As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: The Home Depot Inc (HD) Home Depot is the world’s largest … Read More

Value Opportunities in Emerging Markets

During their recent episode, Taylor, Carlisle, and Juan Torres Rodriguez discussed Value Opportunities in Emerging Markets. Here’s an excerpt from the episode: Tobias: So, how do you characterize what you’re looking for? You’re looking for undervaluation, but you’ve maybe got the advantage that you can look– because you’re already looking … Read More

Warren Buffett’s Auto Racing Analogy for Business Survival

In his 2010 Berkshire Hathaway Annual Letter, Warren Buffett discussed the importance of financial stability, drawing a parallel between auto racing and business: to succeed, you must first survive. He warns against the risks of leverage, which amplifies gains but can lead to ruin when losses occur, as seen in … Read More

Joel Greenblatt: My Largest Positions Are The Ones I’m Confident Won’t Lose Money

During this interview with Howard Marks, Joel Greenblatt recounts an investment that inspired the creation of the Value Investors Club. During a period when he managed only personal capital, he identified a company selling at half its cash value with a strong business attached. The investment was particularly compelling due … Read More

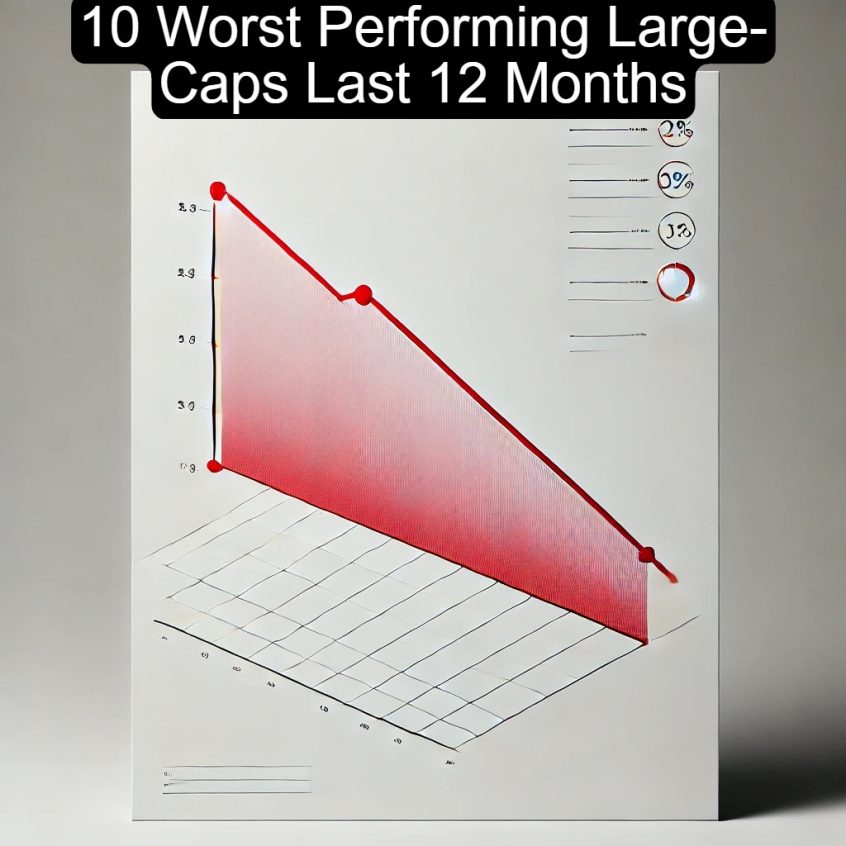

10 Worst Performing Large-Caps Last 12 Months

Over the past twelve months ten Large-Cap stocks have underperformed all others. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Name 1 Year Price Returns (Daily) Walgreens Boots Alliance (WBA) -53.27% Intel (INTC) -47.41% Celanese (CE) -47.16% Moderna (MRNA) -46.48% Dollar Tree (DLTR) -42.21% Humana … Read More

Which Superinvestors Hold Acquirer’s Multiple Stocks?

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, and … Read More

Low Valuations in Emerging Markets Often Signal Fear, Not Opportunity

During their recent episode, Taylor, Carlisle, and Juan Torres Rodriguez discussed Low Valuations in Emerging Markets Often Signal Fear, Not Opportunity. Here’s an excerpt from the episode: Juan: Or, you can take it to sectors or individual companies. If you find a company trading less than five times, that company … Read More

Bill Ackman: There Will Always Be A Place For Fundamental Investing

During this interview with the New York Times, Bill Ackman discusses the value of joining startups for business school graduates, citing it as the best time in history to gain practical skills like payroll management, product marketing, and design. He argues that even if a startup fails, the experience is … Read More

Cliff Asness: How We Avoid the Pitfalls of Traditional Long-Only Active Management

In this interview with Bloomberg, Cliff Asness discusses the challenges of investing in a market dominated by a few highly concentrated stocks, like the “Mag Seven.” As a quant, he emphasizes the advantages of running diversified long-short portfolios, typically balancing around 750 long and 750 short positions across industries. This … Read More

The One Stock That Superinvestors Are Dumping: Is It Time to Sell?

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray … Read More

Why China is the Deepest Value Market in Emerging Markets Today

During their recent episode, Taylor, Carlisle, and Juan Torres Rodriguez discussed Why China is the Deepest Value Market in Emerging Markets Today. Here’s an excerpt from the episode: Jake: What are your thoughts on China these days? Juan: It’s the deepest value market in EM, and potentially, one of the … Read More

Howard Marks: What Warren Buffett Taught Me About ‘Desirable’ Information

In this presentation to Banco March, Howard Marks discusses the futility of predicting the future in investing, noting that most investors cannot accurately forecast macroeconomic factors like markets, currencies, or interest rates. He highlights quotes from John Kenneth Galbraith, Amos Tversky, and Mark Twain to stress the dangers of acting … Read More

Mohnish Pabrai: Even in Frothy Markets, There Are Always Opportunities

In this interview with GreenHaven Road Partners Fund, Mohnish Pabrai discusses investment strategies amid market uncertainties, emphasizing Berkshire Hathaway’s approach of building cash reserves to capitalize on potential market dislocations. He highlights the value of stock picking over broad market indices like the S&P 500, noting that exceptional opportunities exist even … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Prem Watsa, Jeremy Grantham, Seth Klarman, … Read More

Understanding Emerging Markets, Frontier Markets, and Investment Challenges

During their recent episode, Taylor, Carlisle, and Juan Torres Rodriguez discussed Understanding Emerging Markets, Frontier Markets, and Investment Challenges. Here’s an excerpt from the episode: Tobias: Can you just tell us the markets that you focus on, your universe and where you look mostly? Juan: So, our investable universe is … Read More

Ray Dalio’s Investment Wisdom: Humility, Triangulation, and Diversification

In this interview with RWH, Ray Dalio discusses the importance of humility and caution when making decisions in unfamiliar areas, using China as an example. He relies on extensive experience, starting in 1984, and insights from highly knowledgeable and trustworthy individuals to triangulate information and form conclusions. Dalio prioritizes diversification, … Read More

Warren Buffett: Why CEOs Struggle with Business Valuation

During the 2001 Berkshire Hathaway Annual Meeting, Warren Buffett highlights a common issue among CEOs who struggle to assess the value of businesses they aim to acquire. Feeling unsure about asset allocation, they often turn to investment bankers for advice. However, this advice is typically biased, as investment bankers are … Read More

Joel Greenblatt – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

VALUE: After Hours (S06 E44): Deep Value in Emerging Markets, China, India, Korea with Juan Torres Rodriguez, Schroeders

In their latest episode of the VALUE: After Hours Podcast, Tobias Carlisle, Jake Taylor, and Juan Torres Rodriguez discuss: Emerging Markets: 50% of Global GDP but Only 7% of Market Capitalization Why China is the Deepest Value Market in Emerging Markets Today Fallen Angels of Chinese Tech: Understanding Alibaba’s Restructuring … Read More

Apple Inc (AAPL) DCF Valuation: Is The Stock Undervalued?

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, Apple Inc (AAPL). Profile Apple is among the largest … Read More