https://www.youtube.com/watch?v=lTVE9ixrzgA?start=196 During his recent interview with Tobias, Chris Cole explains how to capture crisis alpha and why most investors are not as diversified as they think they are, saying: I have a different philosophy on the world than what is taught in most mainstream finance books which are taught in … Read More

(Ep.1) The Acquirers Podcast: Christopher Cole – Volatility and Crisis Alpha

Here’s a great interview with Tobias speaking to Christopher Cole of Artemis Capital Management. Chris Cole is a 39-year-old hedge fund manager from Texas who uses volatility to provide “crisis alpha.” Cole runs Artemis Capital, a hedge fund that seeks to outperform in a stock market crash–to “generate opportunity from … Read More

Introducing The Acquirers Podcast

We’re launching a new podcast called The Acquirers Podcast. It’s about finding undervalued stocks, deep value investing, hedge funds, activism, buyouts, and special situations. We’re going to uncover the tactics and strategies for finding good investments, managing risk, dealing with bad luck, and maximizing success. We’ll be publishing the first … Read More

This Week’s Best Investing Reads 3/8/2019

Here’s a list of this week’s best investing reads: The Stormtrooper Problem: Why Thought Diversity Makes Us Better (Farnam Street) How The Buffett Yardstick Shows Both ‘Sky-High’ Stock Market Valuations And Investor Sentiment (The Felder Report) The Worst Entry Point in Stock Market History? (A Wealth of Common Sense) Summary Edition Credit … Read More

TAM Stock Screener – Stocks Appearing in Greenblatt, Grantham, O’Shaughnessy Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, … Read More

Seth Klarman Protege David Abrams – Top 10 Holdings Q4 2018

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Aswath Damodaran: Do Not Invest In Companies That Try To Achieve Growth Through Acquisition

Here’s a great article by Aswath Damodaran in which he warns investors who are considering investing in companies that use acquisitions as part of their growth strategy, saying: “If you look at the collective evidence across acquisitions, this is the most value destructive action a company can take.” Here’s an … Read More

Joel Greenblatt – If You Do Good Valuation Work The Market Will Agree With You Eventually

Here’s a great recent interview with Joel Greenblatt at CNBC discussing value investing and the one promise that he makes to his new value investing students at Columbia University, saying: We value businesses like we’re a private equity firm. That’s what stocks are. They’re not pieces of paper that bounce … Read More

Warren Buffett: Stocks – What Else In The World Don’t You Like To Buy Cheaper Than You’re Paying The Day Before?

Here’s a great recent interview with Warren Buffett at CNBC discussing a number of topics including his value investing mindset. Here’s an excerpt from the interview: BECKY QUICK: I know you’re like Dr. Spock. You’re completely emotionless, when it comes to dealing with market moves. But is there any part … Read More

This Week’s Best Investing Reads 3/1/2019

Here’s a list of this week’s best investing reads: Cherish Your Exceptions (A Wealth of Common Sense) An Investment Approach That Works (Farnam Street) Don’t Dismiss The Dire Message From ‘The Index Of The Volume Of Speculation’ (The Felder Report) Numbers Are Not Reality (The Irrelevant Investor) How to follow the economy (The … Read More

TAM Stock Screener – Stocks Appearing in Pabrai, Watsa, Dalio Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, … Read More

Howard Marks: The Greatest Advantage In This Business Is Having Ten-Year Money

Here’s a great excerpt from Howard Marks’ recent interview on Real Vision. During the interview Marks explains how the structure of the Oaktree Capital Funds protects investors from themselves when the ‘herd’ wants to withdraw funds saying: “First of all we have the confidence of our investors. Secondly, the money … Read More

Berkshire Hathaway: 10 Books That Every Investor Should Read

We recently started a series called – Superinvestors: Books That Every Investor Should Read. So far we’ve provided the book recommendations from: Charles Munger: 32 Books That Every Investor Should Read Seth Klarman: 32 Books That Every Investor Should Read Warren Buffett: 35 Books That Every Investor Should Read Bill … Read More

Seth Klarman – Top 10 Holdings Q4 2018

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Charles Munger: Here’s Why Investing Is So Much Tougher Today

Here’s a great recent interview with CNBC’s Becky Quick and Charles Munger discussing the difficulty of being an investor today, compared to when he and Warren started. Here’s an excerpt from the interview: Becky Quick: Charlie thank you very much for taking the time to sit down with us today. … Read More

This Week’s Best Investing Reads 2/22/2019

Here’s a list of this week’s best investing reads: The Distrust of Intellectual Authority (Farnam Street) First Mover Alpha (A Wealth of Common Sense) Un-Complicating Investing (The Irrelevant Investor) Problematic (The Reformed Broker) Under the Influence (Humble Dollar) Charlie Munger on Elon Musk (The Daily Journal Annual Meeting 2019) (Youtube) Howard Marks, CFA: Getting the Odds on Your Side (CFA … Read More

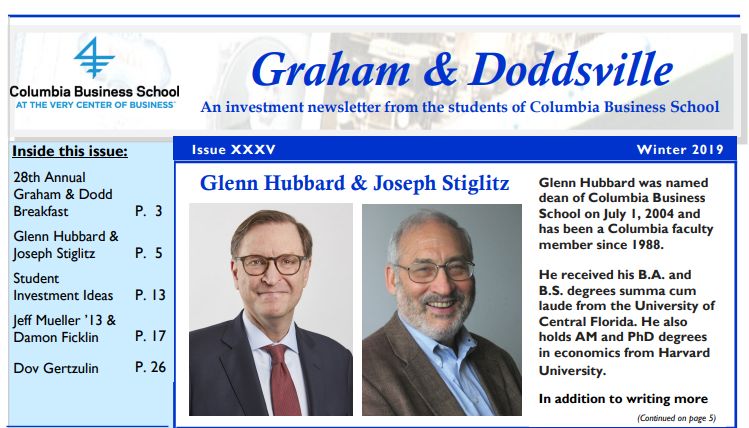

Graham & Doddsville Newsletter – Winter 2019

We’ve just finished reading the latest Graham & Doddsville newsletter. The first interview is with the Dean of Columbia University, Glenn Hubbard and Nobel Laureate, Joseph Stiglitz. In the interview, the two discuss index funds and the future of asset management, Jerome Powell’s job thus far as Fed Chairman, areas of risk and fragility … Read More

TAM Stock Screener – Stocks Appearing in Greenblatt, Burry, Griffin Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, … Read More

Michael Mauboussin: 15 Ways To Identify Market Inefficiencies

Michael Mauboussin has just released his latest paper titled – Who Is On The Other Side?. In the paper Mauboussin describes a number of inefficiencies that exist in the market, driven mainly by the optimism or pessimism of human beings. Included in the paper is Mauboussin’s Checklist for Identifying 15 Market … Read More

Tobias Carlisle – KEYNOTE SPEAKER at Planet MicroCap Showcase 2019

We’re excited to announce that Tobias Carlisle, Founder, Editor and Author of The Acquirer’s Multiple will our Keynote Speaker at the Planet MicroCap Showcase 2019 – April 30 – May 2 at Bally’s Hotel & Casino in Las Vegas! For more information about the event, click here: https://planetmicrocapshowcase.com/. To register for the … Read More