Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

The One Stock That Superinvestors Are Dumping: Is It Time to Sell?

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Berkshire Hathaway Inc (BRK.B) DCF Valuation: Is The Stock Undervalued?

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, Berkshire Hathaway Inc (BRK.B). Profile Berkshire Hathaway is a … Read More

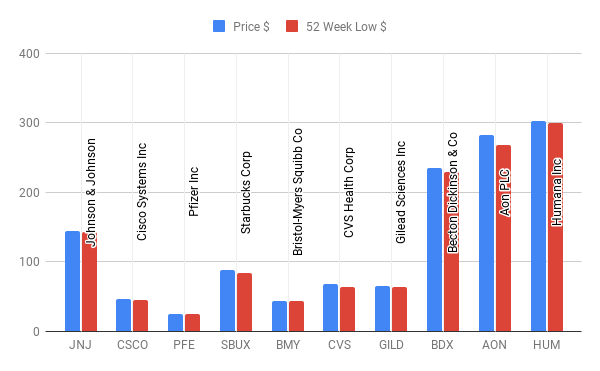

10 Big-Name Stocks Near 52-Week Lows: Are They A Buy?

Over the past twelve months a number of big named companies have been near or below their 52 week low price. Each week we’ll take a look at some of the biggest names currently close to their 52 week lows: Symbol Name Price $ 52 Week Low $ JNJ Johnson … Read More

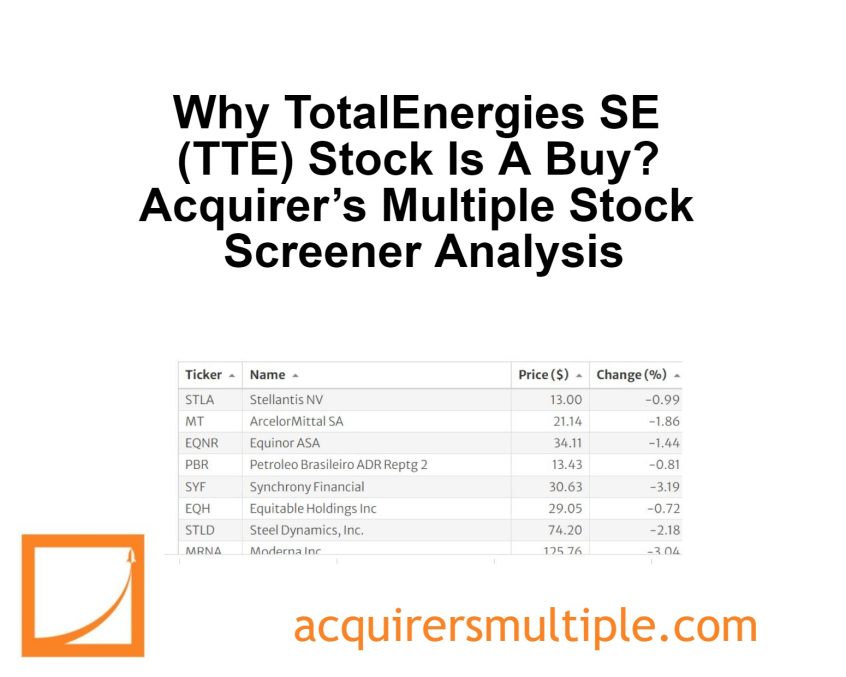

Why TotalEnergies SE (TTE) Stock Is A Buy? Acquirer’s Multiple Stock Screener Analysis

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: TotalEnergies SE (TTE) TotalEnergies is an integrated oil and gas company … Read More

Mohnish Pabrai: The Young Investors Edge: Spotting The Next 50 Bagger

In this interview with MIT’s Brass Rat Investments, Mohnish Pabrai explains why young people have a distinct advantage in identifying emerging trends and investment opportunities due to their proximity to cultural and technological shifts. He highlights historical examples, like the rapid decline of landlines first observed among college students and … Read More

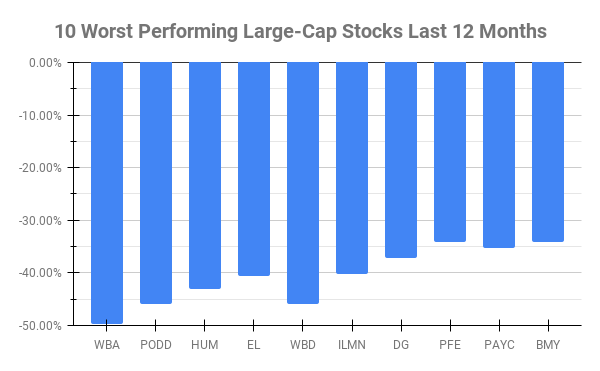

Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers Over The Past 12 Months

Over the past twelve months ten Large-Cap stocks have underperformed all others. Large-Caps are defined by $10 Billion Market Cap or more. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Symbol Name 1 Year Price Returns (Daily) WBA Walgreens Boots Alliance Inc -49.70% PODD Insulet … Read More

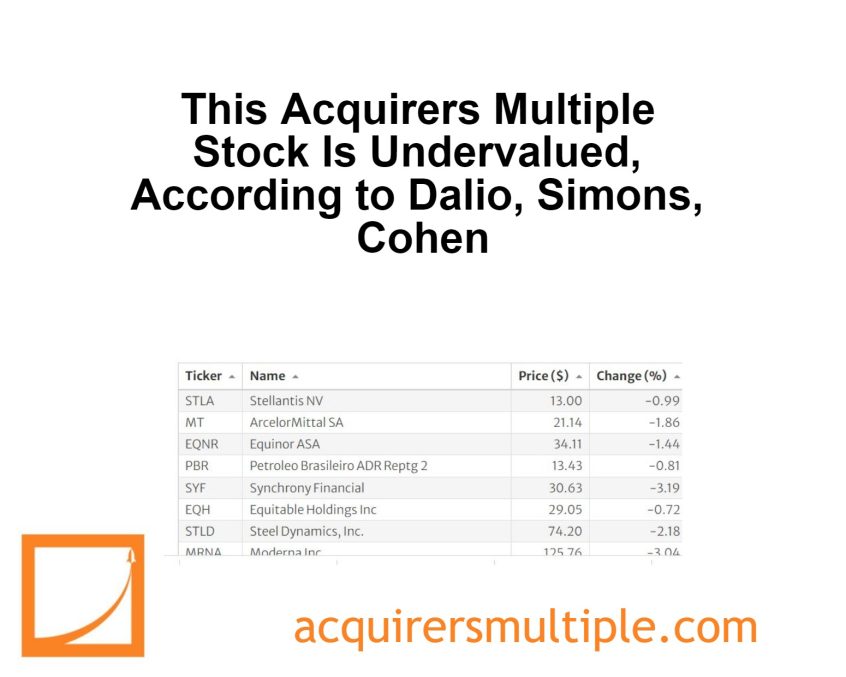

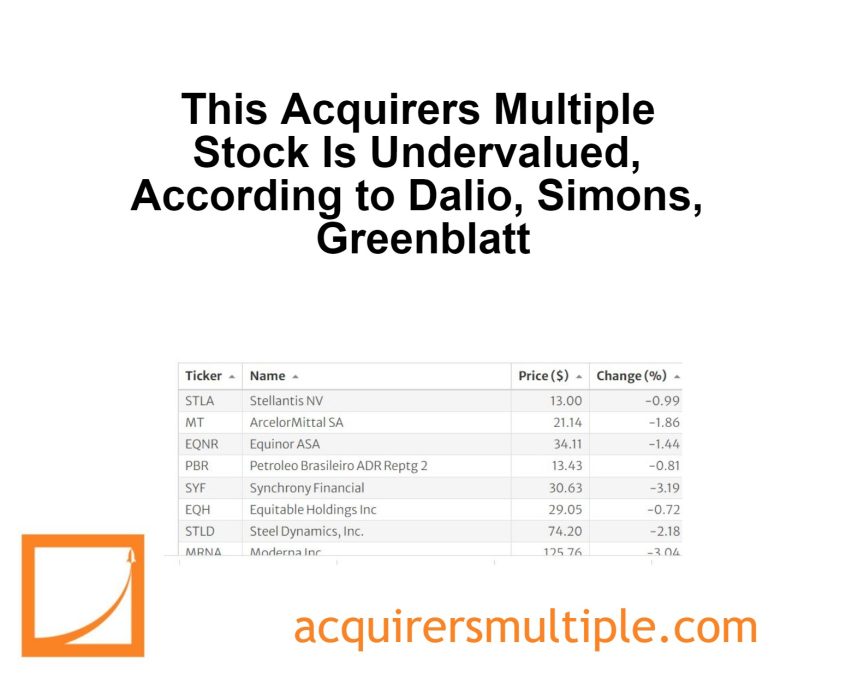

This Acquirers Multiple Stock Is Undervalued, According to Dalio, Simons, Greenblatt

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

The One Stock That Superinvestors Are Dumping: Is It Time to Sell?

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Amazon.com Inc (AMZN) DCF Valuation: Is The Stock Undervalued?

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, Amazon.com Inc (AMZN). Profile Amazon is a leading online … Read More

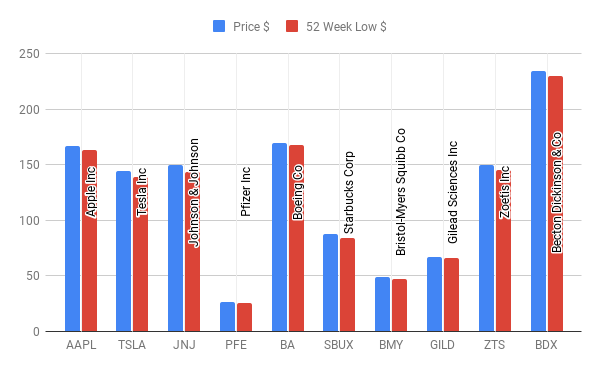

10 Big-Name Stocks Near 52-Week Lows: Are They A Buy?

Over the past twelve months a number of big named companies have been near or below their 52 week low price. Each week we’ll take a look at some of the biggest names currently close to their 52 week lows: Symbol Name Price $ 52 Week Low $ AAPL Apple … Read More

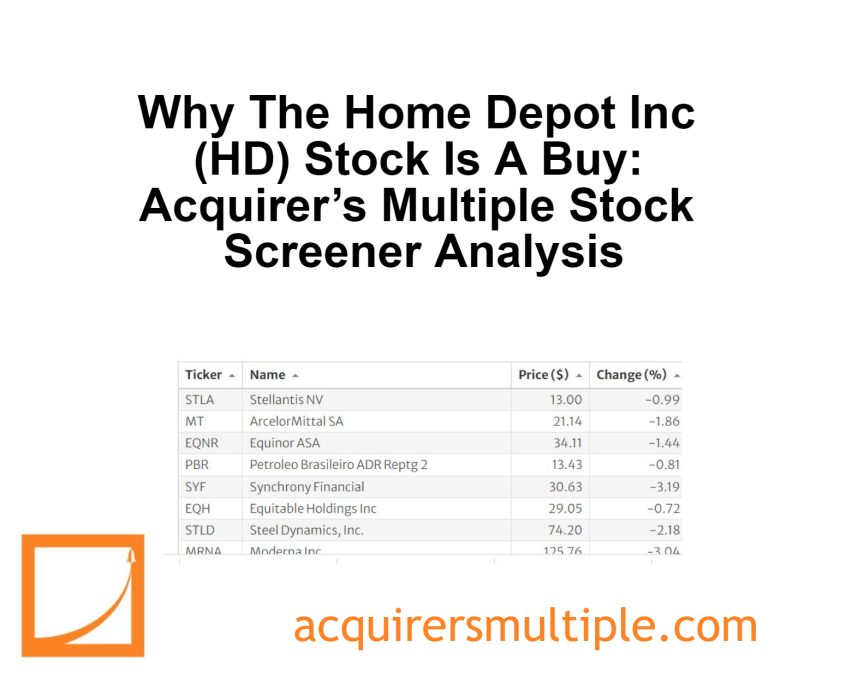

Why The Home Depot Inc (HD) Stock Is A Buy? Acquirer’s Multiple Stock Screener Analysis

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: The Home Depot Inc (HD) Home Depot is the world’s largest … Read More

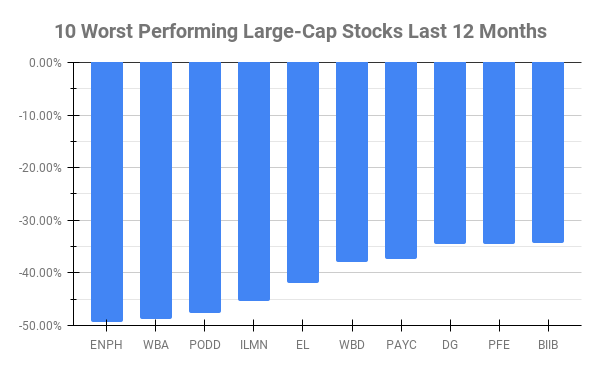

Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers Over The Past 12 Months

Over the past twelve months ten Large-Cap stocks have underperformed all others. Large-Caps are defined by $10 Billion Market Cap or more. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Symbol Name 1 Year Price Returns (Daily) ENPH Enphase Energy Inc -49.25% WBA Walgreens Boots … Read More

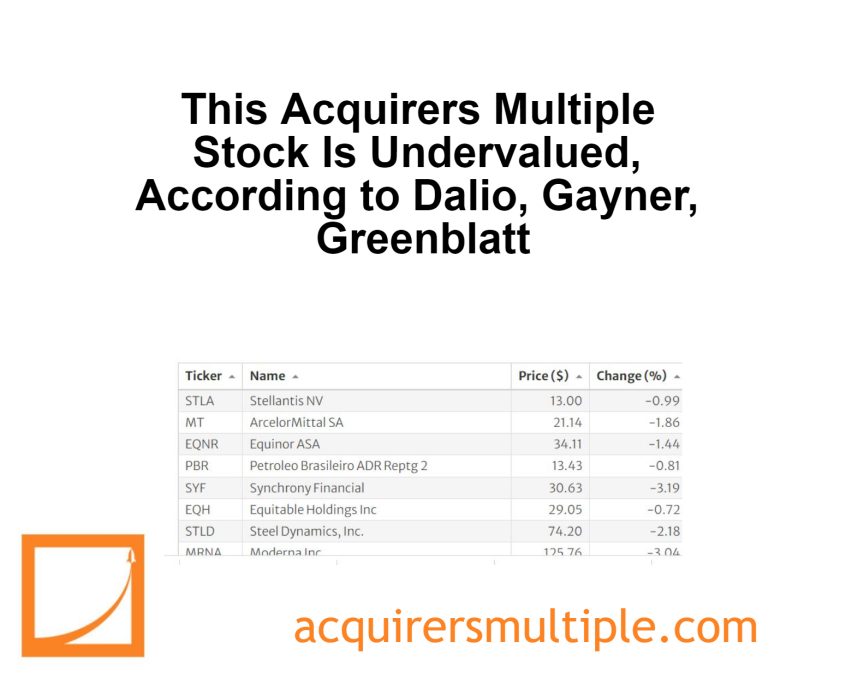

This Acquirers Multiple Stock Is Undervalued, According to Dalio, Gayner, Greenblatt

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

The One Stock That Superinvestors Are Dumping: Is It Time to Sell?

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

Mohnish Pabrai: Low-Risk High-Reward Investing

In his book The Dhandho Investor, Mohnish Pabrai discusses a strategic investment approach likened to pari-mutuel horse race betting, where success hinges on identifying mispriced opportunities that offer high rewards for minimal risk. Papa Patel’s minimal risk motel venture and professional racetrack bettors who profit by selectively betting on undervalued horses … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Ray Dalio – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More