial Strength

In their latest episode of the VALUE: After Hours Podcast, Tobias Carlisle, Jake Taylor, and John Rotonti Jr discussed, Berkshire’s Role in America’s Future and Financial Strength: John: I’ll just say, I think the messaging was similar to 2023. So, in 2023, he actually said, “Berkshire will remain an asset to … Read More

Warren Buffett: Investing Without Hurdle Rates

At the 2007 Berkshire Hathaway Annual Meeting, Buffett addressed a topic that confounds many investors: discount rates and hurdle rates. Unlike Wall Street analysts who obsess over these metrics, Buffett made it clear that he and Charlie Munger don’t operate that way. “We don’t formally have discount rates,” he said. … Read More

Mohnish Pabrai: Let Your Portfolio Naturally Skew into Larger Positions

If you’re like me, one of the things I spend a lot of time thinking about is how many stocks to hold and how big my positions should be. That’s why I found this interview with Mohnish Pabrai on MOI Global particularly interesting. Instead of diversifying widely across companies, Pabrai … Read More