In his latest webinar titled – The Illusion of Smart Money, Aswath Damodaran says that humility is the single most important characteristic you need to be a successful investor. Here’s an excerpt from the webinar: Humble vs Arrogant: I think that investors are better grouped into humble and arrogant, with: … Read More

Aswath Damodaran: Value Investors Should Consider Young Growth Money Losing Companies

In his recent interview on Business Today, Aswath Damodaran discussed why value investors should consider young growth money losing companies at the right price. Here’s an excerpt from the interview: Damodaran: The alternative, and you’re not going to like what I say, requires that you do the hard work of … Read More

Aswath Damodaran: When Someone Tells You The Market’s Expensive, Check Out Their Age

In this interview with Nirmal Bang, Aswath Damodaran recommends that when someone tells you the market’s expensive, you should check out their age. Here’s an excerpt from the interview: Damodaran: The one thing though I’d caution you is when people tell you that the market is expensive check out their … Read More

Aswath Damodaran: My Karmic View In Investing

In his recent interview with Poli Finance, Aswath Damodaran discussed his karmic view in investing. Here’s an excerpt from the interview: Damodaran: I’ll be quite honest. I think every market, every group of investors thinks they’re special. They think you value tech companies you think you need a special valuation … Read More

Aswath Damodaran: Greater Disclosure Is Hurting Investors

In his latest piece titled – Disclosure Dilemma: When more (data) leads to less (information)!, Aswath Damodaran explains why greater disclosure is actually hurting investors rather than helping them saying: As companies disclose more and more, investors should be becoming more informed and valuing/pricing companies should be getting easier, right? In … Read More

Aswath Damodaran: Forget Growth And Value, Focus On Common Sense Investing

In his recent interview with MoneyControl, Aswath Damodaran recommends that investors forget about the terms growth and value investing and instead focus on common sense investing. Here’s an excerpt from the interview: Q: And in this leg of the stocks rally, would you look at growth investing or value investing? … Read More

Aswath Damodaran: An Investing Strategy For High-Priced Markets

In his latest interview on CNBC, Aswath Damodaran discussed his investment strategy for high-priced markets. Here’s an excerpt from the interview: Damodaran: Investors should not overreach in any particular direction. I wouldn’t go crazy and put all my money in gold or real estate because that’s what worked in the … Read More

Aswath Damodaran: The 7 Deadly Sins In Acquisitions

In his latest investing session titled – Acquirers’ Anonymous: Seven Steps to Sobriety, Aswath Damodaran discusses the seven deadly sins in acquisitions. Here’s an excerpt from the lesson: Acquisitions are exciting and fun to be part of but they are not great value creators and in today’s session, I tried to … Read More

Aswath Damodaran: A Warning For Investors That Are Considering Joining The ‘If You Can’t Beat Them, Join Them’ Crowd

In his latest interview on CNBC, Aswath Damodaran provides a warning to investors who may be considering joining the ‘If you can’t beat them, join them crowd’. Here’s an excerpt from the interview: Question: More broadly Cuban’s point, and I’m sure he’ll accuse me of oversimplifying, but I think his … Read More

Aswath Damodaran: 4 Reasons Why Value Investing Hasn’t Worked Over The Last Decade

In his latest article Aswath Damodaran discusses four reasons why value investing hasn’t worked over the past decade and whether it’s time for value investors to consider the possibility that it’s time to change the way we practice value investing. Here’s an excerpt from the article: The attempt to explain … Read More

Aswath Damodaran: Day-To-Day Price Movements Have Little To Do With Earnings, Cash Flows Or Risk

In his latest presentation titled – Illusion, Perception and Reality: Stock Splits and Index Inclusions Aswath Damodaran discusses the effects of value, gap, and pricing events on a companies value and stock price. He makes the point that, “the reality is that a great deal of the price movement on a … Read More

Aswath Damodaran: The 10 Key Perspectives Of Valuation

In his recent four day masterclass at Coronation Capital, Aswath Damodaran discussed corporate finance and business valuation including his ten key perspectives of valuation. Here’s the list: Valuation is not a science or art, but a craft Valuing an asset is not the same as pricing an asset A good … Read More

Aswath Damodaran: The Venetian Glassmaker – Dumbing-Down Valuation Techniques

In a recent interview with Barron’s, Aswath Damodaran discussed glamour stocks, gig-economy companies, buying Tesla, and valuation techniques including how investors can dumb-down their valuation process to the bare minimum. Here’s an excerpt from the interview: Barron’s: Tell us about teaching stock valuation. Aswath Damodaran: Everything I know about valuation I’ve … Read More

Aswath Damodaran: When So Called Pros Bet And Make Money It’s Skill, When Robinhood Investors Make Money It’s Speculation. Why?

In this interview with CNBC, Aswath Damodaran highlighted the hypocrisy of commentary coming from so called professional investors and market commentators towards Robinhood investors, some of which have been generating outsized returns. Here’s an excerpt from the interview: Q: Robinhood often gets the focus here especially because they’re part of … Read More

Aswath Damodaran: Is Your Urge To Remain The Only ‘Sane’ Investor Costing You Outsized Returns

In his latest piece titled – A Viral Market Update IX: A Do-it-Yourself S&P 500 Valuation, Aswath Damodaran discusses the disconnect between US Equities, which are climbing back towards pre-crisis levels, and an economy where consumer confidence and spending are plummeting, the ranks of the unemployed rising, and professional economists are … Read More

Aswath Damodaran: Now Is Not The Time For Investors To Go To The Dark Side!

Aswath Damodaran recently did a presentation at the 73rd CFA Institute Annual Virtual Conference in which he stressed the importance of going back to basics in terms of valuing companies during the current period of uncertainty saying: There is a simple way to think about how to approach valuation. Don’t … Read More

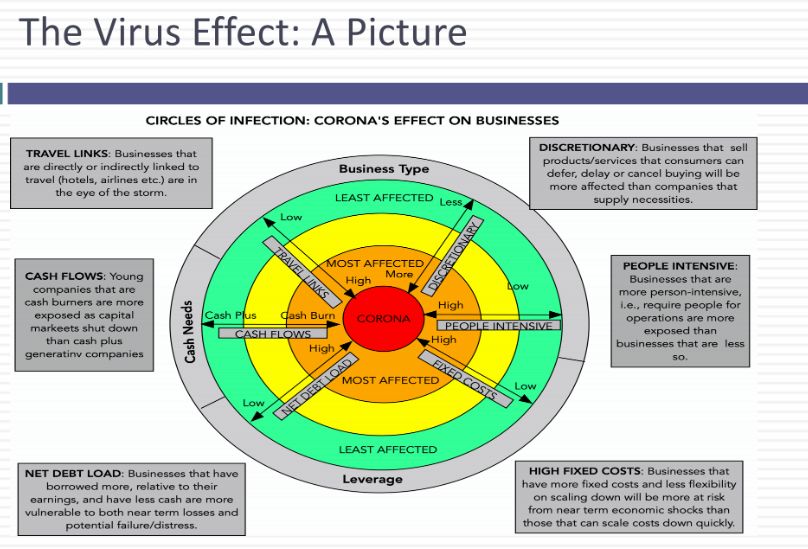

Aswath Damodaran: How To Value Companies During Covid-19

Here’s an interview with Aswath Damodaran with Forbes India in which he discusses how to value companies during times of uncertainty, like we have with Covid-19. Here’s an excerpt from the interview: Q. How do we value companies if we don’t know what cashflows are going to be like, what … Read More

Aswath Damodaran: “If You Are A Believer In Value, As I Am, Good Value Investing Requires Creativity And Out-Of-The-Box Thinking”

Aswath Damodaran has just released his latest data update titled – Data Update 2 for 2020: Retrospective on a Disruptive Decade, in which he provides some extensive analysis on the last decade, and some advice for value investors saying: I believe that good value investing requires creativity and out-of-the-box thinking, … Read More

Aswath Damodaran: Many Active Managers Will Be Wiped Out By ETFs And They Deserve It!

In a recent interview with The Economic Times, Aswath Damodaran was asked about his thoughts on active vs passive investing and the impact that ETFs will have on existing active managers. Here’s an excerpt from the interview: Interviewer: Do you think active investing is going to be dead and passive … Read More

Aswath Damodaran: Do Not Invest In Companies That Try To Achieve Growth Through Acquisition

Here’s a great article by Aswath Damodaran in which he warns investors who are considering investing in companies that use acquisitions as part of their growth strategy, saying: “If you look at the collective evidence across acquisitions, this is the most value destructive action a company can take.” Here’s an … Read More