Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, and … Read More

Great Opportunities In REITs

During their recent episode, Taylor, Carlisle, and Tim Travis discussed Great Opportunities In REITs. Here’s an excerpt from the episode: Tobias: In other areas, you were talking about REITs a little bit before we came on. Do you want to give us your thoughts on REITs? Tim: Yeah. So, REITs … Read More

Warren Buffett: Only 5-10% of Companies Fall Within My Circle of Competence

In this interview with Yahoo Finance, Warren Buffett reflects on his admiration for Jeff Bezos, praising his visionary execution in transforming Amazon from a bookseller to a massive enterprise. Buffett acknowledges that certain innovations, like Microsoft or Netscape, fall outside his “circle of competence,” so he doesn’t regret missing them. … Read More

The One Stock That Superinvestors Are Dumping: Is It Time to Sell?

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray … Read More

Why Investment-Grade Bonds Offer an Attractive Hedge

During their recent episode, Taylor, Carlisle, and Tim Travis discussed Why Investment-Grade Bonds Offer an Attractive Hedge. Here’s an excerpt from the episode: Tim: It’s hard. I don’t know. Whenever I buy puts as a hedge or something like that, which isn’t very likely or maybe I’ll have a client … Read More

Warren Buffett: Investors Must Consider Stocks as Businesses, Not Speculations

In this interview with CNBC, Warren Buffett emphasizes the long-term perspective in investing, comparing stock investments to purchasing businesses, farms, or real estate. Using an example from 1932, he notes that General Motors had 19,000 dealers but sold only a fraction of a car per dealer during tough times, which … Read More

Howard Marks: Misconceptions of Risk in Investing

During his recent interview with Barron’s, Howard Marks highlights a key misconception about risk: many attempt to quantify it using formulas, typically relying on volatility or standard deviation as proxies. However, he argues that these metrics fail to reflect the true nature of risk, which is the possibility of an … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Prem Watsa, Jeremy Grantham, Seth Klarman, … Read More

Why Buffett Slashed His Apple Stake

During their recent episode, Taylor, Carlisle, and Tim Travis discussed Why Buffett Slashed His Apple Stake. Here’s an excerpt from the episode: Tobias: Tim, one of the things we were talking about– Well, Buffett has been selling Wells Fargo for quite a while. So, Wells Fargo has idiosyncratic problems that … Read More

Mohnish Pabrai: Munger – The Abominable No Man: Avoiding Bad Investments

In this interview with UNO’s Maverick Investment Club, Mohnish Pabrai highlights the importance of Charlie Munger’s role as Warren Buffett’s trusted critic at Berkshire Hathaway. Known as “The Abominable No Man,” Munger often rejected Buffett’s investment ideas, providing a vital filter against poor decisions. Pabrai cites Berkshire’s problematic $20 billion … Read More

Lockheed Martin Corp (LMT) DCF Valuation: Is The Stock Undervalued?

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, Lockheed Martin Corp (LMT). Profile Lockheed Martin is the … Read More

Lowe’s Companies Inc (LOW): Is It a Buy? – Acquirer’s Multiple Stock Screener Analysis

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: Lowe’s Companies Inc (LOW) Lowe’s is the second-largest home improvement retailer … Read More

Howard Marks: The Secret to Achieving an Elite Investment Track Record

In this interview with Kiatnakin Phatra Wealth Management, Howard Marks explains why effective risk control is essential to achieving investment success, summarizing his philosophy as “if we avoid the losers, the winners take care of themselves.” Rather than seeking extraordinary gains, Marks focuses on maintaining consistent, good-quality investments, aspiring for … Read More

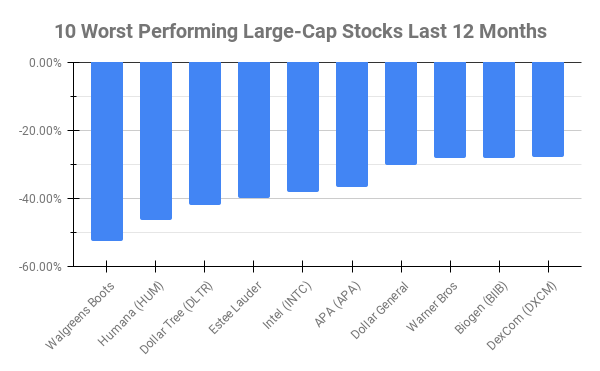

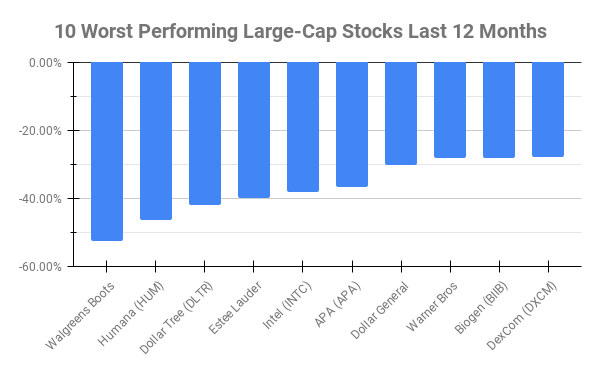

Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers Over The Past 12 Months

Over the past twelve months ten Large-Cap stocks have underperformed all others. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Name 1 Year Price Returns (Daily) Walgreens Boots Alliance (WBA) -51.34% Dollar Tree (DLTR) -46.16% Estee Lauder Companies (EL) -42.40% Humana (HUM) -42.15% Moderna (MRNA) … Read More

Which Superinvestors Hold Acquirer’s Multiple Stocks?

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, and … Read More

The One Stock That Superinvestors Are Dumping: Is It Time to Sell?

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Intuit Inc (INTU) DCF Valuation: Is The Stock Undervalued?

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, Intuit Inc (INTU). Profile Intuit is a provider of … Read More

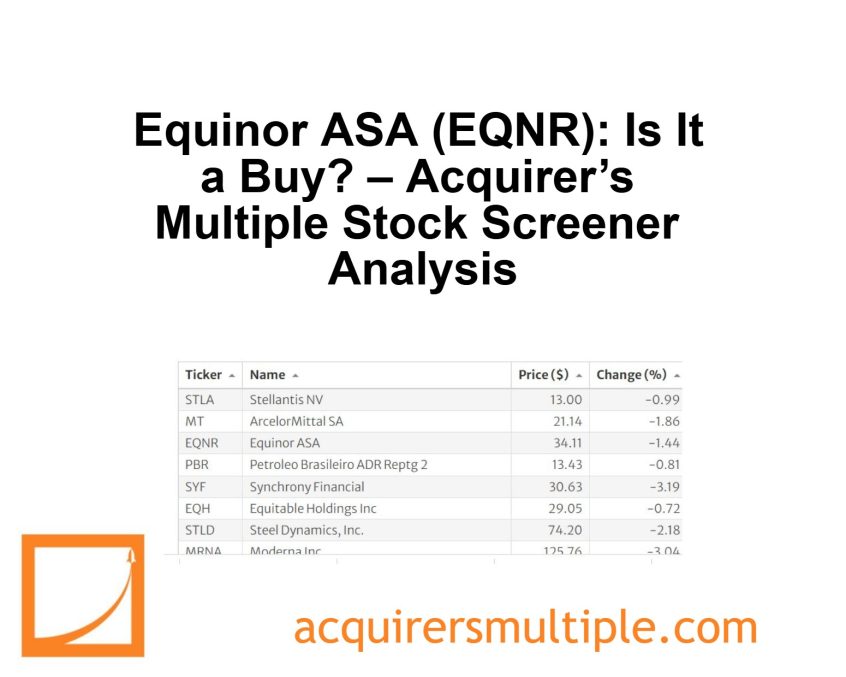

Equinor ASA (EQNR): Is It a Buy? – Acquirer’s Multiple Stock Screener Analysis

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: Equinor ASA (EQNR) Equinor is a Norway-based integrated oil and gas … Read More

Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers Over The Past 12 Months

Over the past twelve months ten Large-Cap stocks have underperformed all others. Large-Caps are defined by $10 Billion Market Cap or more. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Name 1 Year Price Returns (Daily) Walgreens Boots Alliance (WBA) -52.56% Humana (HUM) -46.38% Dollar … Read More