As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Warren Buffett: Beyond Logic: Why Markets Still Panic in the Digital Age

In a section titled Our Not-So-Secret Weapon in his latest Berkshire Hathaway Annual Letter, Warren Buffett explains how the stock market can still be irrational and prone to panics, regardless of the stability of investors or advancements in technology. His key takeaways include: Market volatility: Even good businesses can be … Read More

Meta Platforms Inc (META) DCF Valuation: Is The Stock Undervalued?

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, Meta Platforms Inc (META). Profile Meta is the world’s … Read More

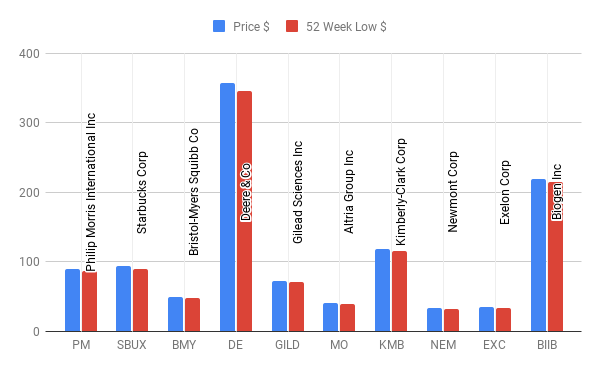

10 Big-Name Stocks Near 52-Week Lows: Are They A Buy?

Over the past twelve months a number of big named companies have been near or below their 52 week low price. Each week we’ll take a look at some of the biggest names currently close to their 52 week lows: Symbol Name Price $ 52 Week Low $ PM Philip … Read More

Why Cisco Systems Inc Stock Is A Buy? Acquirer’s Multiple Stock Screener Analysis

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: Cisco Systems Inc (CSCO) Cisco Systems is the largest provider of … Read More

Howard Marks: Memos: Most Investors Will Not Implement My Investing Secrets

In this interview with David Perrel, Howard Marks explains that while he gives away a lot of investing secrets in his memos, most investors still won’t be able to successfully implement them. He also discussed what it is that he likes about Warren Buffett’s annual shareholder letters. Here’s an excerpt … Read More

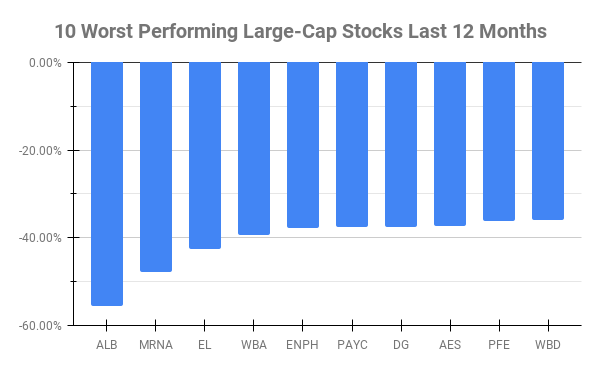

Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers Over The Past 12 Months

Over the past twelve months ten Large-Cap stocks have underperformed all others. Large-Caps are defined by $10 Billion Market Cap or more. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Symbol Name 1 Year Price Returns (Daily) ALB Albemarle Corp -55.50% MRNA Moderna Inc -47.77% … Read More

The One Stock That Superinvestors Are Dumping: Is It Time to Sell?

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Bruce Berkowitz: The FOMO Fallacy: Making Rational Decisions in a Hyped Market

In this interview with Richer, Wiser, Happier, Bruce Berkowitz explains how rampant market fervor, driven by envy and selective information, can be detrimental to rational investment decisions and mental well-being. He discusses how he found himself overwhelmed by the pressure and negativity associated with hype. He resorted to avoiding social … Read More

Procter & Gamble Co (PG) DCF Valuation: Is The Stock Undervalued?

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is currently in our screens, Procter & Gamble Co (PG). Profile Since its founding in … Read More

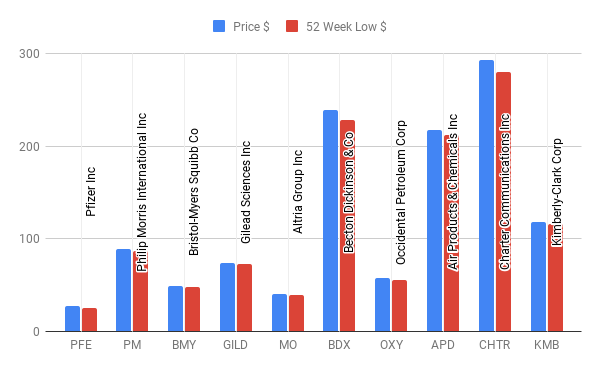

10 Big-Name Stocks Near 52-Week Lows: Are They A Buy?

Over the past twelve months a number of big named companies have been near or below their 52 week low price. Each week we’ll take a look at some of the biggest names currently close to their 52 week lows: Symbol Name Price $ 52 Week Low $ PFE Pfizer … Read More

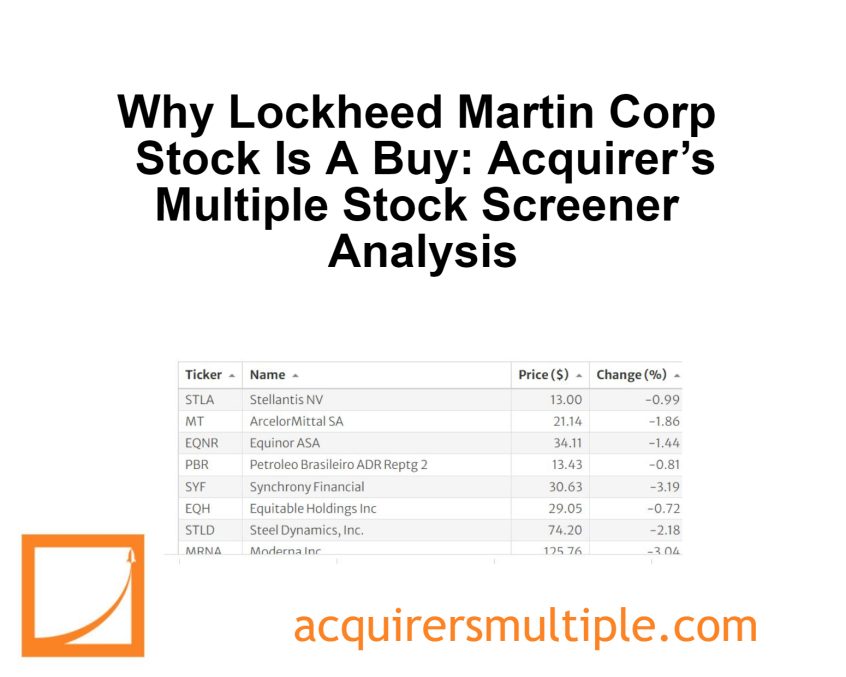

Why Lockheed Martin Corp Is A Buy? Acquirer’s Multiple Stock Screener Analysis

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: Lockheed Martin Corp (LMT) Lockheed Martin is the world’s largest defense … Read More

Warren Buffett: My $269M Mistake: The “Unforced Error” On USAir

In his 1994 Berkshire Hathaway Annual Letter, Warren Buffett discussed his mistake in purchasing USAir preferred stock for $358 million, on which the dividend was suspended. He admits that it was a case of sloppy analysis and hubris. He failed to focus on the problems that would inevitably beset a … Read More

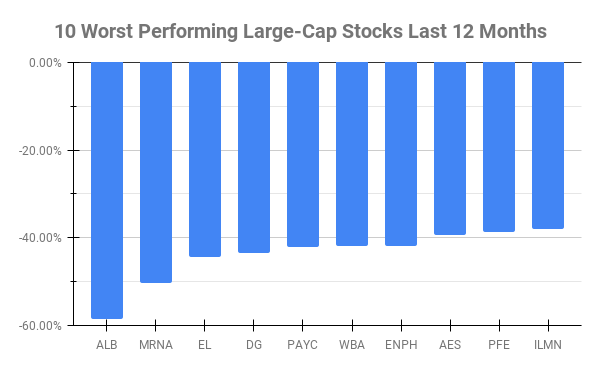

Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers Over The Past 12 Months

Over the past twelve months ten Large-Cap stocks have underperformed all others. Large-Caps are defined by $10 Billion Market Cap or more. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Symbol Name 1 Year Price Returns (Daily) ALB Albemarle Corp -58.43% MRNA Moderna Inc -50.22% … Read More

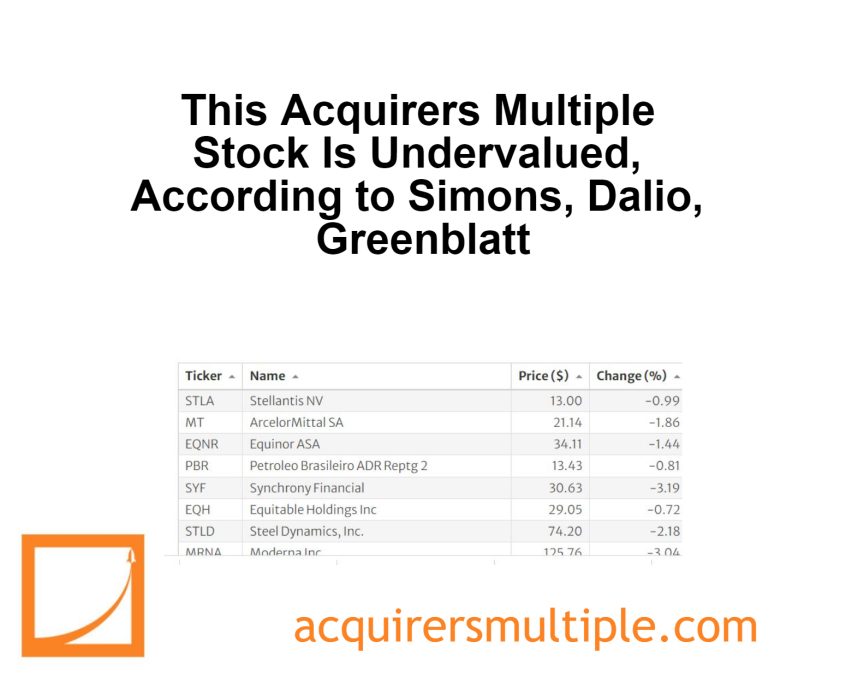

This Acquirers Multiple Stock Is Undervalued, According to Simons, Dalio, Greenblatt

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

Cliff Asness: Embrace Risk, Reap Rewards: Ditch Low-Return Comfort Zones for Investors

In his latest article titled Why Not 100% Equities, Cliff Asness argues for pushing change and embracing some risk for potentially better returns, instead of settling for lower performance due to investor comfort. He says that holding onto lower-performing portfolios because investors might abandon them due to temporary dips is … Read More

The One Stock That Superinvestors Are Dumping: Is It Time to Sell?

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Howard Marks: Are You Swimming Naked? The Hidden Dangers of Malinvestment

In this discussion with Edward Chancellor, Howard Marks explains how bad investments often fly under the radar until put to the test by challenging circumstances. It’s only then that the error’s real impact becomes clear. Here’s an excerpt from the discussion: Marks: The error is in the bad decision. What … Read More